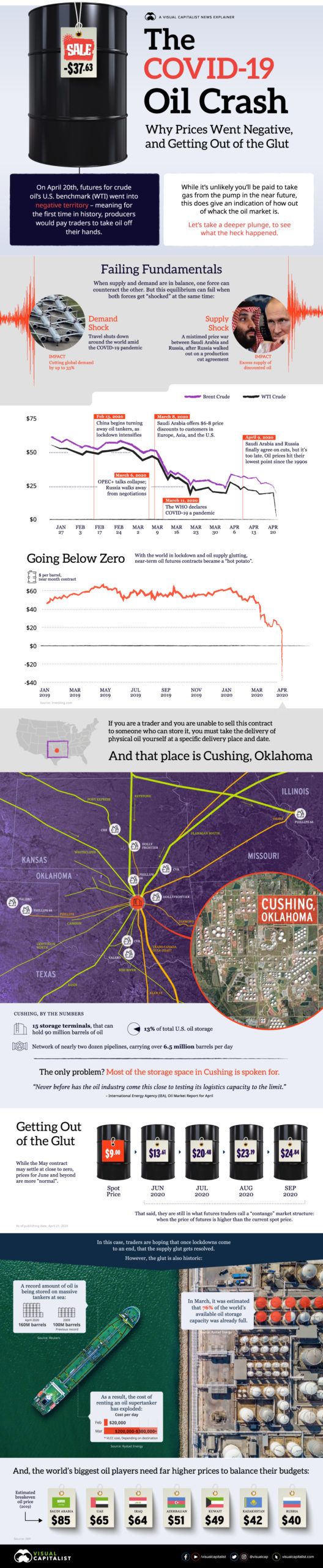

Earlier this month, on April 20, crude oil futures dropped below $0 per barrel. This historic drop on a commodity we all use in regular daily life sent even seasoned investors and traders into shock.

Beyond the obvious fact that most of the world is still under quarantine conditions due to the threat of coronavirus, it’s worth a deeper look to see what happened to cause the massive oil glut.

Can You Be Paid to Pump Gas?

It’s highly unlikely that anyone would be paid to take gas away from the pump, but April 20 did mark the first time in history crude oil producers would actually pay traders to take the barrels off their hands as they run out of storage options.

What Exactly Caused This Oil Glut?

Everyone understands the fundamental concept of supply and demand. Right now as travel is halted and people are stuck in coronavirus quarantine the demand for fuel has dropped by 33%. We would expect prices to drop as demand evaporates.

However, making the whole crude oil situation worse is an ill-timed price war between Saudi Arabia and Russia. Russia inexplicably rejected a crude oil production cut agreement, causing more of an excess supply of oil at the absolute worst time in history and creating the perfect storm.

On April 9th Saudi Arabia and Russia finally reached an agreement to cut production, but it was too late to prevent the crash.

Storing Excess Crude Oil

Traders who have contracts and are unable to sell the contracts to someone who can store the barrels of crude oil must take physical delivery of the oil in Cushing, Oklahoma.

The oil storage facility in Cushing has 15 storage terminals that can hold 90 million barrels of crude oil. However, most of the storage in Cushing is already spoken for, which is a problem we’ve never seen before.

Massive amounts of oil are being stored on tankers out at sea. And here’s where supply and demand come into play once again. Renting an oil supertanker used to cost about $20,000 per day. With space running out quickly, the new cost of renting an oil supertanker is between $200,000 – $300,000 per day.

These costs add up quickly and for traders wishing to make a profit, it means that they will have to sell this oil at a higher price to recoup costs. Inevitably, when quarantine is over, we can expect to pay much higher prices at the pump to dig the world out of this oil glut.