So you want to start a business? Great! It might sound intimidating – and it is a lot of work – but many people have done it before. You can do this!

According to the U.S. Small Business Administration, California has 4.1 million small businesses, which account for 7.2 million employees. If 4 million other people can do it, so can you.

The limited liability company (“LLC”) is one of the most common types of business entity, and is uniquely flexible and powerful, especially for small business owners and entrepreneurs.

This article is your ultimate guide to getting a limited liability company up and running in California. And getting the state right is important, since LLCs are the legal creations of states, rather than the federal government. So the process looks slightly different state-by-state. This guide focuses exclusively on how to start an LLC in California.

Review the detailed, step-by-step suggestions below, along with a full set of the links to the state and federal websites and online forms that you will need. Starting a business can be a bit complicated, so if you would like a professional guide through the process, we will point you to our favorite providers at different steps and stages, foremost of which is ZenBusiness, which can handle the whole process for you, saving you a lot of headache along the way.

Let’s get started!

1. First, make sure a California LLC is the right entity for you

Choose the right business structure before you create it…

A limited liability company (an “LLC”) is a very popular entity choice for starting up a business. The LLC structure provides flexible formation, ownership and management, and has fewer formal and rigid requirements for administration and operation compared to a Corporation, all while providing similar legal protections.

The LLC structure also provides for easier taxation, by allowing “pass through” taxation, so that you do not have to pay taxes at both the business level and at the personal level. But there are other entity structures out there to consider and selecting the correct one is an important first step. More information about the various kinds of business entity, and how to choose the one that is right for you, is available from the U.S. Small Business Administration.

2. Create a Business Plan for Your LLC

You’ve got the idea, now plan your business!

From your company ethos and core values to your service and product design, from your partners and your team responsibilities to your sales and marketing strategies, a business plan is an essential, living document that provides a roadmap for a new company and is a key business asset for long term growth and viability. Importantly, you’ll outline some of the basic business characteristics that you’ll need for creating your limited liability company, including:

- Purpose of the company

- Ownership stakes and contributions

- Description of products or services

- Target consumers

- Marketing strategy

Do I Need a Business Plan?

While there is no legal requirement that you write a business plan, nor is there one “correct” format for a business plan, we still recommend that you do your homework and put the time into creating one. For one, if you hope to bring on an investor, lender, or another member (owners of an LLC are called “members”), they will all want to see your business plan so they know what they are getting into.

Even more importantly, the exercise of creating a business plan will give you the clarity you might not know you even need. It all sounds good in your head right now, but once you start to lay out how much your product or service will cost to produce, how much you can sell it for, and how to sell it, you might realize you had overlooked some small but crucial details – details that could be the difference between success and failure in the tenuous early days of your new business.

As the Boy Scouts say: “Be prepared.” We could not agree more!

How to Write a Business Plan

There are lots of websites that will offer you tips and templates for constructing your business plan. Many of them are fine, but if you are looking for professional guidance – particularly if you are going to be presenting your plan to prospective investors or lenders, we recommend that you use LivePlan.

At LivePlan, templates are just the beginning: They will walk you through the entire process of constructing your business plan, up to and including pitching your entrepreneurial venture, forecasting your cash flow, and tracking your venture’s performance.

3. Choose a Name for Your California LLC

It can be both thrilling and daunting but…

Choosing a name for your business is an important and exciting step in creating your company! But don’t jump in uninformed; there are some important considerations to be made in choosing a name – and getting it right the first time can save a ton of time, expense and headache down the road. Crucial factors to consider include…

State of California Requirements

Make sure your name is both original and legal.

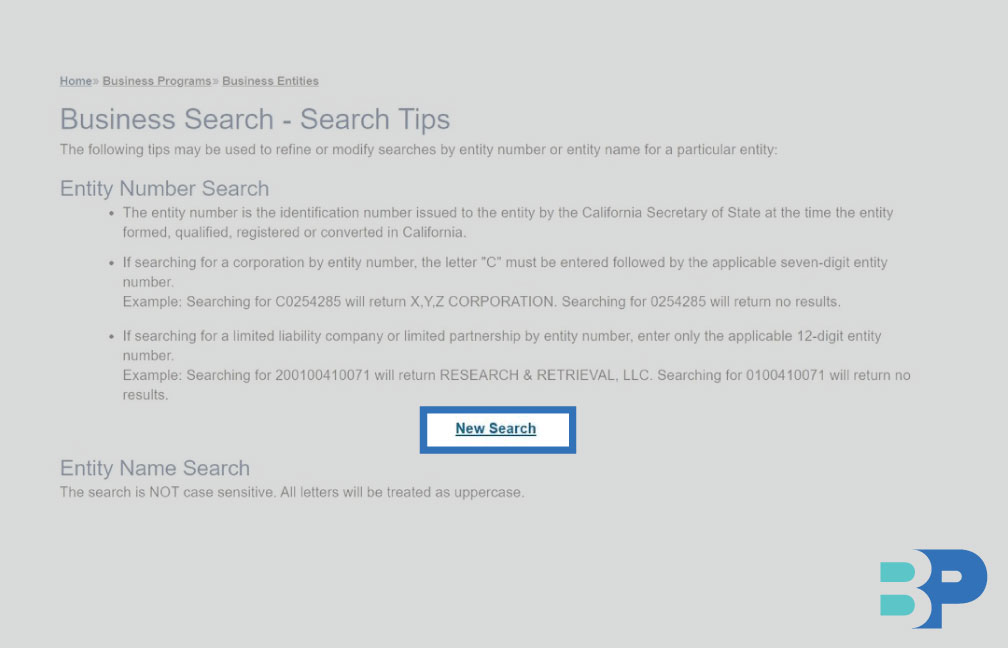

California has a searchable online database of previously registered names to help ensure that you don’t apply for a name which is already in use. So before you set your heart on “Quality Is Our Recipe, LLC,” make sure that name is not already taken.

(Hint: That one is taken – it’s the legal name of the fast food chain Wendy’s.)

Business registrations are handled by California’s Secretary of State, who also provides guidance and specifics for what must be included in the name (an identifier of the business entity, like “LLC” or “limited liability company”) and what cannot be included in the name (like “Bank” if your entity is not a bank).

Using a DBA (Doing Business As) or ABN (Assumed Business Name)

Let’s say you already have registered a business name, but you want to use a different name in your marketing or sales. Or let’s say that you prefer a generic name for legal purposes. Or that you don’t want “LLC” in the public-facing name you use with customers.

That is where the DBA/ABN comes in. The legal name of your company does not have to be the name that your company uses to hold itself out to the general public.

Let’s take the example we already used above. “Quality Is Our Recipe, LLC” is the legal business name of a fast food chain that everybody knows as “Wendy’s.” In this case, “Quality Is Our Recipe, LLC” is the business name registered with the Secretary of State. “Wendy’s” is the Assumed Business Name (ABN), also known as the Doing Business As (DBA) name. The state of California also refers to ABNs/DBAs as “fictitious business names.”

If you want to take the Wendy’s route and use a fictitious business name, then choose an original, compliant legal business name first, register your company with the state of California by filing Articles of Incorporation (that’s Step 4 in our guide) and after that, go register your ABN/DBA with the county in which you will operate.

While in some states you register a fictitious business name with the Secretary of State, in California, this is done instead on the county level. Here is California’s index of counties and their respective websites where you can register your ABN/DBA. We’ll remind you of this information again in Step 4.

A final note: Similar considerations for legal business names apply to fictitious business names, though with an important exception: Generally, you are not allowed to include entity identifiers like “LLC” in a fictitious business name. Check the details on ABNs/DBAs with the counties you plan on registering with.

Internet Domain Name

You will almost certainly want to create a website using your company’s new name. So in addition to ensuring your company’s new name is not already registered in the state of California, and that it meets the Secretary of State’s requirements, you should also consider if the name is already used for an existing website.

So do your own online searches and then look for a hosting service to confirm availability and snatch up the domain using GoDaddy’s domain name registration tool.

(But don’t buy your domain until you have confirmed with the state that you can get the business name you want)!

Trademark Consideration

You have confirmed that the perfect name is available with the state, and you have already checked with GoDaddy and verified that the domain name is available. All done? Not quite.

You should also consider whether the name is available for trademark registration. The name might be available in California – but what if someone in New York already trademarked the same name for the same class of goods or services your company will provide?

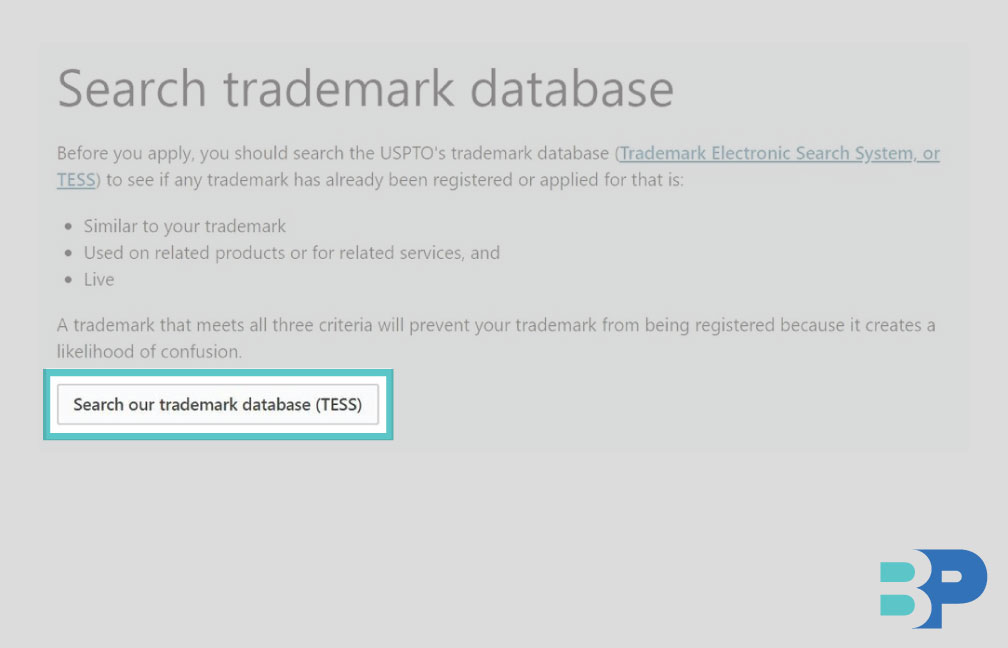

There is not one single step to resolve this, so you should spend some time googling the name to see what comes up, combing through California’s Trademark Search tool, and searching the U.S. Patent and Trademark Office’s (USPTO) online database of trademarks.

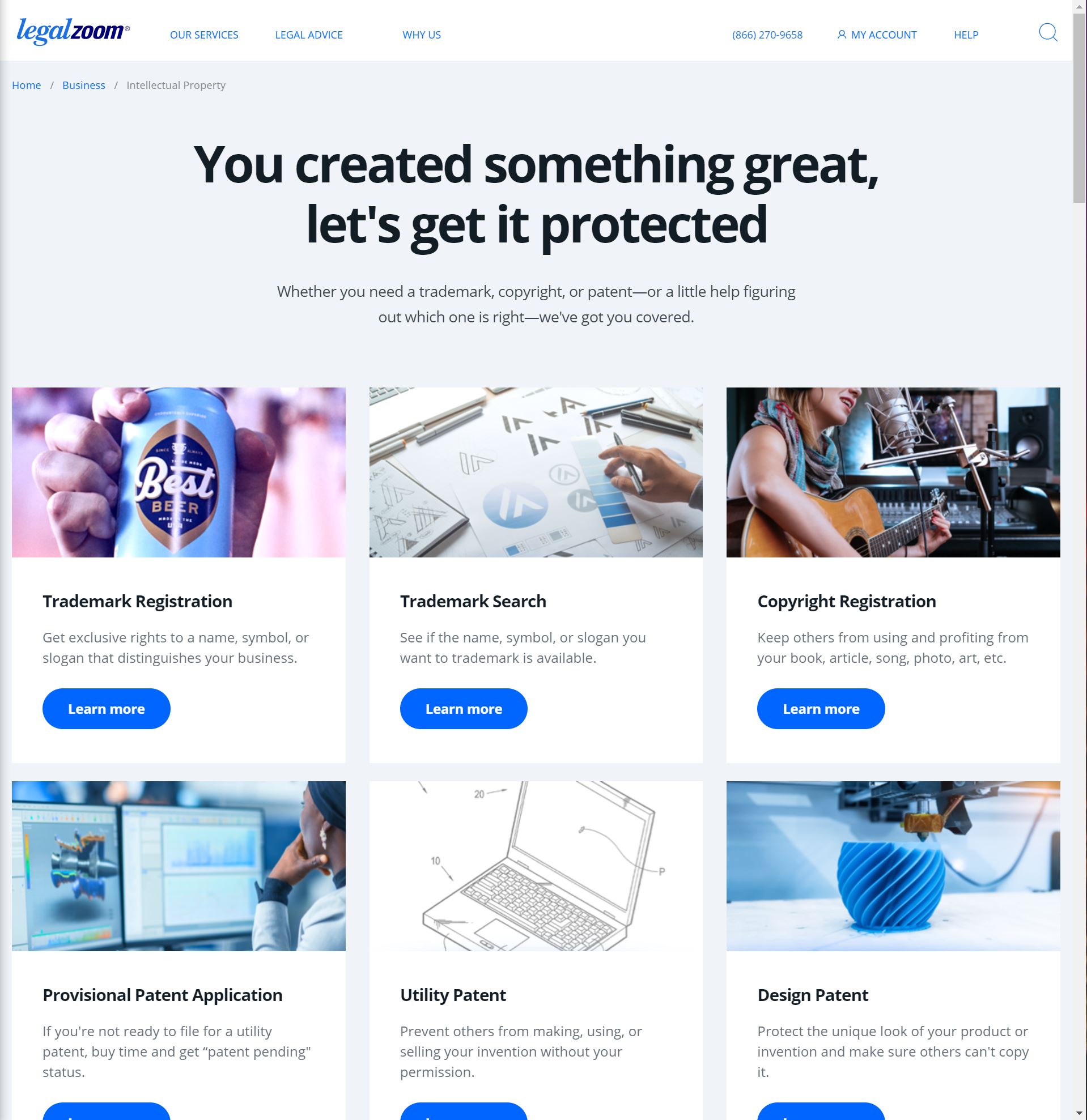

Trademark law is quite complicated though, and even dedicated amateurs can miss things. If acquiring a trademark is essential for your business, it is best to consult an attorney, which the Attorney Advice portal on LegalZoom makes easy and drama-free.

4. File Articles of Organization with the Secretary of State

Time to make it official!

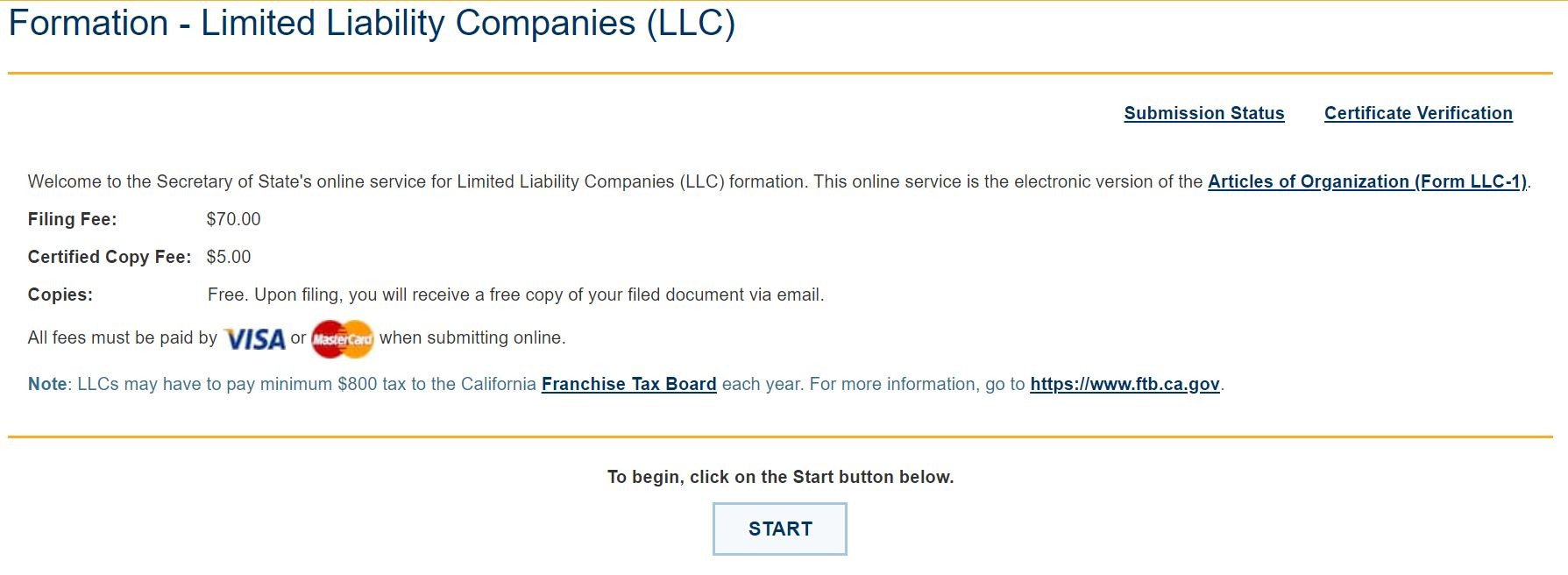

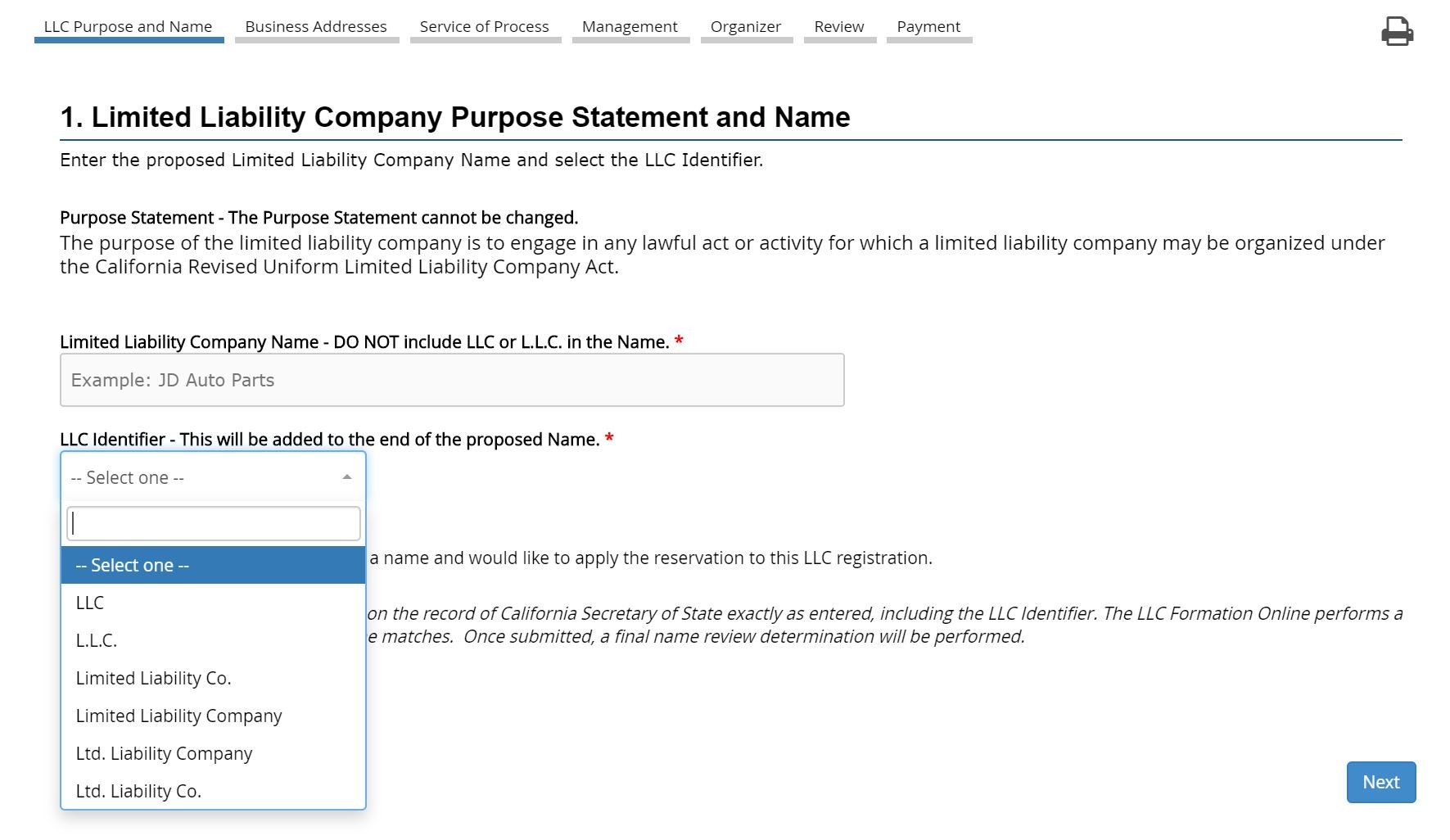

So you have put together a business plan and chosen a name for your LLC, which means that now it is time to officially register your new company with the state of California by filing Articles of Organization!

If you did not already do so in creating your business plan, you will need to discern and be ready to share the following info:

- Purpose of the company

- Business and mailing addresses of the company

- Management: manager-managed or member-managed?

- Registered Agent information

You can file the Articles of Organization yourself online. The filing fee is $70. (Though more fees are coming. Sorry, but that’s just how it is in California.)

And remember, if you are planning to use a fictitious business name (ABN/DBA) rather than the legal name you registered with the Secretary of State, do not forget to register your fictitious business name with the county you plan to operate in.

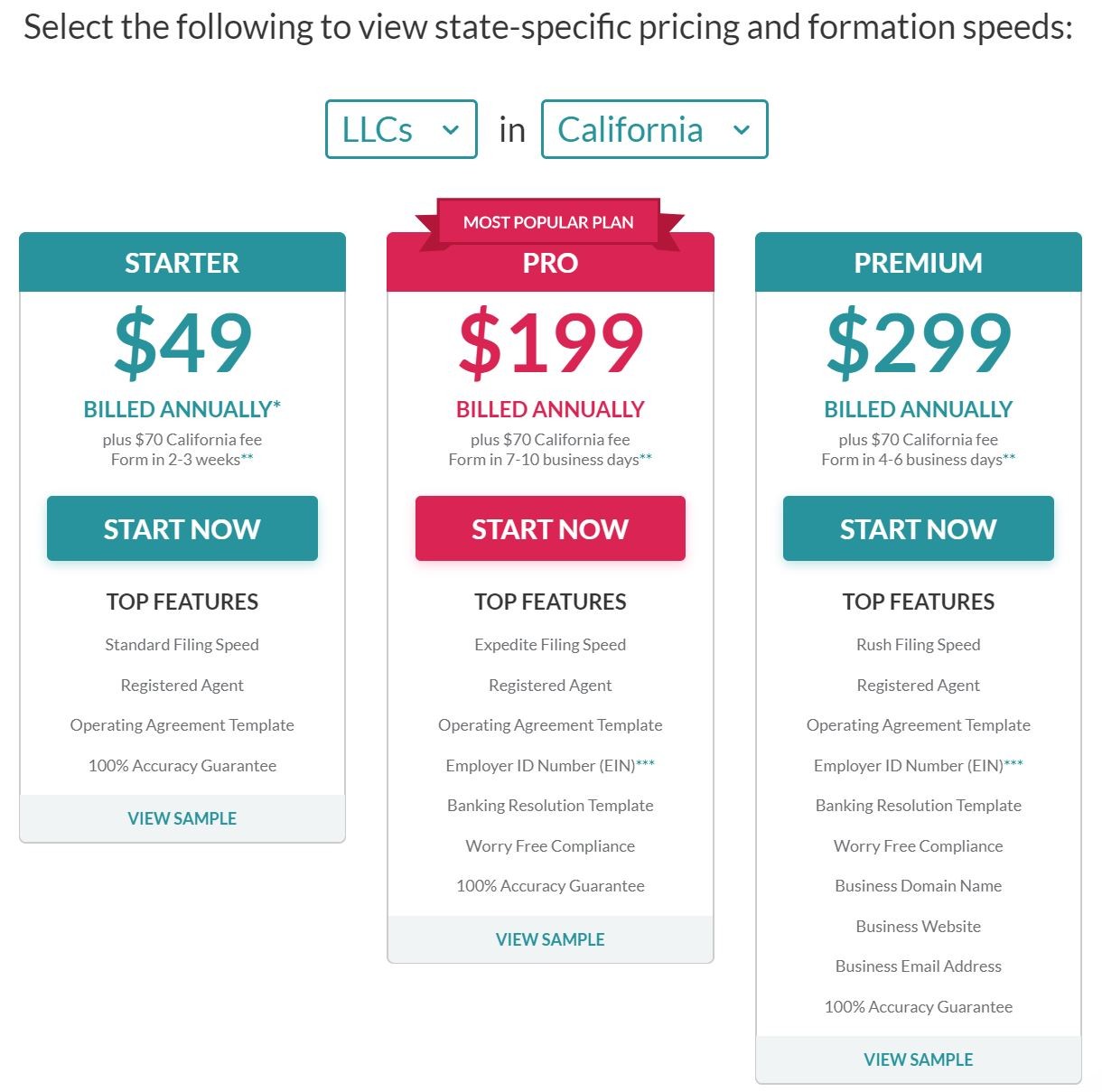

If all of this sounds a little intimidating or complicated, don’t worry! Lots of business owners – both first-timers as well as experienced entrepreneurs – agree with you, which is why many of them use a professional LLC formation service, like ZenBusiness or LegalZoom. Using a service can be cost-effective, efficient, and the service can help clarify for you the finer points of registering your company.

We have used both of these services in the past, and they are both reliable and trustworthy, though we think ZenBusiness is slightly easier to use, and therefore your best bet if this is the first time you are registering an LLC.

Another advantage to using a professional LLC formation service? It can serve as your Registered Agent.

Speaking of which, what is a Registered Agent?

What’s a Registered Agent?

Whether you are filing the Articles of Organization yourself or engaging help of a professional service to do so, you will have to choose your company’s “Registered Agent.”

Don’t be intimidated: While this may seem complicated, it really is not. A Registered Agent is essentially a designated person or company which a business designates as the official person or company that can receive important mail on a business’s behalf. That’s it: An official mail-receiver.

Usually, a Registered Agent can be literally any individual or company that is located in the state and can receive mail there. While some business owners may choose to be their own Registered Agent, others choose to avoid the hassle of receiving mail or want an agency to do so on their behalf.

Having a Registered Agent is important, for example, if you have the misfortune of being sued. If someone sues your business, they will probably “serve” you, i.e. present you with the lawsuit filing document, via your Registered Agent.

If you are starting a business out of your home, it’s a good idea to pay for a Registered Agent, because the mailing address of a company’s Registered Agent is public information. So if you don’t want your home address published on California’s Secretary of State website, use ZenBusiness’s Registered Agent service (for $49/year they will serve as your Registered Agent and file your LLC registration papers as well).

5. File a Statement of Information with the Secretary of State

One more step to make it official with the state!

We warned you that more fees were coming. It’s a quirk of business registration in the Golden State that after you file Articles of Organization for your LLC, you then have to file a Statement of Information within 90 days. We don’t know why, but them’s the rules!

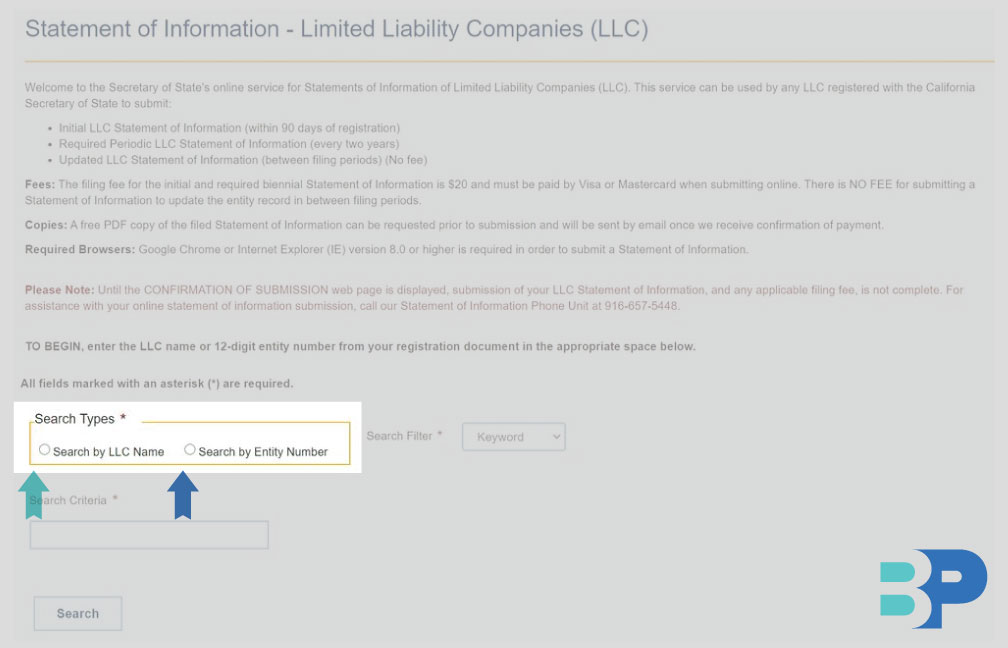

Filing the Statement of Information with the Secretary of State is easy, but it costs $20. You can do it online here.

6. Draft and Sign an Operating Agreement for Your Company

Create a blueprint for how the business works and is managed!

An Operating Agreement is a crucial document for your company that establishes the rights, powers, duties, liabilities, and obligations of all owners (“members”) of an LLC. You can think of it kind of like your company’s Constitution.

While you are not required by the state of California to write an Operating Agreement, and you are not asked to share or file it with the state, this step is crucial. Please do not overlook it. Especially if there is more than one owner or partner in the business, this agreement helps ensure you are all on the same page. Having a signed Operating Agreement can reduce the risk of future conflict between the members (remember how we mentioned the possibility of a lawsuit up above?).

This is by no means a comprehensive guide, but any decent Operating Agreement should touch on the following topics:

- Organization: When and where was the company created?

- Owners of the company (“members”) and ownership structure

- Management of the company

- Voting rights of members

- Capital contributions: What is each member putting into the company?

- Distributions: How will profits or losses be shared?

- Membership changes: What is the processes for adding/removing a member and transferring ownership?

- Dissolution: Exit strategies and what happens when the company closes its doors

As you can see, an Operating Agreement is no walk in the park. It is a legal document that can have profound effects on your business and on your own life, particularly if a dispute ends up occurring between members. At minimum, please consider using the Operating Agreement template that ZenBusiness includes as part of all their business formation packages (including in their $49 “Starter” package – it’s that important).

Better yet, get in touch with an attorney who specializes in business formation. LegalZoom makes this easy with their Attorney Advice portal. It’s kind of like getting insurance – a drag now when you don’t need it and a lifesaver later when you do.

7. Apply for a Federal EIN

Make it official with the IRS…

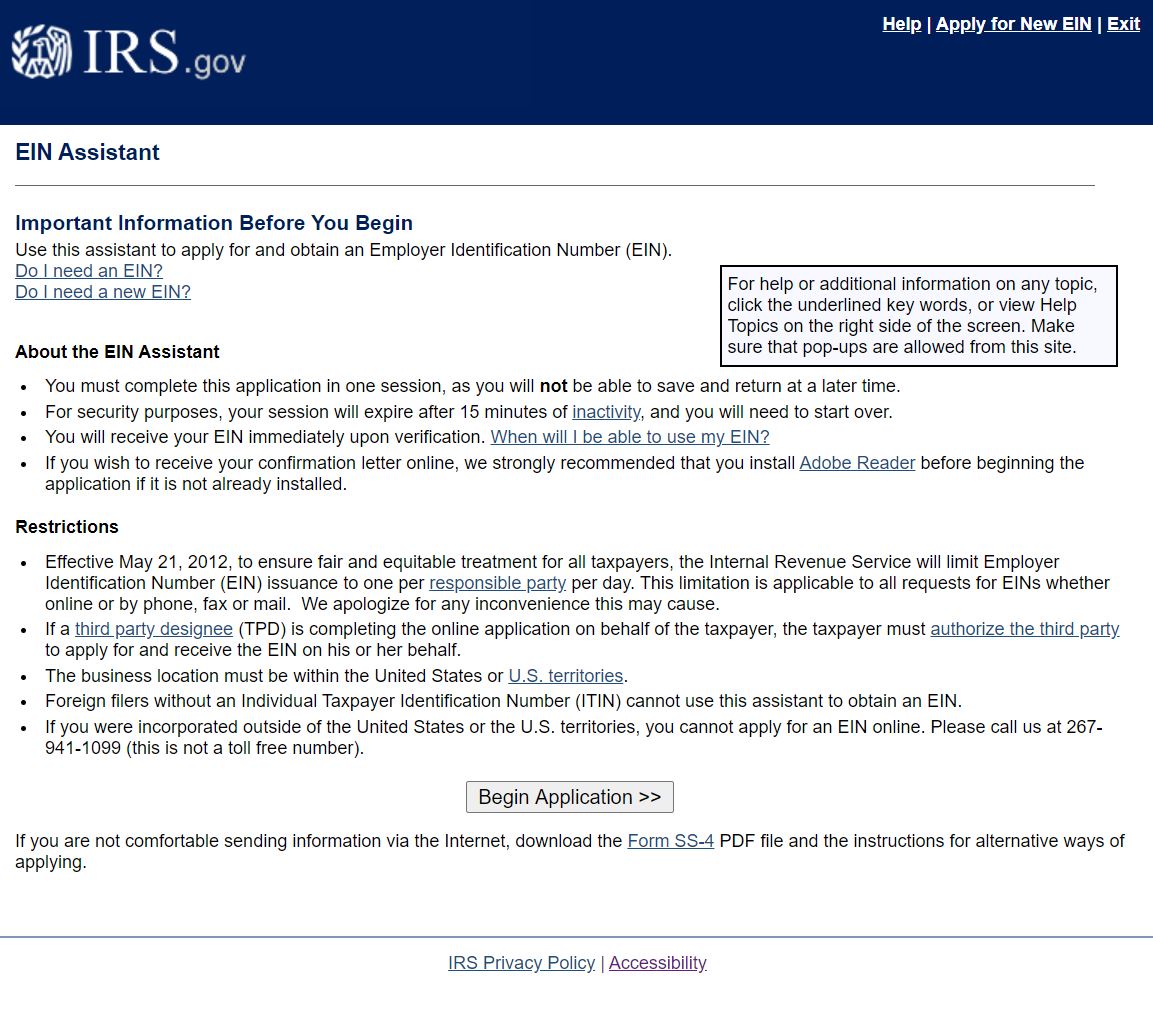

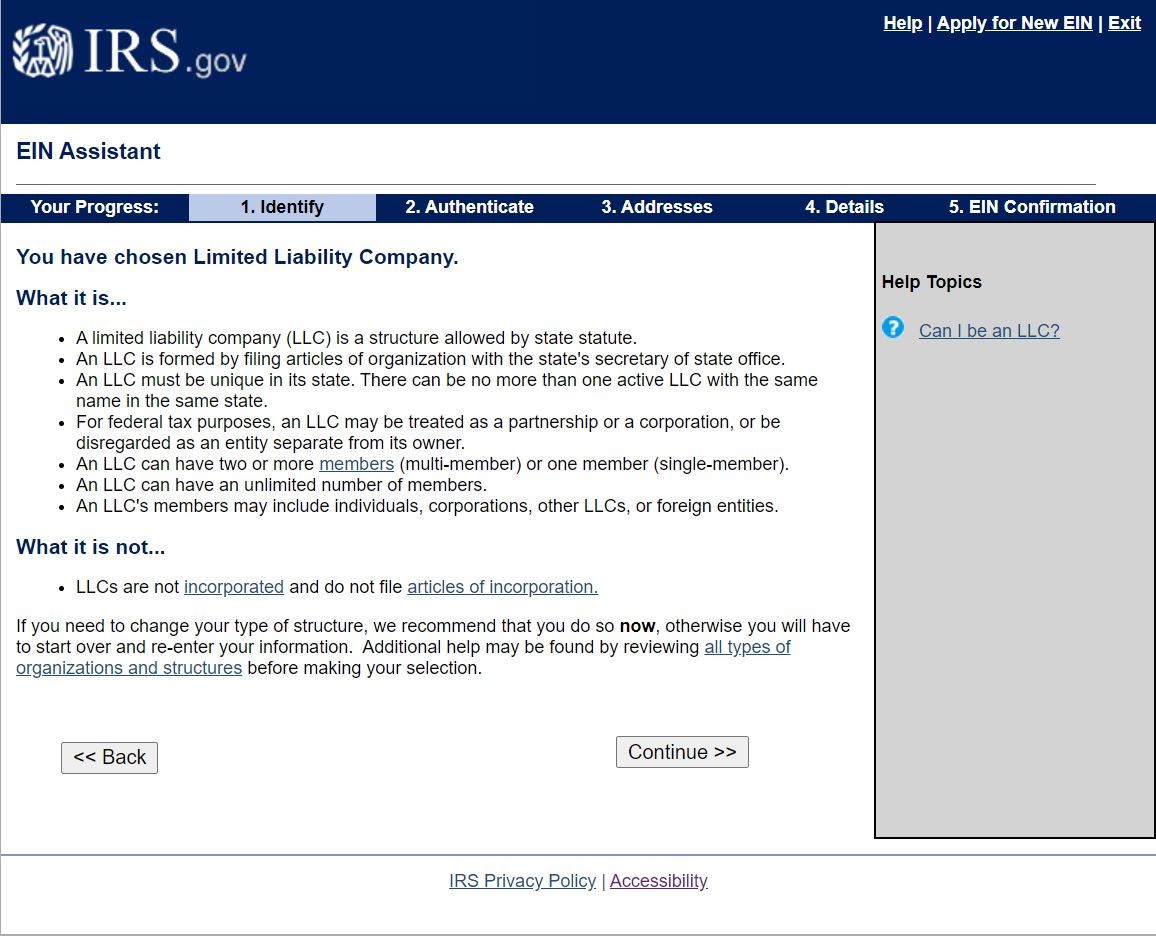

A Federal Employment Identification Number (EIN) is a unique, nine-digit number issued by the Internal Revenue System (IRS). It’s like a Social Security Number for a business: The IRS uses your EIN to identify your business and keep track of its tax reporting. You will need one to hire employees and most banks require an EIN in order for a company to open a banking account – so it’s crucial to getting your business going.

Once your entity is registered with the state and you have some basic information about it (industry, employee count, etc.), you can obtain an EIN online from the IRS for free. Alternatively, if you purchase a business formation package from an entity formation service, they will take care of dealing with the IRS and obtaining an EIN for you.

8. Open a Company Bank Account

Selecting the right banking relationships creates solid business partners …

As we discuss below in Step 12 (“Protect the Company”), the whole point of creating an LLC is to create legal protections for the owners of the company, in particular, protecting the owners’ personal assets from the operations of the business.

Creating a business bank account is absolutely essential in this regard. It is imperative that the affairs of the company are maintained separately from the affairs of its owners – importantly, this includes the financial affairs of the company.

As you get your LLC going, you should open a bank account and fund that account with enough cash to handle the company’s initial operations. To do so, you’ll likely need copies of your filed Articles of Organization, your signed Operating Agreement, your new EIN number, and two forms of personal identification.

If you are looking for easy nationwide access, consider banking with a major national bank that has a big presence in California, like Chase or Wells Fargo. But if you are looking for a more personal touch, look into a smaller, regional bank like California Bank & Trust or Fremont Bank.

Do You Need a Business Credit Card?

As the old adage goes: “You have to spend money to make money.” You are going to rack up some expenses in the course of getting your LLC off the ground, so why not get some of that money back? That’s precisely what a business credit card will enable you to do.

Whether you want to maximize for getting cash back, for regular ad spending on social media, or getting travel rewards, there is a card for you. BusinessPundit’s personal finance editor, Patrick Beckman, has put together a ranking of the best business credit cards, along with a guide to the tips and tricks that will enable you to get the most out of your card.

Further, having a company credit card will help protect your personal assets from business liability, just like your business bank account. And it will also help you streamline your bookkeeping, so that you aren’t having to comb through your personal credit card statement and distinguish personal from business expenses.

Set Up Your Business Bookkeeping

Make sure you’re keeping solid books.

In addition to opening up a business bank account, ensure that your new LLC is properly tracking its financial affairs with solid bookkeeping and accounting. Among other things, this will set you up for easier tax filing down the road (potentially including sales tax, employer taxes and taxes on the company’s income). Beyond just relieving you of tax season stress, it will also keep your bill from your CPA lower, since they won’t have to do a bunch of catch-up.

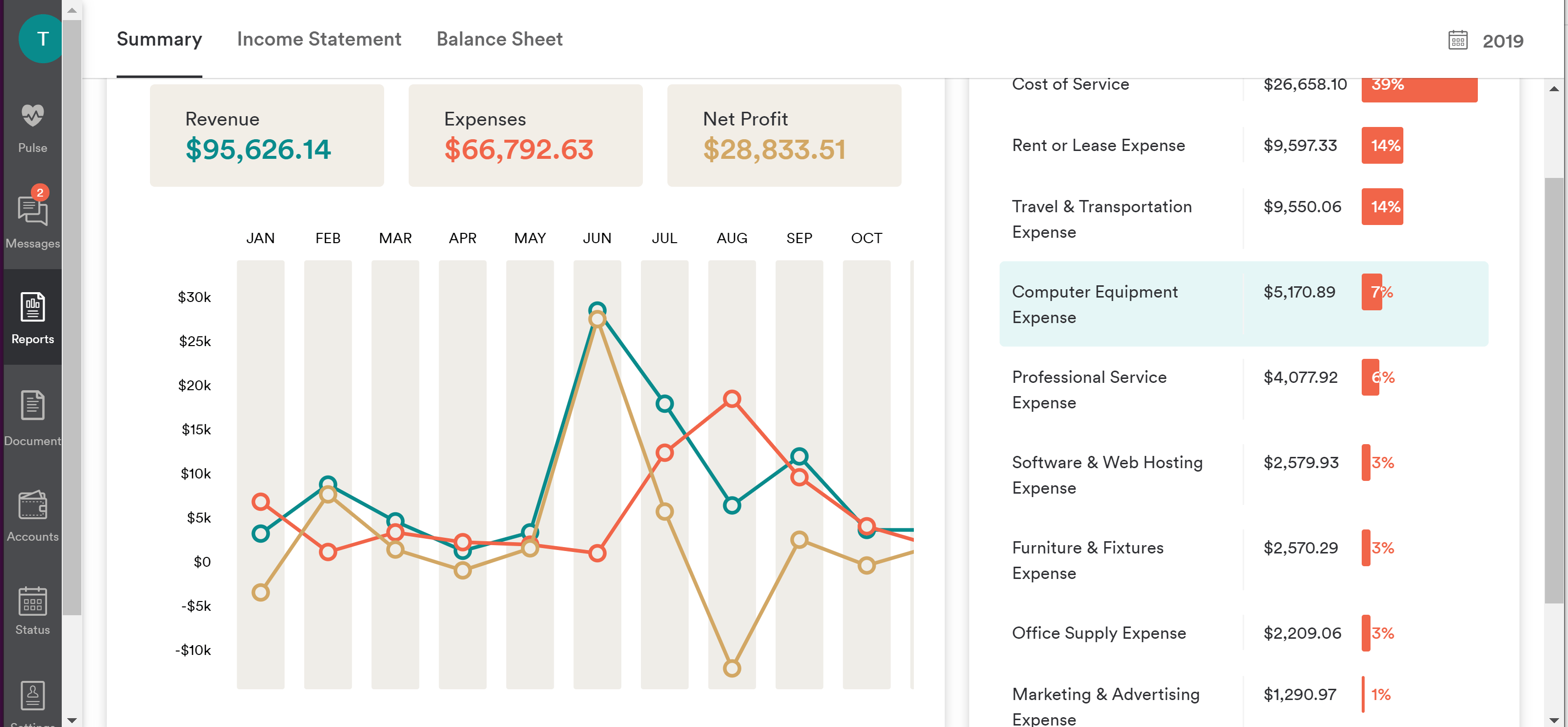

There are a number of great online options for fairly simple and straight forward bookkeeping and accounting solutions, either doing it yourself or through a supportive accounting service.

If you have ever heard of bookkeeping and accounting software, then you will have heard of QuickBooks – and for good reason. They are the leader in providing easy-to-use bookkeeping software powerful enough to get the job done right. QuickBooks is what we use, and if you plan on doing your books yourself, we recommend it.

In the past, we have also turned to others for help. Bench is among the industry leaders in “cloud” or “remote” bookkeeping, and it is also a solution we have worked with in the past.

If you would rather hand off your books to a professional team (at a very affordable rate!), but still want to be able to see clear breakdowns and trends of your company’s finances, you will love the crisp, clean graphs and interactive dashboard that Bench offers all of its clients.

9. Pay Your Annual California LLC Tax (and Fees)

For the pleasure of doing business in California…

Now that you are registered with the IRS and have a company bank account, you should be aware that the state of California wants its piece of the pie too!

Is this another fee? The California Franchise Tax Board (FTB), the state-level equivalent of the IRS, calls it a “tax,” so you be the judge. They require every LLC to pay a yearly tax of $800, which must be paid, according to the FTB website, “by the 15th day of the 4th month after the beginning of the current tax year.”

In other words, pay your $800 annual tax within three and a half months of registering your LLC with the Secretary of State. Otherwise, the FTB may charge you interest and penalties. The FTB is not to be trifled with, either. They are (in)famously punitive.

The FTB provides a guide all about LLC taxes and fees, including filing dates and amounts, which you should check out. One thing to note is that in addition to the annual tax, your LLC may also owe an additional fee if it earns more than $250,000. See the chart below for a breakdown of these fees.

Getting nervous? Many business owners work with a Certified Public Accountant (CPA) who specializes in limited liability companies and other issues surrounding business taxes. You can use the CalCPA website to find a CPA who can help you with your LLC tax questions.

10. Register with the CA EDD

Hiring employees is a big decision and comes with important responsibilities…

Just because you started a business does not mean you need to hire employees. Many businesses, in fact, have no employees – just the owner(s) and maybe some independent contractors who provide services on an occasional basis. But if you have workers who qualify as employees, then you need to put them on payroll. Determining employee vs. contractor eligibility is tricky, and we recommend talking with a professional if you have any questions.

But let’s say that you do know you have or will have employees. What’s next?

Put simply: Payroll is complicated. You will certainly want to use a tool or service of some kind for running your payroll. But regardless of what service you choose, in California you will need a payroll tax account number from the Employment Development Department (the “EDD”). To get a payroll tax account number, simply go to the EDD’s e-Services for Business page and enroll.

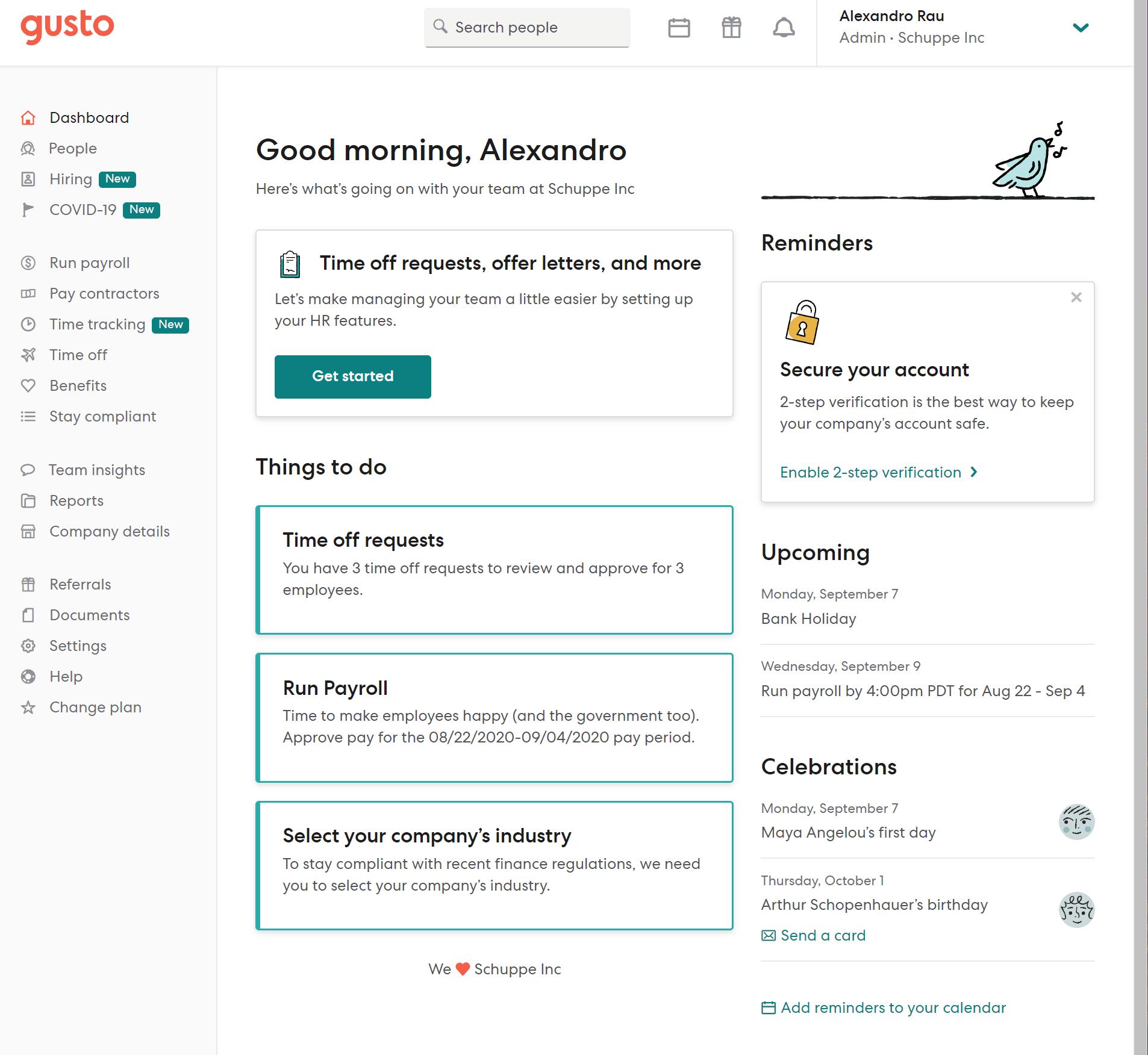

Once you’ve done that, it’s time to choose your payroll provider. The Business Pundit team has experience using all of the top payroll systems, and none of them are as easy-to-use and intuitive as Gusto. Not only is the platform easy to navigate, their resource center and customer service team are top-notch. Gusto puts a lot of effort into the user experience of their platform, which makes using their payroll tool (dare I say it?) fun.

Gusto will also help you take care of all the other tricky parts of having employees, like worker’s compensation, health and retirement benefits packages, and securely storing employee records. And as a (further) added bonus, Gusto integrates seamlessly with Bench, one of their preferred bookkeeping solutions, which we recommended in Step 8, above.

11. Apply for licenses and permits

Do you need a license?

For certain types of businesses, you will need to acquire the proper licenses and permits for the company, based on its location and industry.

Unfortunately, figuring out which permits and licenses you need is up to you. Luckily, there a few tools that the California Secretary of State recommends to help you: the CalGold database and the California Department of Consumer Affairs website.

Looking for a little help? Luckily, LegalZoom has an entire Business Licenses portal to help you take care of the permitting for getting your business going.

12. Protect the owners and the company

You’ve put a lot of time, energy and expense into your new company, so now protect yourself and the company!

You created your business entity to build your company brand and to protect you personally from the affairs and operations of the business. Ensuring that the company is its own independent entity can help establish that independence and protection, which is why we recommended paying close attention to your Operating Agreement, setting up a company bank account, getting a business credit card, and pursuing the right licenses and permits for your location and industry.

But there are a few other things you can do that will help you sleep more soundly at night, and that will, with just a little bit of effort, protect you in case something goes wrong.

How to Sign Legal Documents

When your company enters into its own contracts, you the owner sign on behalf of the company, not on your own behalf. It may seem trivial, but legally it is a world of difference – and your signature should reflect that. After all, signing on behalf of the company helps show the company’s independence and separates it from you the individual owner.

Here’s how we structure signature sections on contracts in order to reflect the separate legal existence of the company. Feel free to steal this:

Agreed to:

_[Your Company Name]_

By: _Your Signature_

Its: _Founder and Owner [or whatever other title you use]_

Get Insurance

Just as the company obtained its own bank account, it should pursue its own insurance to protect its operations. Depending on your company’s location, industry and exposure to unique risks, discussing the needs and options for coverage with an insurance professional should be a top priority.

Like with many professional services, we recommend working with someone who is an expert in small businesses and LLCs. Hiscox is the nation’s leading insurer for small businesses, so we recommend you give them a call to discuss your new company’s insurance needs.

13. Protect your intellectual property

The Secret Sauce: Your company’s intellectual property is your company’s market edge!

You and your company have invested blood, sweat, and tears (not to mention time and expense) in developing the products or services that you are offering to the public. The way you have done that, the proprietary information you developed on the way, the relationships (partners, vendors, customers and more!), and all of the information that’s “under the hood” or “behind the tech”… that’s what makes the Company unique and what gives it an edge in the market. That’s the secret sauce and your company needs to protect it!

Types of Intellectual Property

Intellectual Property (“IP”) comes in many forms, but the most common forms (and the types to consider protecting from the start) are fairly well known – though sometimes misunderstood. They include:

- Trademarks: associated with goods or services and protect brand identity

- Copyrights: protect creative expressions

- Patents: protect inventions, including products, improvements, processes, computer tech

- Trade dress: protect the overall appearance of something in commerce

- Trade secrets: protect a company’s internal, confidential information and processes

How to Protect Intellectual Property

An important place to start in protecting your company’s IP is understanding how the IP is protected generally (from others in the market and the public generally). Among the common forms of IP discussed above, some come with intrinsic protection upon use or creation, while others require taking formal action on a specified timeline. For example…

For Copyright

An artist can claim copyright protection in a painting he creates without doing anything more. However, he can gain additional, statutory protection in that work if he files it with the U.S. Copyright Office (more information from that office is available here).

For Trademarks

Similarly, a business can claim trademark protection in a business name or product/service brand name when it first offers the product/service and associates it with that name. However, the business can gain additional protection at a national level if it registers the trademark with the U.S. Patent and Trademark Office (more information on registration from that office is available here).

For Patents

By contrast, there are very specific timing and registration requirements for protecting patents (more information on registration from the US Patent and Trademark Office is available here).

Use IP Agreements

In addition to protecting the intrinsic value of the company’s IP from others in the market and third parties generally, it’s also important to protect the company’s IP from individuals and companies that the company will naturally work with, including employees, vendors, and other third parties. The Company should consider written and signed agreements with these parties that specifically indicate which parties own what IP and that limit how each party can use that IP. Some of the most common types of IP agreements include:

- Non-disclosure (“NDA”) or Confidentiality Agreements: limit IP disclosure among parties

- Independent Contractor Agreements: for working with hired parties

- Work Made for Hire Agreements: for establishing IP ownership with hired parties

- Non-Compete Agreements: limit employee or contractor competing against Company

- Non-Solicitation Agreements: limit employee or contractor from soliciting business from Company’s partners

Get Help Protecting Your Company’s IP

From protecting your company’s IP to crafting IP agreements for third parties, there is no replacement for a trained and talented intellectual property attorney. You can use LegalZoom’s Intellectual Property portal to get started.

14. Comply with local tax requirements

The taxman cometh…

In addition to federal and state taxes, some counties and cities require businesses to pay local taxes as well. A quick and easy way to determine if a business’s county or city has such requirements is to ask others in the community in the same industry. You should then follow up with a search online with your county and city name along with “taxes” or “tax registration.” Every locality is different, after all.

15. File regular reports with the state

Keep telling the state of California that you’re alive…

Remember the Statement of Information (all the way back in Step 5)? Well, you will need to do that either every year or every other year – make sure you check which filing frequency applies to your company. More information on filing Statements of Information is available from the Secretary of State here.

In Conclusion …

You did it!

From business plans and viable name selection to operating agreements and state registrations, there’s certainly a lot to consider when setting up an LLC in California. But properly planning and putting in the time, energy and effort to consider these many facets ahead of time can go a long way in avoiding headaches, misunderstandings, and even fines and penalties. (Believe it or not, the CA Franchise Tax Board has Special Agents who serve warrants and arrest people.)

If you dot your i’s and cross your t’s, you will be fine and you can go about focusing on your entrepreneurial passions, rather than worrying about administrative challenges. Of course, seeking professional services can help ensure all needed items are checked off the list and can help get a business get up and running smoothly. If that’s a route you’re considering, check out ZenBusiness to get started with forming an LLC in California.

LLC Resources

How to Start an LLC in Florida

How to Start an LLC in Texas

How to Start an LLC in New York