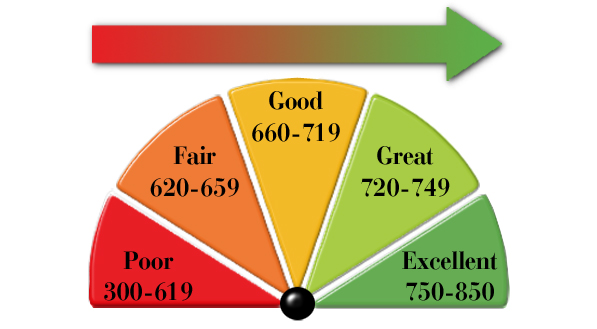

Credit scores are the bane of modern existence. Sure, they help banks make better lending decisions but when your credit score sucks – it stops you from getting the credit that you need. So how can you raise your credit score? Well, there are plenty of ways to raise your credit score but when you’re in a hurry there are a few methods that can bring rapid results just like these:

Challenge Mistakes

You want to request a copy of your credit report from Equifax, Experian and TransUnion and you should. If you find there are any mistakes on your credit report – you aren’t required to take them lying down. You can file a dispute – online – with each of the three credit bureaus and they’re obliged to fix your report if there’s an error.

Ask Creditors to Change the Report

If all the facts are true but you have some leeway in being able to make amends; make an offer to pay off any debts in exchange for the creditor amending the report to either “paid as agreed” or in exchange for removing their black mark completely. Make sure that you get any agreement in writing from the creditor before you make a payment; it’s very difficult to enforce “he said, she said” after the fact.

It’s also possible to request a “good-will adjustment”. For example, you were unemployed and missed a couple of card payments. Talk to the card provider and point out your previous (and current) good standing and ask if they’ll remove their comments. They’re not obliged to help you out but you’d be amazed at how often creditors will help you out.

Review Your Reported Credit Limits

One thing that can damage a credit score is being perceived to be running cards at their maximum balance each month. Annoyingly, card companies sometimes make mistakes and fail to report a balance increase to the credit ratings agencies. If you see that a card issuer has done this; contact the issuer and ask them to update your credit report.

Show Responsible Use of Cards

We recently ran a piece on the best credit cards for those with bad credit scores; so don’t think that you can’t get a card when you have a poor credit rating. If you use those cards responsibly; that is you don’t max out the credit limit each month AND you make payments each month – you can repair your credit rating as the lenders will issue regular statements of responsibility to the credit ratings bureaus.

Get a Friend’s Help

If you can’t get a bank to issue you a credit card; you might be able to get a friend to help out. In this case they add you to their credit card account and give you a written statement which says how much of their limit they are willing to extend to you and how you will pay that off. Then stick to that agreement. You must make sure that you stick to the agreement though – otherwise you will lose a friend as well as further damage your credit rating.

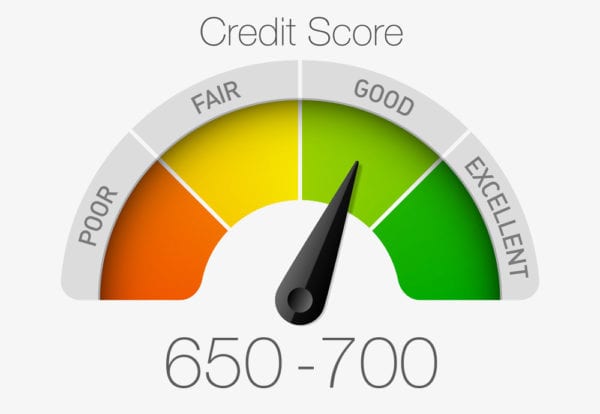

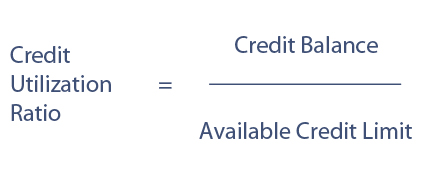

The Less You Use Your Cards – The Better Your Credit Rating

Your credit score is, in part, based on your utilization of the credit available to you. This is measured by the “credit utilization ratio”. That is if you run a regular balance of $300 on a $1,000 limit – your credit utilization ratio is 30%. If you run $750 on $1,000 then it’s 75%. The bad news? Lenders prefer to see a score of less than 30% and ideally less than 10%. This is true even if you pay off the entire balance each and every month.

Improve Your Credit Utilization Ratio

The easiest way to improve your credit utilization ratio is to ask your card provider to increase your limit. Thus if you have $1,000 on $1,500 limit you ratio is 66% but if they up your limit to $3,000 it’s only 33%. There is a note of caution attached to this tip – you have to keep your spending at the previous level; otherwise you’ll quickly find your credit card payments rising and your credit score falling.

Always Pay Your Bills on Time

You’d be amazed to learn that your bills, that is your payment history on your bills, contribute just over a third of your credit score. Each time you make a late payment; your credit score tanks substantially. The best way to make sure that you pay your bills on time each month is to automate your payments. However, you still need to review each bill as it comes in to make sure that there are no mistakes and you’re not being over/under charged for something.

Mix and Match Your Credit

It’s a funny thing but the credit bureaus like borrowers who have a varied debt profile. So if your current debt is all credit card based it might be better to take a small personal loan, with the caveat that you must be able to make the payments on that loan – that’s the key message here, you can only improve your credit rating if you make payments – and you should see your credit score rise.

Never Cancel a Credit Card

Card issuers are always on the lookout for people who regularly open new card accounts to take advantage of attractive introductory offers and who then abandon those cards when the offer period expires. That means when you cancel a credit card; your credit score drops. Instead of cancelling a card; it can be a good idea to use it to pay off a single bill each month and pay the balance in full immediately. This ensures a better credit score because it has a low credit utilization ratio balanced with regular, on time payments.

Summary

There are plenty of things you can do to tackle a low credit score that will make a rapid impact. However, the key theme is simple; make payments on time and keep your balance much lower than the limit of your cards. Don’t be afraid to ask for favors or challenge mistakes on credit reports. Never take out credit that you can’t afford; it’s a recipe for disaster.