“A friend of mine from the States sent me an email the other day,” says Chad Rigetti, VP of Business Development for Intrade, from its Dublin headquarters. “It said: ‘Someone should do a study on how all the American liberals are obsessively logging in to Intrade to view their electoral prediction map. Doctors are going to start prescribing it in place of Xanax, for anxiety.’”

There’s something to that. Especially when you consider Intrade’s prediction markets might be more accurate than polls. The reason is that Intrade provides a predictive flexibility not found in traditional polls. Rigetti explains:

Our markets provide a financial incentive for people who have any sort of information pertaining to that to disclose it. There are people who know and people who have very strong leanings one way or another. Our markets give people not only a financial incentive to disclose that but an efficient mechanism by which to do so.

Traders who are only moderately sure of something can decide at which price they enter the market. They can also decide how much to weight their opinion by how many shares they buy at each price. The market allows people who have good information and who have trust in their own information to weight that in the market estimation or likelihood of the market price.

I compare that to a poll of course, where everyone’s vote counts for one lot and they only get a binary answer: yes or no.

Our markets are different. You don’t get a binary answer. You can choose at which price you enter the market, at which price you exit the market, and how much you’re willing to purchase or sell at every single price point. It’s much more sophisticated, much more complex and academic studies have shown people will generate much better predictive information.

Although Intrade’s contracts are binary, they also cover the spectrum of probabilities within them.

Currently the vast majority of the contracts we list on our platform are binary options whose price ranges from $0-$10 in dollar value and the prices are phrased in terms of a probability. They’re put on a 0-100 scale, so a contract trading for $8 out of 10 is phrased as having the value of 80.0 points out of a hundred.

He adds:

If you are liberal or a Democratic voter and you’re worried about the direction of the country, the picture that our markets are painting right now would be reassuring. On the other hand, if you’re a Libertarian, a John McCain fan, or Republican, it’s not looking good.

Rigetti, who also happens to be Canadian, is a physicist by trade. After participating in Intrade for some time, he joined the company’s lean, high-powered team, located in Dublin. I Skyped him there for his commentary on Intrade in US politics, its potential in other markets, and future uses for this innovative system. Our interview is below.

BP: How many people, on average, are active on Intrade at any given time?

Rigetti: I would say a few thousand active traders. However, in a ratio of active traders to users of the information, people come to Intrade just to stay abreast of the issues which we cover–the ratio is probably around 100:1. We’ve had three quarters of a million unique visitors to our site in the past 30 days (quoted roughly 1 month ago).

BP: Are most of your users from the United States?

Rigetti: The majority are, absolutely. We have registered members from over 150 different countries. The vast majority are from the United States and other English speaking countries, primarily Canada and the U.K. The information itself is watched by people in countries around the world.

BP: Can you name some prominent recent instances where Intrade was accurate, for Americans?

Rigetti: Absolutely. We accurately predicted the outcome for every single state in the 2004 presidential election and all but one of the Senate races.

This year, one of the things that was really cool for me was the Democratic VP Selection Markets. The VP markets are really interesting because, largely, the decisionmaking process isn’t public. Specific information is leaked in order to do a public press-wise vetting of the candidates, but much of that happens behind closed doors.

In general, we get inputted through the market mechanism through the most knowledgeable people–and from the broadest most diverse community possible–that will have a say in the outcome of that event or has knowledge pertaining to it. With the VP selection markets it’s different, because not a lot people have all of the information that will be used to make that decision.

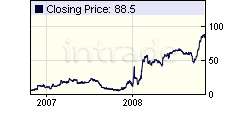

Nonetheless, our markets showed very interesting behavior where Joe Biden was not at all a frontrunner one week out from the moment that the nominee was announced. He was trading somewhere around 7% or 8% to win.

In the seven days leading up his share price on Intrade went up about three and a half times. In a field of about four or five different viable candidates he became the clear leader on Intrade more than about 48-72 hours before he was named, even before anyone was floating his name as a serious candidate.

Everyone was focused on Tim Kaine, Evan Bayh as the frontrunners at that point, but our markets were saying Joe Biden is the most likely guy. Much like people do with typical stocks, they look at not only the current price but the secondary indicators like market momentum or volume, stuff like that.

The combination of Joe Biden’s volume and the uptake in trading interest on his market to us made it very clear that there was something going on. Our market reflected that.

The kicker happened about eight hours before anything was leaked by the Obama campaign. They did this really crazy thing were they said they were going to announce it by text message. The text message took four hours or maybe eight hours to finally get sent out to all the people on the list.

Eight or six hours before any of that was leaked, or before anything was reported in the mainstream media, Biden was trading at about 80% to be the nominee. If something hits 80% on our markets that’s where you get to the point of it being rather slam dunk.

How certain is a certain thing? 80% is you’re pretty damn sure that that’s going to happen. And that was a full work day before anything was reported.

BP: Do you have a percentage of how accurate Intrade’s markets are in general at predicting events?

Rigetti: That’s a really hard question to answer in a scientifically accurate way. How do you define whether a market was correct or not in assessing something or in predicting something where you only get to run the experiment once?

If the market said there was 100% chance of something occurring and it didn’t occur that means the market was wrong. Anything less than that means that it’s impossible to say if the market was wrong, or if this was the one time out of a hundred that it should be wrong.

If it’s predicting with 80% chance of something to occur then that means that one time out of five it doesn’t occur. You don’t get to run it 10,000 times; you get to run it once. The solution to that is to do reasonable studies about how reliable a predictor the market is giving. You have to do longitudinal studies to take… each prediction by the markets in the past and put them all into one pool and see how they’re doing on average.

Each prediction is different, so you have to wait a long time for all that information to aggregate. To assess how well our markets are doing academics have to wait for the data to build up over a long time and then look backwards at it and see how they are doing longitudinally.

That data is only starting to gain critical mass, if you will. The studies that have been done on the data that is available have shown that our markets certainly are better than other predictors, in elections at least, where the other predictor is a poll, or a meta poll, or an analysis of polls or something.

The originator of this entire idea with respect to policies is the Iowa electronic markets run by the University of Iowa. They have studied how accurate their own markets are and have shown the numbers that they’re accurate 75% more often than polls are. Markets are just a much more sophisticated way to arrive to a useful piece of data.

BP: Could markets be sorted by demographic to get data that could replace a poll?

Rigetti: We don’t want anyone to mistake what we’re doing for polling because it’s not polling. It’s actually much more sophisticated and the data is much more accurate.

With respect to allowing participants from only certain geographic areas or of certain demographics to participate on a certain market or to trade on a certain market – that’s an interesting point and it’s something that has been floated before.

This is what I would view as a second generation for prediction markets and where’s it’s going to go, towards providing a service for other institutions or for governments or for companies answering very specific and well-formed questions by accessing what we have now as a sort of global pool of liquidity from which we can select members that represent different demographics.

A US company might wonder how a new product it’s developing will play in certain markets in Asia so we could access those members of our community of traders and allow them to trade on a market to assess that. That can all be done through a prediction market platform like Intrade. I would say right now we’re the only people who could do that. That’s sort of prediction markets 2.0 – that’s where we’re going and it’s a wonderful application and it’s interesting.

BP: From an investment standpoint, are most Intrade market volatile? Is there such thing as a steady, slow growth Intrade market?

Rigetti: That’s interesting. Intrade markets are subject to volatility like any markets. Some of that volatility comes from the same reasons for which our markets are very useful – namely that they aggregate information in real time.

The traders that are participating on our exchange will reflect the information that comes into the public domain or not into the public domain but becomes available very, very, very fast.

For example, someone wrote a blog posting on some obscure website that Sarah Palin boarded a plane that had left Alaska the day that McCain had scheduled a press conference in Ohio to announce his VP selection – and within seconds her price on Intrade had shot up.

You have eyes that are all over the world that are crawling the web with their ears open and their eyes open on the TV, the radio, talking to friends, texting. We’re sort of the aggregation point where all that information is put into a single number that is digestible and interpretable in terms of a probability of something happening.

You can’t see real time reflections in poll sentiments or in poll numbers or even in punditry, however reliable the pundits are. People come to our markets and watch things changing in real time.

On that point, during the VP debate we created a contract that would measure who would win the debate according to the unbiased market price on Intrade. So if Obama’s probability to win the presidency improves more than McCain’s shortly after the debate that is the market saying that they think the Democrats got the better of it or vice versa.

We created a contract that would measure the difference in our own market prices in the denouement of the VP debate. Watching this contract move in real time as the debate was happening, we saw that Palin immediately surpassed expectations. The likelihood that the GOP would benefit from the debate was illustrated by the fact that the market price shot up.

Then, in the second half, people say Biden came back. Well, that was reflected. You could see it with comments trades occurring. It’s really fascinating. There’s nothing else like it.

BP: Has anybody gotten rich off of Intrade?

Rigetti: I can’t disclose any confidential trader information. But check out this Washington Post article for more information.

The volumes in terms the number of lots or the number of dollars that are traded on our exchange are, by traditional financial exchange standards–like the New York stock exchange or the Irish stock exchange in Dublin–small.

However, by most other measures, we’re pretty big. In the past 30 days about $26M have traded hands on the exchange. That’s not small, and there certainly is an opportunity for people to support themselves.

It’s not as mature as traditional markets, but there is a huge opportunity for people who want to do that on our markets to make money and to improve the efficiency and liquidity of our market place and therefore the quality and predictability of the information we generate.

BP: I noticed there was a prediction running on Intrade that it will crash for an hour on Election Day. Is this a real concern for you guys or is it just another prediction?

Rigetti: That is a contract in Intrade.net, our virtual currency platform that appeals to a different demographic than Intrade.com. A key part of Intrade.net is it allows users themselves to define questions.

Suppose you’re thinking about going to law school and you want to know if you’re going to get into Columbia, NYU or Stanford. You could list a market and have your friends or anyone predict on it and arrive to some sort of market estimate as to how likely you are to get in to those different schools and whether you should pay an exorbitant application fee.

Someone has created a market on Intrade.net on whether Intrade will crash on Election Day and we’re not going to edit that. That’s fair play. It is the core of our business and of course we’re concerned about it because people are concerned about anything that affects them in a major way.

Still, I think we’re confident that we’re fine. There can never be a guarantee in anything of this sort. Every business is subject to bumps in the road but it’s not a major concern for us.

*

Intrade recently opened a fine art market, one of many new innovations to come. “Politics is interesting, is passionate, it’s exciting and that’s what we’re known for,” he says, “but the space is wide open. The potential for public good is wide open.”

Chad Rigetti is Vice President of Business Development for Intrade, The Prediction Market, located at www.intrade.com.