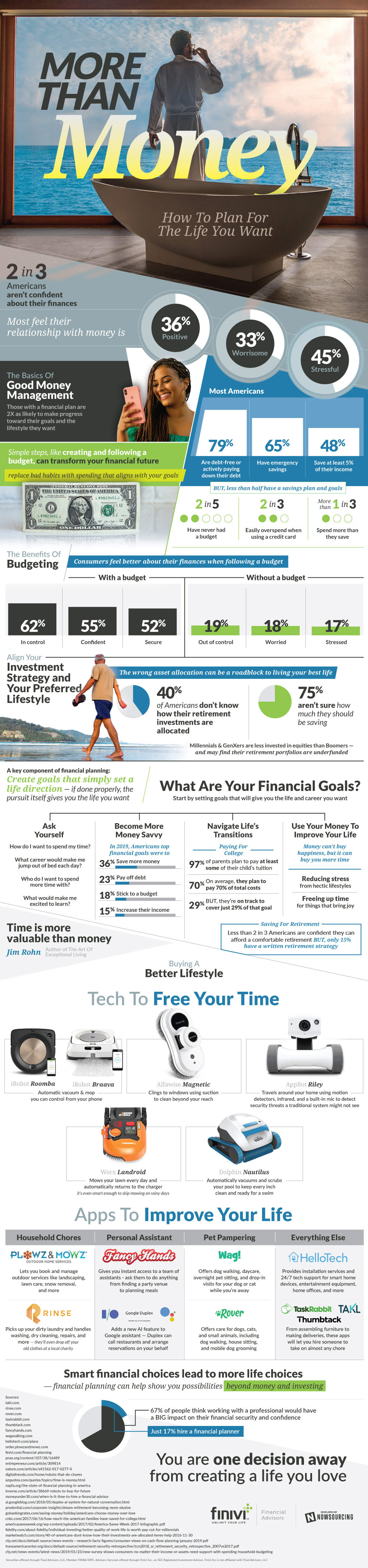

Most Americans aren’t confident in their finances – most feel their relationship with money worrisome or stressful. But many are taking steps toward financial freedom. 79% of Americans are debt-free or are actively paying down their debt, 65% have emergency savings, and 48% save at least 5% of their income. These are some of the basic stages in good financial planning – another very good way to stay on top of your money is to have a budget that you stick to. 2 out of every 5 Americans haven’t ever had a budget. Overspending is a problem for many; 2 in 3 easily overspend when using a credit card and more than 1 in 3 spend more than they can save.

Having a budget that you maintain can help you in many aspects. With a budget, many feel more in control, more confident, and more secure as compared to those without a budget who feel they are more worried and stressed about their money. Making sure you know how to make a budget is also important, but a surprising number of people don’t know how to – 40% of Americans don’t know how their retirement investments are allocated and 75% aren’t sure how much they should be saving for the future.

A key to financial planning is to create goals that simply set your life in a direction – if done properly, the pursuit itself will give you the life you wanted the entire time. Some of these goals could include asking yourself how you want to spend your time, what career you make you jump out of bed every morning, and what would make you more excited to learn. Another big goal to set is to become more money savvy, to navigate life’s transitions better, and to use the money to improve your life.

Improving your life doesn’t mean having more money to spend, it means having more time to do the things you love. “Time is more valuable than money,” says Jim Rohn, author of The Art Of Exceptional Living. Money can’t buy happiness but it can buy things to help free up time to give you more time to do the things you love. Some of these products include the iRobot Roomba can automatically vacuum your home and can be controlled by your phone. Another few are the Alfawise Magnetic, which clings to windows using suction to clean beyond your reach, the AppBot Riley which roams your home utilizing many sensors such as motion detectors and infrared to detect security threats most other systems wouldn’t see.

Robots are also used outdoors – the Worx Landroid automatically mows your lawn and returns to the charger every day – it even recognizes rainy days and stays inside and the Dolphin Nautilus which vacuums and scrubs the walls and bottom of your pool keeping it ready for a swim. All of these products show that if you are willing to spend the extra money, you can make your life a whole lot simpler.

Find out how to improve your financial wellbeing with tech and tips here.