Image: Aldo Gonzalez/Flickr

It’s tax man time. Around the country every April, private citizens and most business owners scrape together 25% or more of their income and send it off to the IRS. So how is it that giant multinationals, purportedly taxed at around 35%, manage to pay close to nothing—or, in GE’s case this year, nothing—in taxes?

For example, between 2007-09, the country’s top five companies (by market capitalization) have paid between 4.5% and 25.8%. Luckily for them, tax returns, due to the type and amount of information they require, don’t actually give the IRS much headway on figuring out which activities are legitimate, and which are shadowy. With more than 50,000 tax rules, corporate accountants have space to be creative. They do, saving their employers billions of dollars.

Here are 25 companies that will probably pay a much lower tax rate than you this year.

25. Carnival Cruise Lines

Image: Scott L/Wikimedia

Cruise lines aren’t just about glamorous vessels and state-of-the-art leisure technology. There’s something far murkier than the oil that pumps through the hearts of Carnival’s twenty-two ships.

No, there is no aquatic killer stalking the decks, but your pocketbook may think so. Case in point, between 2005 and 2009, Carnival brought in a windfall of $11.25 billion. Sounds pretty sweet, right? Bear in mind that the average tax rate for a corporate entity is about 35%. Even following that, it would have left them with a little over with a $7.3 billion profit. Not too shabby, all things considered.

How much did they actually pay in taxes, courtesy of the warren of tax shelters, incentives and hidey holes they utilized? $126 million. For the average person, $126 million seems like a lot, but when the national deficit is in the trillions (1 trillion = 100,000 million), that is barely a drop in the bucket. Far from the average of 35%, they paid out a paltry 1.12%. Don’t know about you, but to us, something about that seems all wet.

24. Boeing

One of the biggest aerospace companies in the world also flies by on some blessedly low tax rates. From 2004-2009, Boeing made $17.5 billion pre-taxes. That’s nothing to sneeze at. But they only paid $796 million in taxes, thanks to tax breaks on sales made outside the United States, and a full 38 subsidiaries in tax havens outside of the US. One estimate has the company’s 2007-9 tax rate at -0.8%; its tax rate since 2004 has hit a maximum of only 4.6%. Add the recent $35 billion federal military contract to the cockpit, and Boeing has a mighty sweet relationship with the government.

23. AT&T

AT&T is the largest provider of telecommunications in the country, which means, in the grand scale of things, they are pretty ripe for the taxman’s picking.

As with any corporate behemoth with the propensity to grow beyond reason, AT&T began vacuuming up competitors under the guise of providing better and broader service, like a turbocharged Hoover. As of 2007, AT&T even changed the language of their legal policy to stipulate that they can basically shut down any and every part of a user’s service if that user does anything whatsoever that AT&T deems “detrimental” to itself and anything remotely related to it and its sundry bits and pieces. That makes their old slogan, “reach out and touch someone,” seem incredibly creepy, doesn’t it?

Surprisingly enough, with 2010 sales of $123 billion, pretax income of $19 billion and taxes of $6.2 billion, their tax rate is, compared to other multinational groups, close to where it ought to be. Because there has to be a loophole somewhere, executives can bill the company $14,000 a year for their private tax purposes.

22. Ford Motor Co.

Ford had a so-so year in 2010, with sales of $118 billion. Pretax income was $3 billion, yet they only paid $69 million in taxes. This means, for those of you keeping score, that their tax rate was only about 2.3%. Ford’s losses deserve credit for that tax fringe benefit, but hey, at least they never took a government bailout.

21. Cognizant

Cognizant offers IT-related consultancy and services around the globe, where it also has a number of convenient tax havens. What makes their 19.8% tax rate galling is that they’re part of a group of other multinational companies who are trying to get Congress to pass yet another tax repatriation holiday. The last one they passed back in 2004 didn’t go as well as planned. Well, not for the little guys anyway. However, it was a smashing success for executives who came up with the idea. We have just a few words for Congress courtesy of Frankie Goes to Hollywood: “Relax, Don’t do it.”

20. IBM

Edward Norton’s character, the narrator from the movie Fight Club, once opined that, “when deep space exploration ramps up, it’ll be the corporations that name everything. The IBM Stellar sphere, the Microsoft Galaxy, Planet McDonalds.” Although IBM may not yet have stamped its name on NASA’s next generation of space vehicles, its tax evasion tricks, like many of its tech-company bedfellows, are still pretty out of this world. For the whole of 2009, IBM’s gross income was $13.4 billion, with a 45.7% profit margin. ’09 was the sixth consecutive year of IBM seeing increasing profits. That same year, it only had a 26% tax rate. It’s not Google’s 2.4% rate, but it’s still lower than what most of us pay.

19. Oracle

Image: Oracle Corp. Communications/Flickr

When it comes to hoarding gold, the software, hardware, technology consultancy and telecommunications industries are where it’s at. One of the big five technology firms, Oracle, boasted an income of $23.25 billion in 2009, and $26.82 billion in 2010. How much of that do you think that the business hardware and software company paid to the IRS?

Like the others on this list, the answer is not much. About a quarter of Oracle’s revenue comes from an Irish subsidiary with no employees, according to a recent filing uncovered by BusinessWeek. That’s despite the fact that about 44% of its business comes from the US. Even when there are products or services that originate from the United States, Oracle, like many multinationals, has found that building a labyrinth of tax shelters around the globe is the best way to fool Uncle Sam’s probing hand.

18. Microsoft

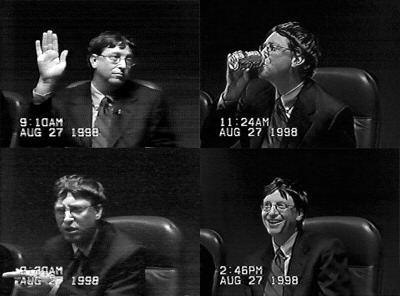

It’s a little ironic that Microsoft is on this list, considering how much money how much money the Bill and Melinda Gates Foundation pours into such worthy causes as education, health care, the reduction of poverty, and exposure to innovative information technology.

Gates may no longer run the show at Microsoft’s Redmond Washington offices, but the man’s philanthropy starts to look more like a mercenary government when you realize how much money he didn’t spend on taxes. Remember that the going rate for the corporate tax rate is 35%. But even since the halcyon days when Gates was in charge, his baby has paid maybe 5-10% in taxes. In a weird way, Gates has funneled the money he should have owed the government into philanthropy that arguably fills the gub’mints gaps.

17. Allegheny Energy

Image: Don O’Brien/Flickr

Allegheny is probably thumbing its nose at other power companies, since it has paid between 1.1% and 2.28% in taxes over the last ten years. Why so little? Unlike most huge companies, it does not really have a multinational arm, so it can’t simply stash its dough in the Bahamas. Moreover, it’s a power generation company that provides and generates electricity in Pennsylvania, West Virginia, Virginia and Maryland.

This crucial serviced earned them $2.5 billion over the course of several years. Out of all that, you might think that some of the cash went to the IRS; indeed, a paltry $58 million did. This was due to a tax break, which they received after suffering huge losses in energy trading as well as other ventures back in the early 2000s. Talk about silver lining.

16. Cisco

If a tax holiday strikes you as an extraordinarily bad idea, welcome to the club. But that is precisely what big name companies like Cisco (who makes consumer electronics, like routers, modems, and computer security products) are trying to get Congress to allow with a targeted website called WinAmerica.

Congress would pass this tax repatriation day, and multinational companies like Cisco or Google bring in a lot of their offshore funds (stashed in places like the Bahamas because there are no tax laws there) into the US, but at a much lower tax rate than usual.

The problem is, Cisco already pays an enviable tax rate of 19.8%, because of those aforementioned offshore funds. How low? Try 19.8%. Last time Congress passed such a holiday back in 2004, most of the money went back to the executives who begged for the breaks in the first place.

15. Broadcom

Image: Coolcaesar/Wikimedia

If you were a manufacturer of semiconductors for the wireless and broadband communications sectors of the technology world, how would you save as much money as possible? If lobbying Congress, performing all your research and development in the United States in order to get tax breaks, and selling your products in the markets of low-tax countries to keep your profit margin in the black are your answers, then you might be Broadcom.

Broadcom pulled in more than $1.2 billion over the last few years, but only paid a nano-scale $41 million in taxes, or 3.32%. If you have used an iPod, played a Wii or used an iPhone, you will have used a product that had some of its guts made at Broadcom. Note that the low corporate tax burden on each product doesn’t necessarily make it feel lighter.

14. NVIDIA

This multinational company manufactures graphics processing units (GPUs) and chipsets for various computers. Their hardware covers markets from gaming to supercomputing, computer-aided design to smartphones.

Here’s that multinational tech company equation again: Tech + diverse product line + global reach = > loophole use to avoid taxes. For about $1.8 billion in net profit during 2005-2009, NVIDIA only paid $41 million in taxes, or a 2.2% tax rate.

Their workaround for this was entirely legal. Like other tech firms, NVIDIA does much of their R&D over here, granting them huge IRS tax credits. Then they shill their products out to countries with a low tax rate. NVIDIA’s slogan is “NVIDIA – The Way It’s Meant To Be Played.” Oddly fitting, considering how they are playing the government like a harp.

13. Xcel Energy

While we consumers have been happy for years with our carbon-belching fossil fuel-driven plants, Xcel tries to do a little better. They boast plants that run on coal, wind, solar, and hydropower, along with biomass power generation and nuclear power. That is all well and good for the residents of Minnesota, Colorado, Michigan, North and South Dakota, New Mexico, Texas and Wisconsin who make use of Xcel’s energy output.

But something is fishy here. With such a huge coverage area, you might expect (and rightly so) that Xcel is seriously raking in the dough. Over the course of four years, they pulled in about $4.3 billion dollars, while paying a paltry $77 million in taxes.

As it turns out, they may actually be in trouble with the IRS over it too. We can’t help but picture Xcel like the kid who got his hand stuck in the cookie jar. That measly 1.78% rate can’t hold forever, after all.

12. Amazon

Amazon is one of the world’s leading online retailers of everything, from pacifiers for your preemie to cashmere Chihuahua sweaters. All that stuff has netted Amazon pre-tax profits of $3.5 billion, but they paid taxes of only $152 million. That’s an almost-Bahamian 4.3%.

You have to give Amazon credit where it’s due, though, even if you disagree with their (perfectly legal) tax sheltering antics. Amazon is one of the best purveyors of stuff we need, as well as crap we think we want. They know it, and as long as there are customers willing to buy their stuff, they’ll keep squirreling away the money.

11. Host Hotels and Resorts

Host Marriott has split apart and absorbed other companies no less than six times since 1992. Since then, it has garnered handsome and creative tax breaks, including a $75 million benefit for installing coal treatment machinery in 2002, a slew of tax breaks for the construction of their hotels, and, of course, lobbying.

Such maneuvering helped it keep all but 3.05% of its 2004-9 earnings all to itself. Over that period, it drew in $1.1 billion before taxes, yet only paid $34 million in taxes. That’s what we call a hospitable tax situation.

10. ConocoPhilips

Image: FICelloguy/Wikimedia

ConocoPhilips is the fifth-largest oil company in the country. Typically, CP, like lots of other multinational companies, would want to hide its wealth offshore, but since most of its oil comes from countries where the tax rate is even higher, the oil giant has to rely on government-sponsored tax breaks, like the 2004 oil and gas manufacturing deduction, purportedly passed in order to help domestic oil companies stimulate job growth in the United States. And you know how those oil companies sink their money into domestic job growth whenever they can.

CP’s tax break recently billowed out around the $451 million mark (how much they paid in taxes on a $16 billion income between 2007 and 2009). For those keeping score, that’s $451 million that might have been put to (cough) domestic jobs. Of course, with the guys holding the purse strings being who they are, that money probably went right back into lobbying ($18 million in 2009, for example).

9. Valero Energy

Image: Coolcaesar/Wikimedia

Valero Energy, based out of San Antonio, has made a killing with its strategy of refining sour, rather than sweet and light, crude oil http://www.marketwatch.com/story/valero-energy-ceo-to-wall-st-youve-got-us-wrong?source=blq%2Fyhoo&siteid=yhoo&dist=yhoo. But there’s certainly a lot of sugar on its tax strategy. Think $68 billion in sales, but a $157 million tax refund from the IRS over the course of three years, plus a $134 million tax break for the oil and gas they manufactured (to stimulate domestic job growth, remember?). They’re also cozy with the Department of Defense, for whom they’ve provided bulk fuel for contracts worth hundreds of millions of dollars. Incidentally, one of their other brand logos is the shamrock, signifying that fortune does indeed favor the well-connected.

8. Citigroup

Picture, if you will, an Olympic-sized pool full of money. Now picture it filled up with hundreds and gift-wrapped by the government. Then you have Citi’s whopping $2.5 trillion bailout.

Perhaps even more impressive is how much the bohemoth didn’t pay in taxes after their $4.4 billion year worth of profits last year. That is to say, they didn’t pay a single cent. How’s that for self-centered greed? It just goes to show you that while you may find, with ample work, a seemingly worthy politician with the country’s best interests at heart, the truth is that everyone has their price.

7. Pfizer

Image: David Richfield/Wikimedia

Pharmaceutical companies’ products are supposed to make us feel better. They break our fevers, they ease the pain of our aching and aging joints, they help us with our…intimate issues, and a whole lot more.

However, the maker of such wonders as Advil, Dimetapp and Depo Provera is no stranger to back alley-esque drug testing schemes in Nigeria, lawsuits over faulty heart valves, hostile takeovers, and monopolizing industries. What’s more, their primary US plant in Groton, CT is one of the worst polluters in the country. If we overlook for a moment that they’ve had their wrist slapped more times than a naughty child in Sunday School (including a fourth indictment on drug fraud charges in the span of ten years back in 2009), we can get to their taxes.

Like many other multinational company, they don’t really pay much due to offshore accounts and the right government friendships. 17.1% is their current tax rate as of 2010. For a company whose net income was over $67.8 billion in 2010, it’s almost enough to make you swear off drugs completely.

6. Qualcomm

Image: Coolcaesar/Wikimedia

Wireless giant Qualcomm, with a 2010 revenue of $10.9 billion and a tax rate of 20%, is by no means the biggest offender when it comes to paying taxes (or not, as the case seems to be). If you think offshore tax shelters are bad, Qualcomm, along with several other corporate groups, are trying to get Congress to pass a tax holiday via a site called WinAmerica. Apparently they think that by combining “fiscal responsibility” with the devil-may-care attitude of Charlie Sheen, it will endear them to the American public when all their tax money (brought in at a much lower rate) will build up jobs and foster opportunities.

Though nice in theory, the truth of the thing is that that the money saved doesn’t go to worthy causes. It will mostly just go back into execs’ pockets, lobbying efforts, and more outsourcing schemes.

Would you rather have a fake tax repatriation holiday, where bigwig corporations put on a mummer’s show and make as if they are going to do the right thing, only to offer us up some purple Kool Aid, or get poked in the eye with a sharp stick? At least with the stick and eye scenario, you have a choice about what type of wood and which eye. The other doesn’t even give you the illusion of a chance or choice.

5. Bank of America

Once upon a time, banks were arguably a noble institution. You stashed your money with them for a nominal fee, and, with savings accounts, you earned interest. Sometimes they charged you additional fees.

But as Wall Street grew bigger and more unwieldy, like the Titans of Greek myth, they became reckless and dangerous, devouring all in their path for the sake of profit. Case in point: Bank of America. Not only did BofA grab a $1 trillion bailout, they announced a $4.4 billion profit around the same time. Then the IRS gave them back $1.9 billion in tax refunds. Government and Wall Street aren’t just scratching each other’s backs, they’re giving each other full-body massages.

4. Goldman Sachs

Image: QuantumQuark/Wikimedia

Money is Goldman Sachs’ their raison d’etre. The company, which deals in investment banking/management, securities and other financial matters, besides constructing custom revolving doors, cleaned up rather well in 2008. After making a $2.3 billion profit that year, they received an $800 billion refund from the Federal Reserve and US Treasury. Talk about friends in high places. Seen another way, that’s one big chunk of the national deficit to be moving around.

3. ExxonMobil

Do you enjoy paying taxes? Do you enjoy giving upwards of 25% of your hard-earned money to the IRS every year? ExxonMobil, like you, certainly doesn’t. That’s why, back in 2009, they didn’t pay a single cent in taxes in the United States.

Exxon accomplished this by shifting the bulk of their operations overseas, meaning that the IRS can’t touch any profits the company brings in. Even if they take a loss here in the States, they can at least break even, if not do even better, in the long haul.

Exxon, like many corporations, also muddies the waters of the tax pool by breaking themselves into multiple entities. In addition, that pesky ruling that allows multinational conglomerates to function like people means that when Exxon does pay taxes, it might end up paying far less, to the tune of 5-15%.

This is in contrast to Big Oil’s usual tax-laden state of affairs. Most of the time, big oil companies actually pay upwards of 40 to 55% of their profits back to the tax man. Unlike companies that focus on software and technology, overseas holdings in countries where most of our oil comes from (Saudi Arabia, Iraq, etc.) are burdened by even higher taxes than in the US.

They tried to offset this by funneling profits from places like Abu Dhabi and Azerbaijan into accounts in the Caribbean including the Cayman Islands. For them, it’s legal, and no, Sammy can’t touch it.

2. Google

When it comes to search engines, there are lots of choices. Dogpile, Bing, Altavista, Mahalo, Lycos and Alexis, to name a few. Or proprietary and purpose-driven search engines like The Ladders (provider of listings for $100k jobs), LexisNexis (subscription-based provider of legal, government and business based info) and MapQuest (AOL-owned as of 2000 and provider of, what else? Maps and directions).

Despite all of these choices, Google is still the most popular, almost to monopolistic proportions. It’s a $30 billion company, but the taxes it pays on those profits are a fallow 2.4%, thanks to a popular strategy known as the “Double Irish.” Google has two Irish subsidiaries. One is a holding company in Bermuda, the other is located in Ireland. In Ireland, intellectual property royalties reduce income taxes, lowering an already meager 12.5% tax rate. Google’s Irish company in Ireland pays those royalties to its Irish company in tax-haven Bermuda, funneling them through the tax-advantaged Netherlands on the way.

All told, this tasty strategy has saved the Internet giant $3.1 billion over the last few years.

1. General Electric

“Imagination at work.” This is GE’s current slogan. It certainly takes a certain amount of imagination for their chief accountant, himself a former employee of the Treasury, to work things just so. That, and a disgusting amount lobbying in Washington for lower taxes.

To boot, John Samuels, the aforementioned, bow tie-wearing accountant, isn’t the only one. Former IRS officials and even writers of tax law straight out of Congress itself were in the fray. They joined Samuels in the fold of GE’s financial department to save the conglomerate a few bucks.

A measly $5.1 billion of GE’s $14.2 billion income for 2010 came from its operations stateside. Their total tax burden for 2010 amounted to zero. In fact, they got $3.2 billion back. Those tax subsidies, shelters and tax credits provided a giant invisibility cloak for the hulking giant that is GE, helping the tax man not see it.