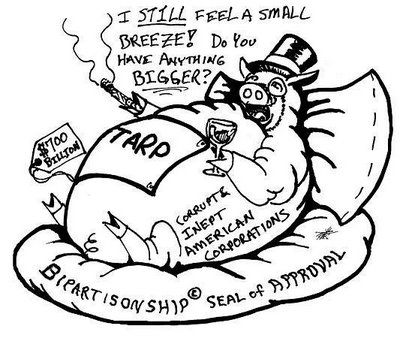

At the center of all the bailouts and government initiatives to ameliorate the subprime meltdown is the Troubled Asset Relief Program, or TARP. To supporters, TARP represented a critically necessary precaution against systemic market failure. Leave the banks to their own devices, and the entire world economy could collapse. To critics, TARP was little more than a bailout, paving the way for moral hazard – that is, future bank irresponsibility. Today, we trace the roots of this controversial program to where it currently stands.

The Original Purpose

Signed into law in October 2008, TARP authorized the U.S. Treasury Department to to purchase $700 billion worth of “troubled assets” – essentially, any troublesome, hard-to-value or illiquid asset that a bank or financial institution purchased prior to March of 2008. The purpose of TARP, according to its oft-updated Wikipedia page, is improving “the liquidity of these assets by purchasing them using secondary market mechanisms, thus allowing participating institutions to stabilize their balance sheets and avoid further losses.” The assistance came at a price, however. In order to qualify for TARP funds, the nine largest American banks had to fork over senior preferred stock and warrants commensurate with the aid they received. Perhaps most controversially, TARP also stipulated several restrictions on executive pay at beneficiary institutions, including prohibition of “golden parachute” payments and “excessive” incentive compensation.

The Major Participants

As noted, America’s largest banks all received TARP funds and participated in some way or another in the program. According to the Wall Street Journal, Goldman Sachs, Morgan Stanley, Bank of America, Wells Fargo, Citigroup, Morgan Chase, State Street Corp and Bank of New York Mellon were the major participants. Not all of them participated willingly, however. The WSJ notes that some of the big banks “were unhappy about the government taking equity stakes.” Largely, bank reluctance to taking TARP money stemmed from the accompanying restrictions discussed above on bank operations and executive pay. Their opposition mattered little, however, for all of the banks eventually “acquiesced under pressure from Treasury Secretary Henry Paulson” to take the money. Of the nearly $250 billion in equity stakes TARP authorized the Treasury to take in “potentially thousands of banks”, it bought:

- $25 billion in preferred stock from Bank of America (including Merril Lynch)

- $25 billion in JP Morgan

- $25 billion in Citigroup

- $20-$25 billion in Wells Fargo

- $10 billion in Goldman

- $10 billion in Morgan Stanley

- $3 billion in Bank of New York Mellon

- $3.5 billion in American Express

- $2 billion in State Street

Repayment Progress

Interestingly, while these banks were expected to repay all that they had borrowed, they were actually not permitted to begin repaying any TARP assistance until June 2009. Even then, repayment was no simple matter. Banks seeking to begin repaying their TARP debts had to submit to what Calculated Risk Blog called a “government stress test” to prove there was a plan in place to safely raise repayment capital. In other words, they actually had to apply to begin repaying. Furthermore, CNBC noted that the Treasury did not “allow any one bank to repay the TARP first”, preferring instead to “approve them in batches.” Most of the larger banks discussed earlier (like Goldman Sachs and JP Morgan Chase) survived early stress tests and got the green light to begin repaying their TARP debts. Generally speaking, these banks could not have been happier to begin putting TARP behind them. Despite being required by regulators to raise only $1.8 billion of non-government insured capital, Morgan Stanley took to the market and raised $4 billion. Goldman Sachs “did not even wait for the results of the stress test”, selling $2 billion of non-guaranteed debt. Following suit, JP Morgan exceeded TARP stress test requirements by selling $2.5 billion in unsecured debt, as did US Bancorp. Capital One Financial, for its part, sold $1.55 billion. The other leading TARP banks continued raising capital until ABC News reported on June 9 that “10 of the country’s 19 stress-tested banks can now pay back $68 billion in federal funds” from TARP. Perhaps no bank was more eager to close the book on TARP than JP Morgan, whose CEO Jamie Dimon likened the program to a “scarlet letter” and declared as early as April 2009 that “we can pay it [TARP] back tomorrow. We have the money.”

On December 9 2009, Bank of America became the latest bank to repay in full what it borrowed – $45 billion – from the TARP program. To date, Rueters states that “the total amount of TARP funds repaid so far totaled $116 billion”, including Bank of America’s repayment. The Treasury is currently forecasting that that this amount could grow to $175 million repaid by 2010’s end. A complete list of which institutions have and have not repaid their TARP funds can be found here. Among those who have yet to repay, Citigroup is perhaps most troubling. According to a December 15 TIME Magazine article, Citigroup had “worked out a deal to repay $20 billion in government bailout money”, but the deal involved terminating a “loss-sharing agreement the bank had with the government for Citi’s riskiest assets.” While CEO Vickram Pandit holds that the move is in Citigroup’s best interest, analysts nevertheless “say Citi’s rush to repay the assistance” will necessarily “make the bank weaker, not stronger” by “reducing Citi’s capital ratios and hurting earnings.” In any case, $20 billion is less than half of the $46 billion Citi owes to TARP. Another notable from the yet to repay category is AIG, which borrowed $40 billion, though reports of a planned two year repayment have surfaced.

What’s Already Been Spent

TARP specified several purposes for which funds would be dispersed at the time of its passing, as well as how much money would be devoted to each purpose. The Committee For a Responsible Federal Budget has done some excellent work charting this out and breaking it down into plain English. In absolute terms, $386.38 billion has actually been spent of the $698 billion that was authorized – with a deficit impact of $157.47 billion. Beyond that, the Committee breaks down TARP spending (authorized and actual) as follows:

- The Capital Purchase Program (which authorized buying shares in the major banks) was allotted $250 billion, of which $195 billion was spent.

- The Systemically Significant Failing Institutions program authorized $40 billion to buy shares in AIG, of which all $40 billion was spent.

- The Term Asset-Backed Securities Loan Facility authorized $20 billion to repay losses suffered by the Federal Reserve Bank of New York, none of which has been spent.

- The Targeted Investment Program authorized $40 billion for stock purchases in Citigroup and Bank of America, of which all $40 billion was spent.

- The Automotive Industry Financing Program authorized $25 billion for loans to automakers and their financing arms, of which $21 billion was spent.

- The Asset Guarantee Program set aside another $12.5 billion in loan guarantees for Citigroup and Bank of America, none of which was needed.

The Road Ahead

The New York Times reported on December 9, 2009 that Treasury Secretary Timothy Geithner extended TARP into October 2010 and “pledged to deploy no more than $550 billion of it.” While Republicans in Congress called for the program to be canceled and its funding reallocated to federal debt repayment, Geithner nevertheless insisted “this extension is necessary to assist American families and stabilize financial markets because it will, among other things, enable us to continue to implement programs that address housing markets and the needs of small businesses, and to maintain the capacity to respond to unforeseen threats.” With most of the major banks no longer entangled with TARP funds, Geithner maintains that 2010’s TARP commitments will be limited to the housing market, small banks, small business lending and “increased support for the Federal Reserve’s Term Asset-Backed Securities Loan Facility.” Happily, Geithner also expects TARP will ultimately cost taxpayers “at least $200 billion less than the $341 billion projected” in August of 2009.