The first Bitcoin transaction, made between the cryptocurrency’s elusive creator Satoshi Nakamoto and cybersecurity veteran Hal Finney, came in January 2009. And this pivotal moment was the start of something big: in 2017, in fact, the number of Bitcoin transactions over a single day regularly exceeded 250,000. Moreover, the same year also saw the value of a single unit of the digital currency shoot to above $4,000, making one Bitcoin worth nearly three times as much as an ounce of gold.

However, to put Bitcoin’s rise into context, the many advances made in the field of cryptocurrency must be taken into consideration. This list article, then, traces the history of that field and identifies its 30 most crucial developments, all of which have helped progress cryptocurrencies to where they are today.

Methodology

To create this list article, we first turned to similar authoritative lists detailing the major developments in the history of cryptocurrency. These included the following:

● Forbes, “Coin Toss: 10 Milestones of the Cryptocurrency Craze”

● International Business Times, “From Online Payments to Bitcoin: The Evolution of Cryptocurrency”

● Koinex Crunch, “A Brief History of Cryptocurrency”

In order to determine the significance of these developments, we additionally scrutinized articles that described the short- or long-term consequences that certain milestones and technological innovations have had on the history of cryptocurrency as a whole. Those developments ultimately chosen to be included, then, were judged to be the most noteworthy of their kind.

The ordering, meanwhile, was based simply on chronology, with the list progressing from the earliest major development in the history of cryptocurrency to the latest.

30. The RSA Algorithm Is Brought to the World (1977)

The RSA algorithm has played a leading role in public key cryptography, an encryption scheme that, in 2008, Professor Nigel Smart of the University of Bristol described as “an invisible glue which allows us to keep our data secure and to prove who we are to organizations.” As such, Smart continued, the RSA algorithm is part of “the backbone of the security of our electronic age.” And as a vital development in public key cryptography, it’s also a milestone in the history of cryptocurrency, as it’s a public key that enables investors in virtual money to receive their funds. The RSA algorithm itself is named for the first letters of the last names of MIT’s Ron Rivest, Adi Shamir and Leonard Adleman, who published a paper on the new invention back in 1977. Intriguingly, though, Englishman Dr. Clifford Cocks – along with two other colleagues at the U.K.’s Government Communications Headquarters – is also credited with working out the basic idea that became the RSA algorithm as early as 1973. However, this information was kept under wraps until 1997.

29. David Chaum Invents ecash (1993)

In 2016 David Chaum was dubbed “the father of online anonymity” by Wired magazine. And he could feasibly be heralded as a cryptocurrency pioneer, too, as in 1993 he came up with the concept of ecash – an early precursor to today’s forms of digital money. By 1997, moreover, he had managed to raise finances for his idea and even got a bank in St. Louis to sign up to it. But it turned out that Chaum may just have been too ahead of his time. Come 1999, DigiCash, the firm the innovator had set up to manage the ecash scheme, went bankrupt, with Chaum then offering his patents to bidders. At the time, he told Forbes, “It was hard to get enough merchants to accept it, so that you could get enough consumers to use it, or vice versa.” Of course, anonymized and encrypted digital currencies are now commonplace.

28. Douglas Jackson Launches e-gold, a Cryptocurrency Precursor (1996)

As an amateur scholar of economic history, Douglas Jackson had formed the opinion that a currency backed by gold bullion was superior to the fiat money favored by most countries. In 1996 that notion prompted the one-time oncologist to launch e-gold, an innovation that Wired described in 2009 as “a private, international currency that would circulate independent of government controls.” And, despite a series of setbacks, e-gold went from strength to strength in the years following its debut; by 2005, in fact, there were 3.5 million e-gold accounts in 165 countries. Unfortunately, organized criminals also saw the benefits of the system – a fact that didn’t escape the U.S. government. As a result, the FBI and Secret Service raided Jackson’s home, e-gold’s parent company and the system’s servers, leading to a charge of money laundering for the entrepreneur and effectively stymying e-gold’s operations.

27. Adam Back Invents Hashcash (1997)

Well over a decade before Bitcoin ever came to fruition, British cryptographer Adam Back came up with an algorithm that would prove crucial to the digital currency. Specifically, in 1997 he devised the “hashcash” proof of work data that inspired the system that Bitcoin uses to mine new coins. But that’s not all that hashcash is good for. In effect, it can also be used to combat large batches of spam emails by making attaining a proof of work for each one a lengthy and difficult process. Despite hashcash’s importance to Bitcoin, however, Adam Back has proven to be rather modest about the inadvertent role he played in the development of the cryptocurrency. In a 2013 post on the Bitcoin Forum, for example, he wrote, “[W]hile it is true that I invented hashcash, I am not claiming Bitcoin is some simple extension. Bitcoin has actually several key innovations that no one succeeded with before.”

26. Wei Dai Proposes b-money (1998)

Computer science graduate Wei Dai arguably laid the groundwork for cryptocurrencies all the way back in 1998. His outline of the working of b-money, an electronic currency, was posted on an internet mailing list in November of that year and, as Dai told IEEE Spectrum in 2012, it aimed “to enable online economies that are purely voluntary, ones that couldn’t be taxed or regulated through the threat of force.” What’s more, although the system he proposed had certain deficiencies that made it unworkable in practice, it did suggest transactions being verified by a proof of work. This was one of the concepts later used by Satoshi Nakamoto to create Bitcoin, and Nakamoto himself would acknowledge his cryptocurrency’s debt to b-money in a 2008 email to Dai.

25. PayPal Is Established (1999)

The origins of PayPal date all the way back to 1999, when software company Confinity trialed a scheme that allowed users to make U.S. dollar payments via email. The following year, however, saw Confinity – now called X.com – turn their attentions to auction site eBay so that buyers could remunerate sellers via their PayPal accounts. And this savvy move paid off: by 2004, in fact, PayPal’s revenue had reached $1.4 billion, making it a powerful player in the world of online payments. Arguably, PayPal’s greatest achievement was to make internet users comfortable with the idea of transferring funds online. In this way, it can be said to have paved the way for the advent of digital currencies. What’s more, in a neat turn of events, PayPal itself would start to take payments in certain cryptocurrencies in September 2014.

24. The Tor Browsing Software Is Given an Official Release (2003)

The official Tor blog states, “Could cryptocurrencies claim that they provide privacy if Tor was not around to give strong transport-layer anonymity?” Indeed, using the browsing software – formerly known as The Onion Router – is an option for those who want to ensure that they can’t be tracked down by their IP address when making a cryptocurrency transaction. Tor works by routing web traffic through what it describes as a “series of virtual tunnels,” thus making it extremely difficult to track down the physical location or identity of any individual user. Naval Research Laboratory mathematician Paul Syverson and MIT graduates Roger Dingledine and Nick Mathewson jointly developed the software, which was given a pre-alpha release in 2002; it was then officially released the following year.

23. Hal Finney Unveils Reusable Proof of Work (2004)

Hal Finney may have spent his early career as a video games programmer, but arguably his one true passion was combating the tendency of big business and government to intrude in the lives of private citizens. To that end, in 1991 he began to volunteer his time to the Pretty Good Privacy project, an innovative encryption scheme that Finney saw as “broadly speaking… dedicated to this goal of making Big Brother obsolete.” And the invention that may have been Finney’s greatest achievement was a piece of cryptographic technology intended to circumvent official organizations: that is, reusable proof of work (RPOW). RPOW was an archetype of a cryptocurrency that, in Finney’s own words, “provides for proof of work tokens to be reused” in much the same way as physical cash is transferred from individual to individual. Finney unveiled this system in 2004, and it can be seen as a clear precursor to the cryptocurrencies, like Bitcoin, that were to follow in its wake.

22. Satoshi Nakamoto Publishes the Paper “Bitcoin: A Peer-to-Peer Electronic Cash System” (2008)

In October 2008 Satoshi Nakamoto introduced the world to a future phenomenon: Bitcoin. He achieved this, moreover, by publishing a white paper that neatly outlined the workings and aims of the cryptocurrency. And what that paper – titled “Bitcoin: A Peer-to-Peer Electronic Cash System” – revealed may have caused alarm in some quarters, not least because it described a way of transferring funds “without the burdens of going through a financial institution.” Indeed, with Bitcoin, Nakamoto had come up with a payments system that was both secure and completely outside the influence of national and international authorities. In addition, the paper described the more technical aspects of Bitcoin’s workings, including the hashcash-inspired proof of work system central to the creation of new coins. All of this would be put into practice, of course, the following year, when Nakamoto would mine Bitcoin’s “genesis block.”

21. Satoshi Nakamoto Creates Blockchain (2008)

In “Bitcoin: A Peer-to-Peer Electronic Cash System,” Satoshi Nakamoto describes a cryptocurrency network that “timestamps transactions by hashing them into an ongoing chain of hash-based proof of work, forming a record that cannot be changed without redoing the proof of work.” In this way, he summed up the form and operation of what came to be called “blockchain,” a system crucial to Bitcoin and subsequent cryptocurrencies. Put simply, the Bitcoin blockchain acts as a secure, decentralized electronic “ledger” of transactions made. But that isn’t all that the technology can be used for; Ethereum, for instance, runs its own blockchain to enable individuals to create their own apps. And in a 2017 article for Harvard Business Review, Marco Iansiti and Karim R. Lakhan have argued that blockchain itself even “has the potential to create new foundations for our economic and social systems.” This process, they have noted, may “take decades,” however.

20. The First Bitcoin Block Is Mined (2009)

In January 2009 the mysterious Satoshi Nakamoto set the Bitcoin revolution in motion by mining the fledgling currency’s first ever block of 50 coins. And Nakamoto presumably intentionally made sure that the moment was fixed in history by including within the code for the block a headline from the January 3, 2009, edition of British newspaper The Times. This read “Chancellor on brink of second bailout for banks,” leading some to speculate that the elusive developer of Bitcoin had a political point he wanted to make about the vagaries of the conventional financial system. It’s also worth noting that, either by accident or design, the so-called “genesis block” that Nakamoto mined cannot be redeemed, due to the certain unique characteristics within its code.

19. The First Bitcoin Transaction Is Made (2009)

After Satoshi Nakamoto mined the first Bitcoin block in early January 2009, it was just a matter of days before the cryptocurrency was used in its first transaction. That pivotal moment came on January 12, and the man who received the digital coins was Hal Finney, an expert on the development of encryption software. Finney had also been involved in trying to create a digital currency – perhaps why he was particularly intrigued by Nakamoto’s recent innovation. But although Finney was excited by the concept of Bitcoin, it still seems as if he initially underestimated just how successful it was going to be. And the cryptographer admitted as much in a 2013 post on the Bitcoin Forum, where he wrote, “[In late 2010]… I was surprised to find that [the Bitcoin project] was not only still going [but that] bitcoins actually had monetary value.”

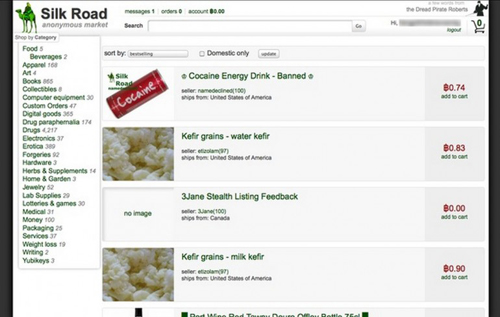

18. Silk Road Goes Live (2011)

Understandably, encrypted and anonymized digital currencies may appeal to those who have reason to hide their commercial activities from law enforcement agencies. Indeed, it’s easy to see how, for example, drug dealers and purchasers would relish the cover that the likes of Bitcoin can provide. And the now-notorious site Silk Road thrived by capitalizing on both the relative difficulty of reaching the “dark web” on which it could be found and the secure, anonymous nature of Bitcoin transactions. Founded by Texan Ross Ulbricht, who went under the pseudonym “Dread Pirate Roberts” online, Silk Road went live in January 2011 as a marketplace for often illegal drugs. And just 18 months after the site’s launch, Forbes would reveal that business there was booming: apparently, to the tune of approximately $1.9 million in sales per month.

17. Bitcoin Reaches Parity with the U.S. Dollar (2011)

A little more than two years after the first Bitcoin transaction in January 2009, the digital currency passed a major milestone. It was on February 9, 2011, in fact, that Bitcoin first reached parity with the U.S. dollar on leading exchange MtGox – an achievement that arguably now marked it out as a legitimate force to be reckoned with in the worlds of international commerce and finance. In the following two years, moreover, the upward trend largely continued, culminating in the price of one Bitcoin rocketing to over $1,100 in late 2013. And while the cryptocurrency has suffered from market volatility since then, it’s worth noting that, in August 2017, a single Bitcoin became worth over $4,300. Anyone who invested in Bitcoin back in February 2009, then, may well now be sitting on a digital goldmine.

16. Namecoin Launches with a Decentralized DNS (2011)

In the wake of the success of Bitcoin, several other developers, programmers and cryptographers followed Satoshi Nakamoto in releasing their own variant cryptocurrencies. Perhaps one of the most significant of these, though, is Namecoin, which was created by Vincent Durham and unveiled in April 2011. In part, it’s because Namecoin was the first “altcoin” – or new cryptocurrency – to emerge after Bitcoin’s launch. Particularly of note, however, is the fact that Namecoin’s developers took Bitcoin’s main infrastructure and added an innovative feature to it: specifically, a decentralized domain name system (DNS). In this way, Namecoin users can more securely store personal information or details of a domain name, for example – a useful measure for those wanting to keep identifying details out of the hands of others.

15. Ripple Is Released (2012)

Originally developed by Arthur Britto, David Schwartz and Ryan Fugger and launched in 2012, Ripple functions both as a distinct digital currency and as an electronic network for financial dealings. It’s arguably best known for the latter, however, for which it claims to be “the world’s only enterprise blockchain solution for global payments.” Furthermore, Ripple accepts both conventional currencies and cryptocurrencies, enabling individuals to, for example, pay over money owed in dollars and receive funds in Bitcoin in return. And given this convenience to the consumer, not to mention the speed at which transactions take place on Ripple, it’s perhaps no surprise that financial institutions all over the world have since partnered with the company to take advantage of its settlement technology – including the likes of Santander, Royal Bank of Canada and Westpac Banking Corp.

14. Peercoin Launches with Proof of Stake Security (2012)

When Peercoin was introduced in 2012, it joined a growing list of altcoins that had launched in Bitcoin’s wake. Where Peercoin differed from those other cryptocurrencies, though, was in its use of proof of stake security. Indeed, as the 2012 white paper announcing Peercoin states, this new cryptocurrency relegated proof of work to solely “initial minting,” making it, as the paper’s authors Scott Nadal and Sunny King described, “largely non-essential in the long run.” This hybrid system had one key advantage, moreover. The proof of stake method depends on coins that are already in existence, and, in Peercoin’s case, is used to then determine the number of future coins investors receive. This means that new coins can be created without using the large amounts of electricity needed to mine cryptocurrencies using only the proof of work principle.

13. The Total Value of Bitcoin Exceeds $1 Billion (2013)

In March 2013 there was a total of almost 11 million bitcoins in circulation. At the same time, the value of each Bitcoin had risen to more than $92. Do the math, and you’ll find that this meant that the value of all bitcoins now exceeded $1 billion – a highly significant milestone that had taken the cryptocurrency just over four years to achieve. But that landmark moment wouldn’t have happened without a steep increase in Bitcoin’s worth – just a month beforehand, a single unit of the virtual currency had been equivalent to only $32. But despite Bitcoin’s success, there were still those skeptical as to whether it was a good buy. For instance, while speaking to IEEE Spectrum in 2013, ClearBridge Investments’ Michael Kagan shared his doubts, saying, “I just don’t feel comfortable getting involved with something vulnerable to being hacked or manipulated, and with no recompense if it is.”

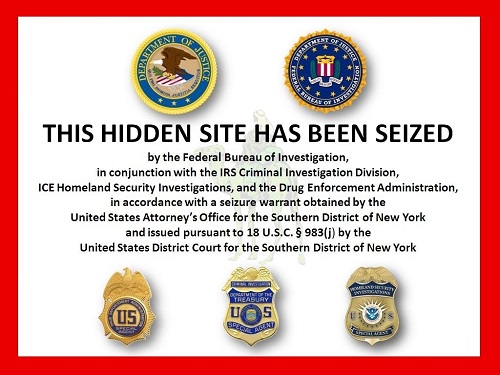

12. Silk Road Is Closed and the Value of Bitcoin Plummets (2013)

Since its creation in early 2011, Silk Road had been operating as a dark web marketplace for sometimes illegal drugs. And given the site’s wares, it’s understandable that the FBI had been tracking its operations very closely. Agent Chris Tarbell, in particular, had been searching for the identity of the mysterious “Dread Pirate Roberts,” and when he found the IP address that seemed to suggest the location of the site’s founder, the authorities swooped in. In October 2013, in a dramatic snatch, FBI agents arrested Roberts – a.k.a. Ross Ulbricht – with his laptop open in a San Francisco library. Silk Road itself, meanwhile, was seized by the agency and shut down. And that closure seemingly had an effect on the value of Bitcoin – the currency fell from a little under $146 to just below $110 when the news of Silk Road’s fate emerged.

11. The World’s First Bitcoin ATM Opens for Business in Vancouver (2013)

The first ever automatic teller machine (ATM) dispensing paper money opened in London, England in 1967. But it was to be another 46 years – in October 2013, to be precise – before the world’s first Bitcoin ATM appeared at Waves Coffee House in Vancouver. The machine allowed Bitcoin owners to exchange their digital money for conventional currency after being identified, in a suitably hi-tech manner, by their palm prints. Individuals could also sign up at the machine to create a Bitcoin account, and around a third of the first day’s 81 users did just that. Even more impressively, the ATM did $10,000 worth of business in that one day alone. But there were limits to the new service. As Jordan Kelley, then CEO of ATM operator Robocoin, told ABC News at the time, “For Canadian customers, we’ve set a transaction limit of $3,000 per day. You can’t just put in or take out a million dollars.”

10. BTCChina, the Country’s Largest Bitcoin Exchange, Stops Deposits in Yuan (2013)

As with conventional currency, world events can sharply curtail a cryptocurrency’s value. That was the case with Bitcoin in December 2013, after BTCChina made a perhaps unexpected announcement. Specifically, in a message posted on Chinese social media site Sina Weibo, the leading Bitcoin exchange stated that it would no longer accept deposits in yuan, the Chinese national currency. This came after a statement made by the People’s Bank of China that cautioned financial institutions against the trade of Bitcoin, adding, “Bitcoins are virtual goods that have no legal status or monetary equivalent and should not be used as currency.” And although BTCChina’s notice went on to state that their measure was a temporary one, and that cryptocurrency deposits were to be unaffected, the development had an almost immediate effect on Bitcoin’s worth, cutting it from $1,200 to just $572 on the MtGox exchange. In January 2014, however, BTCChina began to allow deposits in yuan once more.

9. The University of Nicosia Begins Accepting Tuition Payment in Bitcoin (2013)

In 2013 Cyprus’ University of Nicosia earned headlines as the first accredited college on the planet to accept payment for tuition in Bitcoin. Given the sometimes violent fluctuations in Bitcoin’s worth, this may have initially seemed a risky venture to some. A spokesperson for the university, however, outlined the institution’s reasoning to GeekWire in November 2013. They explained, “The intention of this initiative is to ease transmission difficulties for certain students and to build our own practical knowledge about this field, not to engage in currency speculation.” In addition, the University of Nicosia now offers what it states is “the world’s first postgraduate degree in digital currency” – a online master’s course that it believes will “[position] the university as a leader in Bitcoin and blockchain technology education globally.”

8. Overstock Becomes the First Major E-Commerce Site to Take Bitcoin (2014)

In January 2014 Overstock became the first major retail website in the U.S. to accept payment in Bitcoin. Later that same year, it began accepting the cryptocurrency on its sites around the world, too. Headquartered in Utah and having traded since 1999, Overstock sells everything from bookcases to barbecues and handbags to humidifiers. And it does so very successfully – back in 2014, in fact, it boasted annual sales of $1.3 billion. While speaking that year about Overstock’s choice to allow Bitcoin payments, the site’s CEO Patrick Byrne said to Wired, “As long as you can get on the internet, you can order and pay in Bitcoin. You can order in North Korea if you want – as long as you’re having things delivered to, say, Singapore.” And it was Byrne who personally pushed for the move, which seemingly fits well with his libertarian belief in a financial system outside the control of large corporations and overweening governments.

7. Leading Bitcoin Exchange MtGox Is Hacked (2014)

The February 2014 hack of MtGox was not the first time that the Tokyo-based Bitcoin exchange had been infiltrated. It had previously happened in 2011, for instance, leading to the site being shut down for days on end and the loss of $8.75 million. But while MtGox had bounced back from that previous data breach and went on to earn itself a reputation as one of the most trustworthy Bitcoin exchanges, in 2014 it would not be so lucky. Indeed, it had been in hot water even prior to the hack. By late 2013, for instance, the U.S. government had confiscated $5 million from MtGox because the firm had not filled in the requisite paperwork to be registered as a money transfer service. CoinLab, once a MtGox business partner, was also suing the company for $75 million. When the hack and the resulting loss of 850,000 bitcoins – valued at the time at close to $400 million – occurred, then, it was arguably the nail in MtGox’s coffin, and the exchange then fell into bankruptcy.

6. Ethereum Launches (2015)

Ethereum was first described in a 2013 white paper by Vitalik Buterin, a Russian-born programmer who wanted to create a digital platform that would go much further than merely being an encrypted payment system like Bitcoin. Indeed, Ethereum’s own blockchain also enables individuals to create what it has termed “smart contracts”: apps that can benefit from the security the chain provides. In this way, Ethereum goes beyond Bitcoin’s use of blockchain as a mere “ledger” for financial transactions. And since the platform’s launch in 2015, it has earned Buterin high praise indeed from Fortune magazine, which has labeled him a “boy genius” and “arguably as successful an entrepreneur as [Snapchat’s] Evan Spiegel or [Airbnb’s] Brian Chesky.” That success, moreover, can be measured by Ethereum’s highly impressive market capitalization of over $28 billion in September 2017.

5. Bitcoin’s Value Exceeds That of Gold (2017)

March 3, 2017, saw Bitcoin reach a milestone that tech website Engadget has deemed “a weird but auspicious moment in human history.” That’s because, on that day, the worth of one unit of the cryptocurrency – then $1,238.11 – exceeded that of the value of an ounce of gold, which was priced at $1,237.73 by Bloomberg Markets. Just 38 cents were in it – but it was a slim margin that made Bitcoin the winner. That achievement may have seemed unthinkable just two years before, when a single Bitcoin was equivalent to a mere $200. And as 2017 went on, the gap between the price of gold and the price of Bitcoin, in fact, became increasingly extreme. In mid-September of that year, for instance, an ounce of gold was worth $1,331.60; one Bitcoin, by contrast, had a value of $3,363.42, according to CoinDesk’s Bitcoin Price Index.

4. Cryptocurrency Company OneCoin Unravels (2017)

The cryptocurrency boom, and particularly the steady rise of Bitcoin, has likely enticed many to consider acquiring a few digital coins of their own. Unfortunately, though, one particular cryptocurrency investment opportunity turned out to be nothing more than a Ponzi scheme. OneCoin offered interested parties the chance to learn about cryptocurrency trading with educational packages that cost as much as $29,000. These packages also included tokens which, in theory, could be used to invest in OneCoin. However, in 2016 British newspaper The Mirror pointed out a clause in the OneCoin website’s terms and conditions that arguably spoke of the scheme’s true nature. This read, “The company does not warrant that product descriptions or other content is accurate, complete, reliable, current or error-free.” And, as it turned out, Indian authorities were wise to the scam; in April 2017 police in Mumbai apprehended 18 individuals involved in OneCoin and seized close to $3 million in funds.

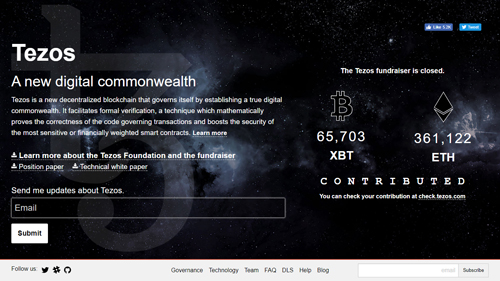

3. Startup Tezos’ Initial Coin Offering Raises a Record Amount (2017)

Like many startup companies, Tezos used crowdfunding to help subsidize its decentralized blockchain system. More specifically, this crowdfunding took the form of an initial coin offering (ICO), in which individuals give money to a fledgling cryptocurrency firm in exchange for an amount of that cryptocurrency. In Tezos’ case, investors received “tex” tokens in return for their financial assistance. What’s more, a lot of people seem to have found that deal appealing, as just 13 days after the ICO was launched in July 2017, Tezos had raised over $230 million in Bitcoin and ether coins. That astounding sum ensured that the company had held the biggest ever ICO at the time. Indeed, it easily surpassed the previous record set by Bancor, which had earned approximately $150 million with its ICO – itself a noteworthy achievement.

2. LedgerX Becomes the First Digital Currency Exchange to Get U.S. Federal Approval (2017)

In September 2015 the U.S. Commodity Futures Trading Commission (CTFC), seemingly aware of virtual money’s march into the mainstream, issued a statement deeming that cryptocurrencies would be regulated as commodities. And according to financial technology expert and New York Law School professor Houman Shadab, the move was a logical one. Shabad told the Washington Examiner that this state of affairs at the time was one that cryptocurrency firms had “long already taken for granted.” Perhaps even more noteworthy, though, was the CFTC’s ruling in July 2017 that Bitcoin exchange company LedgerX would become the first such operator of its kind to be federally regulated. LedgerX, for its part, greeted the news with a statement on its website that read, “Traditionally, our company has purposely been working quietly on the sidelines. Now, with official United States regulatory approval for our exchange and clearing house licenses, this is going to change dramatically.”

1. Russia Moves to Regulate Cryptocurrencies (2017)

In April 2016 it was reported that the Russian Ministry of Finance was planning to outlaw the use of digital currency altogether in the country. What’s more, the penalties proposed for those who chose to ignore the legislation were steep. Financial executives caught dabbling in cryptocurrencies, for instance, may have faced prison sentences of up to seven years. Speaking to Bloomberg, a Russian central bank spokesperson said of the matter, “Bitcoin can be used to finance the shadow economy and crimes, and… we cannot allow [this risk] in Russia’s financial system, which we are striving to make transparent and healthy.” By September 2017, however, the Russian government had apparently had a complete change of heart, with Bloomberg reporting that the nation would now seek to both permit the use of and regulate cryptocurrencies. And Russian Minister of Finance Anton Siluanov confirmed this move, explaining, “The state certainly understands that cryptocurrencies are a reality, there is no point in prohibiting them. It is possible to regulate them, so the Finance Ministry will draw up a bill by the end of the year.”