Bankruptcy, foreclosure, repossession – just a few of the words that come to mind when we hear the phrase ‘credit crunch’. But for a select few the global financial crisis has generated cash, acquisitions, bonuses and, er… $1000 garbage bins!? Take a look at Business Pundit’s round up of the biggest winners (and one loser).

10. John Thain

So called ‘most hated man on Wall Street’, Thain directed the sale of Merrill Lynch to Bank of America at a 70% premium and was destined to become president of global banking, securities, and wealth management before he was forced out. Having already received tens of millions of dollars in compensation, Thain had the cheek to suggest he receive a further $10m bonus for ‘saving’ Merrill Lynch. And only weeks later it emerged he had spent $1.2m in corporate funds on renovating two conference rooms – including $131,000 on rugs, a $68,000 antique credenza, $87,000 worth of chairs, a $35,000 commode and $1,400 on a garbage bin. Thain subsequently apologized for his lapse in judgment, and reimbursed the company in full. How gracious.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

9. David Einhorn

Einhorn rose to prominence as head of Greenlight Capital, a hedge fund trading in corporate debt offerings, before being accused of market manipulation in 2002. Realising the dire state of Lehman’s balance sheet he started shorting their stock in 2007 when shares were around $40, prompting a temporary ban on naked short-selling. Analysts estimate he made upwards of a 90% return on investment – and, not content with his massive payday, he even found time to force out Lehman’s CFO, Erin Callan, by going public with an embarrassing phone conversation between his analysts and her. In all fairness, she would have lost her job anyway.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

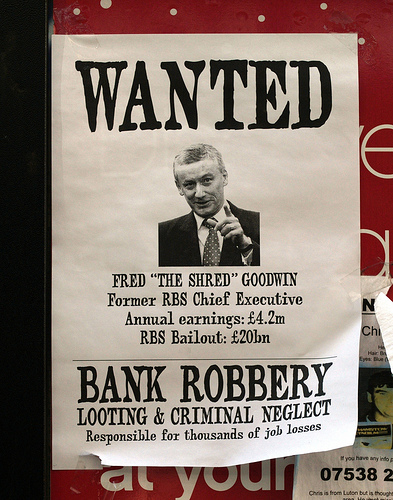

8. Sir Fred ‘The Shred’ Goodwin

The former Royal Bank of Scotland chief came in for severe criticism in the UK for presiding over the loss of nearly $40 billion and leaving RBS 70% owned by the government – the biggest loss in British corporate history. Goodwin pre-empted rumors he would be fired by tendering his resignation, allowing himself to draw a pension of over $1m a year – nearly twice what he would have been awarded if he had been dismissed. Following prolonged media outcry and a campaign that included the vandalizing of his house, Goodwin’s pension was reduced to just over $550,000 and he was allowed to withdraw a lump sum tax-free of several million. For many, in the UK at least, he typifies the way fat cat bankers have profited from their own mess.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

7. Bill Ackman

The head of Pershing Capital cashed in on the global downturn by acquiring positions in Wendy’s International, McDonald’s and Ceridian, and pressuring these companies to improve profits by selling their real estate assets or corporate divisions. The resulting asset liquidation forced the share prices of these companies up, whereby Pershing sold their positions off for a profit. Nice work if you can get it.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

6. Warren Buffett

Billionaire investor Buffett, who warned of the impending recession, struck gold again after buying up shares in Goldman Sachs at the height of the credit crunch. With Goldman now booming again (and announcing record bonus payouts this year) the man they call the ‘Sage of Omaha’ is set to make a tasty $2 billion, with the further right to buy more shares over the coming years. And as if that wasn’t enough, Buffett sold a $220m stake in credit ratings agency Moody’s at double the price he paid in 2000, making him one of the global recession’s great winners. Overall considered one of the good guys, despite his stupendous wealth.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

5. Emilio Botin

Dogged by scandal throughout his career, the head of Spanish banking giant, Santander, has built a reputation as a wily dealmaker during the credit crunch due to a string of daring takeovers. Alliance & Leicester, Bradford & Bingley and others have all fallen prey to Botin, allowing him to make Santander into Europe’s second largest banking force. And all this profit has remained intact throughout the recession, as Santander escaped relatively unscathed due to their lack of investment assets. If he can go easy on the fraud, Emilio and Santander will be even bigger in the future.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$ (just check out that pose if you don’t believe us)

4. Andrew Lahde

Outspoken Lahde’s California based hedge fund, Lahde Capital, made millions betting against sub-prime mortgage assets, earning infamy for achieving eye-watering return rates of nearly 1000%. In 2008 he quit finance thanking ‘stupid’ traders and ‘idiots’ for making him rich and publishing a bizarre letter urging the government to recognize the benefits of growing medical dope and telling bankers everywhere to bin their blackberries and go on holiday. His crazy letter has become an internet sensation, attracting support from hemp-legalization organizations and fuelling trade in Lahde fan-merchandise. Whatever next…

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

3. Jamie Dimon

As current CEO of JPMorgan Chase, Dimon presides over what has become America’s largest savings business as a direct result of the credit crunch – acquiring Bear Stearns and Washington Mutual during the downturn. Dimon himself is on course for a bumper bonus this Christmas, again, along with the rest of the JPMorgan employees, after the bank announced it had set aside $7.3 billion for staff payments in the third quarter this year. Looks set to make much, much more in the future.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

2. George Soros

The billionaire financier, philanthropist and democrat backer infamously ‘broke the Bank of England’ in 1992 by short selling the pound, netting over $1 billion on ‘Black Wednesday’. This time round he has turned his hand to a less controversial money-spinner, penning the business best-seller The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What it Means. Soros was one of the few who warned of the impending crisis, telling a Singaporean audience in 2006 that the markets were at their peak, and that global economies should brace themselves for recession and a possible ‘hard landing’.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$ (for ‘Black Wednesday’)

1. John Paulson

Described as the ‘world’s biggest winner’ from the credit crunch, Paulson earned himself a cool $3.5 billion by short-selling the US mortgage market – or betting that the housing bubble was about to burst. By September 2008 he had bet against four of the five biggest British banks, eventually posting a profit of over $450m – and this budding profiteer stands to make even more, having acquired millions of dollars worth of shares in Goldman Sachs and Regions Financial during the downturn. In an attempt to deflect accusations of ‘profiting from the misery of others’ Paulson donated $15m to a charity aiding those fighting foreclosure – a hollow gesture if ever there was one.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

And one who didn’t profit from the crunch:

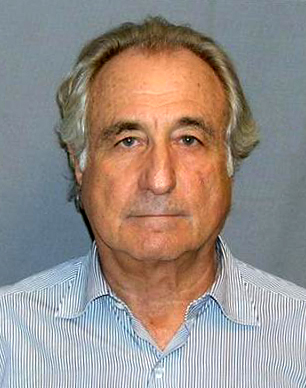

Bernie Madoff

The former chairman of the NASDAQ exchange admitted earlier this year to being the operator of a giant Ponzi scheme – a fraud subsequently called the ‘largest investment fraud in Wall Street history’. Although doubts were raised about his scheme as early as 1999, had it not been for the credit crunch, Madoff may well have gone detected much longer. The recession dried up his sources of liquidity and when investors sought to pull out some $7 billion from the fund, he was forced into giving himself away. As one commentator warned at the time: ‘don’t be surprised if other scams get flushed out in the coming weeks and months as the crisis deepens’.

Business Pundit Genius Rating: $$$$

Business Pundit Villain Rating: $$$$

Images courtesy of: wikimedia, takomabibelot, Tracy O, World Economic Forum, Refracted Moments, Ethan Bloch