There’s nothing quite like the feeling of setting off on a brand-new business endeavor. Starting—and growing—your own small business is an intensely challenging but deeply rewarding journey.

Perhaps that’s why the vast majority of businesses in the United States are small businesses. The Lone Star State is no exception. The 2.6 million small businesses in Texas account for 99.8% of all businesses in the state, according to the U.S. Small Business Administration. In fact, small businesses in Texas employ 4.8 million people—that’s 41.5% of the Texas workforce.

If you are a Texas resident and have been dreaming of getting your small business off the ground, setting up an LLC, short for limited liability company, is a great way to get started. Simpler to set up and operate than a full-fledged corporation, an LLC provides important benefits, including protecting your personal assets.

Creating your LLC takes time, work, and plenty of paperwork. If you didn’t envision spending your life as an entrepreneur being so bogged down by the details, it might be worth hiring a service like ZenBusiness to take care of the whole tedious process for you. Otherwise, read on for your step-by-step guide about how to start an LLC in Texas.

1. Verify That a Texas LLC Is the Right Entity to Use

Other types of business structures you might consider besides LLCs, according to the U.S. Small Business Association, include:

- Sole proprietorship

- Partnership (general, limited, or limited liability)

- C corp

- S corp

- B corp

- Close corporation

- Nonprofit corporation

- Cooperative

Why do so many Texas small business owners form an LLC instead of choosing one of these other structures?

- Simpler setup: Setting up a Texas LLC is easier than establishing a corporation—an entity fully separate from you as an individual.

- Protecting what’s (personally) yours: An LLC structure protects personal assets like the home your family lives in, your personal vehicle, and your life savings in the event that your business gets sued or goes into debt.

- Permitting pass-through taxation: When you run an LLC, you pass your company’s tax bill on to your own personal income tax obligation, avoiding a separate set of corporate taxes.

The LLC blends elements of corporation and partnership structures, according to the Texas Secretary of State. For many small business owners, this structure represents the best of both worlds.

2. Create a Business Plan for Your LLC

There’s no sense in undertaking the multi-step process of forming an LLC in Texas until you have a business plan in place.

A business plan documents the most important aspects and elements of your company. This includes what makes your LLC special and how you envision growing your business over the years.

What Belongs In a Business Plan?

- Executive summary: This overview highlights the most important parts of a long-form business plan. Consider composing it last—after you’ve explored each section of the plan in greater detail.

- Company description: Describe what sets your company apart, who your customers are, what problems your products or services aim to solve, and why your company has what it takes to succeed.

- Market analysis: No matter what industry you’re in, there are market trends to contend with and competitors to outshine.

- Company organization: Here’s where you lay out your business structure—LLC—along with a description of the hierarchy within the business. Who is responsible for what?

- Your products or services: Think about the details of how your product or service works: how it benefits customers, how to handle the logistics of providing the product or service, and how you will protect your intellectual property.

- Marketing plan: Customers won’t just come to you—you have to actively work to bring them in. Make your methods of attracting customers and closing sales part of your core business plan.

- Funding needs: If you’re looking for investors, explain how much money you need and how you plan to use it.

- Financial forecasts: What are the costs of getting the Texas LLC off the ground? How much, realistically, can you expect to bring in?

Why Do You Need a Business Plan?

Strategy is essential to a successful business. As you go through the process of writing a business plan, you think through details that you haven’t yet considered. Creating a business plan can help you:

- Plan for the logistics of running a business

- Plan for future growth

- Secure funding from investors

Preparing to write a business plan can be overwhelming. Services like LivePlan can turn the drawn-out process of writing your business plan into an easy, illuminating experience. By the time you’re done crafting your plan for success, you’ll be ready to cast aside your doubts and show potential investors exactly why your company is worth funding.

3. Choose a Name for Your LLC

There’s a lot more to choosing a business name than coming up with something catchy and memorable. In Texas, the process of naming your LLC requires numerous steps, including reserving and registering your name, getting a certificate for any assumed business names, and trademarking your business name.

How to Reserve and Register a Name for a Texas LLC

You’ve got an idea for a business name. Now you need to find out if that name is available, or if it’s already taken.

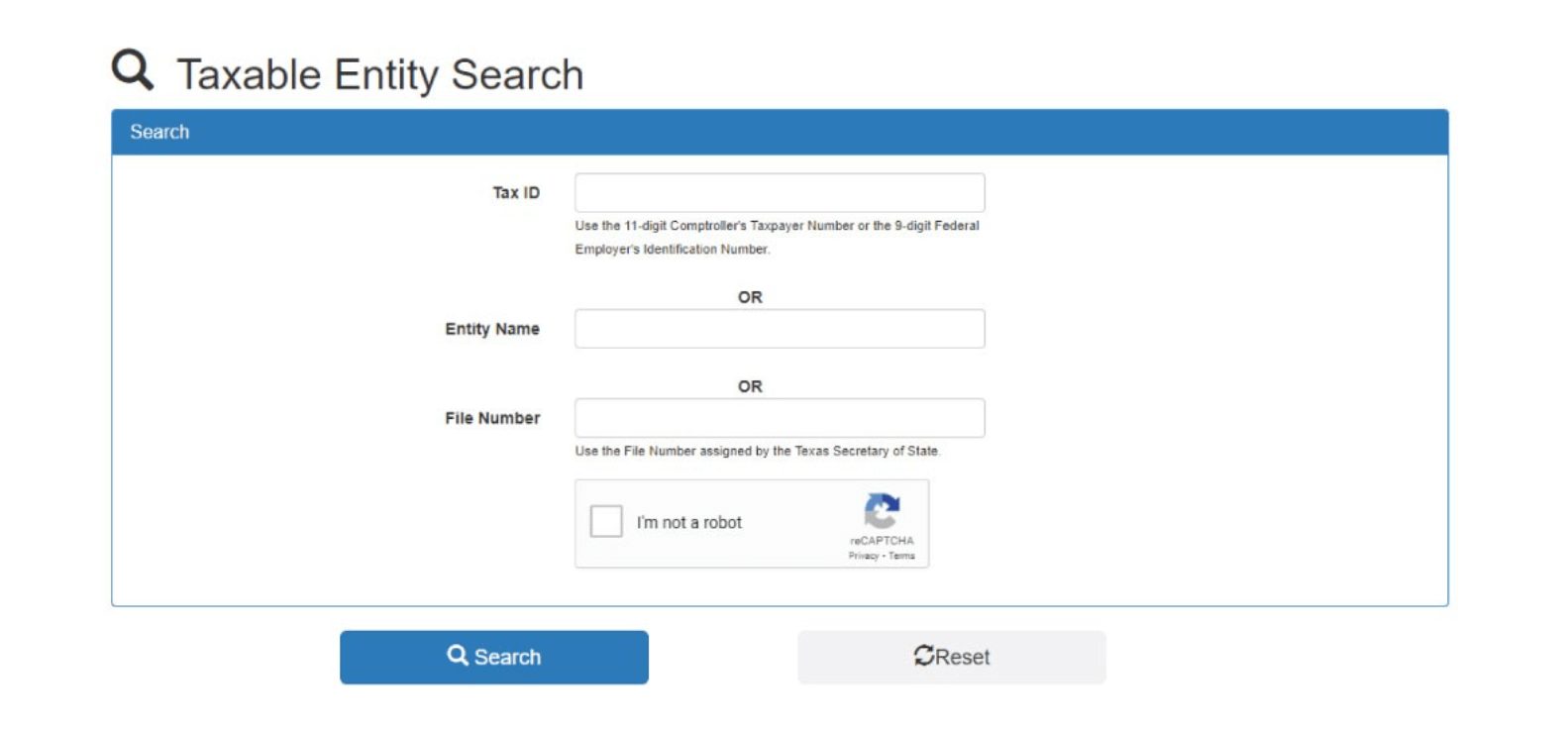

Start by performing a Taxable Entity Search online using the Texas Comptroller of Public Accounts website. Type the name you hope to use into the Entity Name box and hit “Search.”

You don’t need to know the Tax ID or File Number to run a Texas SOS business search.

If your search returns no hits, you’re ready to move on with reserving your business name.

If another company has already claimed your intended name, it’s back to the drawing board. Consider alterations of your original name that emphasize your industry or type of product or service, or take another look at your business plan to remind yourself what stands out about your company.

Your name also needs to meet certain criteria laid out by the Texas Office of the Secretary of State. Under the requirements outlined by the Secretary of State, the name of the LLC can’t contain words that are considered offensive or give a false implication of being associated with a government entity or with a regulated industry. Certain other terms are also restricted from appearing in a business name by the Secretary of State.

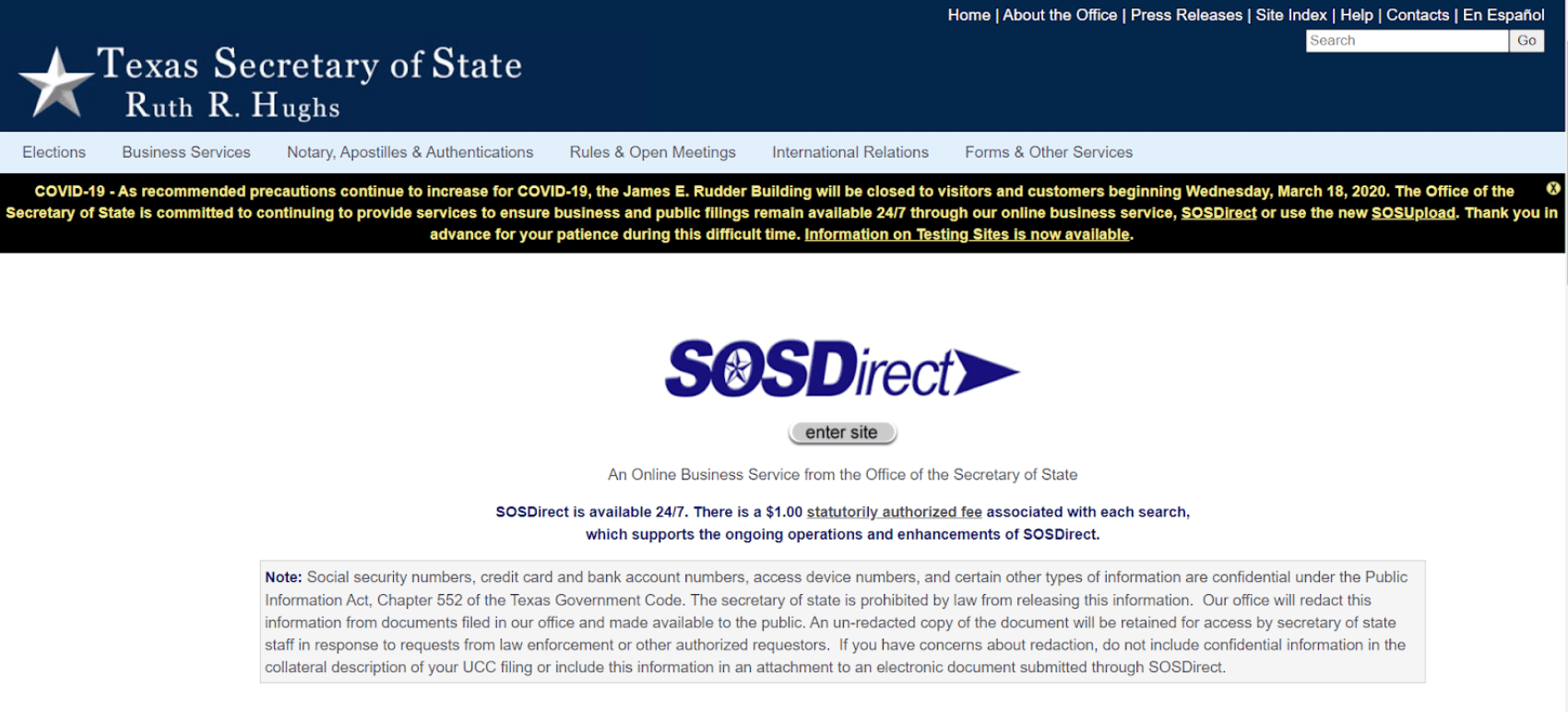

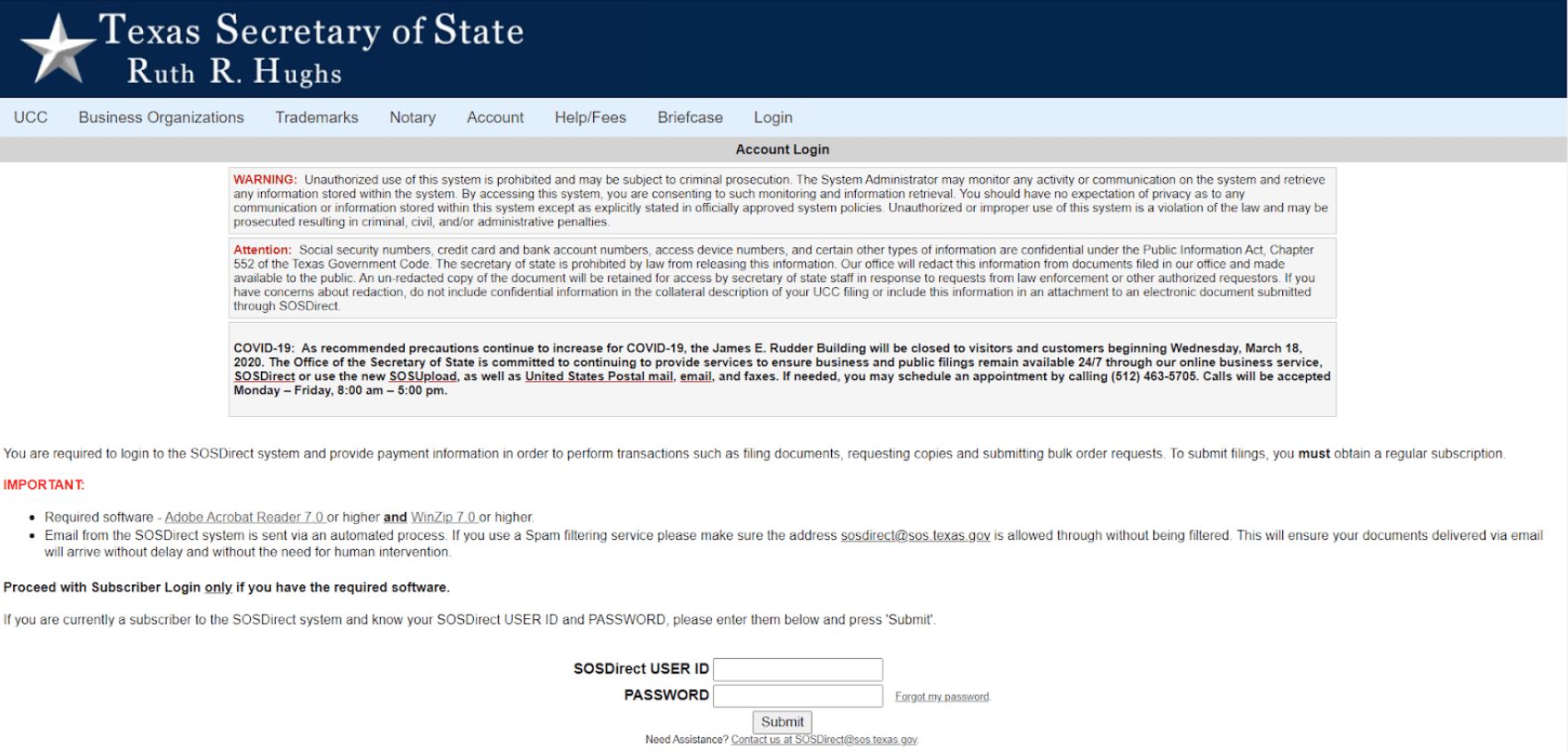

You don’t have to wait for normal business hours (or even business days) to start to begin moving forward with selecting your business name. You can reserve your intended name online at SOSDirect. There is a $40 filing fee for a name reservation in Texas, the Secretary of State reported.

Filing a Name Registration for a Texas LLC

Next, you’re going to want to file a name registration. A name registration alone is not sufficient to start an LLC in Texas—you need a certificate of formation to do that—but it does prevent someone else from registering a company using your business name. You can file a name registration online at SOSDirect or download and print Form 502 from the Texas Secretary of State website.

Once you file your registration for the legal name of your Texas LLC, prepare to get a company website off the ground by registering a domain name. To find out if a domain is available, use the GoDaddy Domain Name search tool.

If the domain name you want for your future website is available, you may be able to register it for as little as $2 to $20 per year (and save with sales and discounts). Names that are in high demand can cost a lot more.

Legal Business Name vs. Assumed Names

The name for which you file registration with the Secretary of State in Texas is the legal name of your LLC. But businesses—like people—don’t always go by their full legal name.

If you use a different name for any of your company’s trade dealings, this other name can be considered a trade name, assumed business name (ABN), fictitious name, or “doing business as” (DBA) name.

Conducting business under a different name than your registered business name is legal, but you usually need to register alternative names with the government. Otherwise, you could face fines and other consequences, according to the Texas Secretary of State website.

You can’t register a trade name, DBA, or ABN in Texas, according to the Secretary of State. Instead, you need to file a document known as an “assumed name certificate” in the county where your LLC is located. If you have multiple locations in different counties of Texas, you may need to file this certificate in each of those counties, paying the $25 filing fee for each individual certificate.

Trademarking Your Business Name

While you’re thinking about names, it’s a good time to start trademarking your company name, product names, logo, and any other terms and goods you want to belong exclusively to your company. You can secure a “common law” trademark just by using these terms, symbols, and other trademarked properties, according to the Secretary of State.

However, it may be worth making your trademark more official. Start by downloading Form 901 from the Texas Secretary of State and searching the United States Patent and Trademark Office (USPTO)’s trademark database to make sure you can trademark your property at the federal level.

When dealing with complicated matters involving trademarking an LLC name, an attorney’s knowledge is invaluable. Find a lawyer quickly with LegalZoom.

4. File a Certificate of Formation With the Texas Secretary of State

Your next step is to file a certificate of formation. This certificate of formation is what officially establishes LLCs in Texas. You can complete this LLC filing online at SOSDirect. You can also download Form 205, Certificate of Formation for a Limited Liability Company, from the Texas Secretary of State website.

Before you attempt to file a certificate of formation, you’ll need to gather together a great deal of information. Here’s what the state will ask for when you file a certificate of formation and officially start an LLC in Texas:

- The name of your company

- The “type,” or organizational designation, of your business

- The name of your Registered Agent

- The address of your Registered Office

- The governing authority of your LLC—specifically, whether your company will be member-managed or manager-managed

- The purpose of the LLC formation (usually a general purpose, “for the transaction of any and all lawful purposes for which a limited liability company may be organized”)

- Your name and address as the “organizer” of the LLC

The filing fee for a Certificate of Formation in Texas is $300.

Remember, if you plan to use a different business name than the legal name under which you submit your certificate of formation, you have to submit this information to the state of Texas in the form of an assumed name certificate, along with a $25 filing fee.

Once you complete your articles of organization (another name for an LLC’s certificate of formation), you must file an assumed name certificate with the clerk of every county in which you have a business office or conduct your business under that alternate name.

Do It Yourself or Hire a Professional?

As a small business owner in the midst of an LLC launch, you’ve got enough on your mind without the hassles of filing a certificate of formation.

Are you starting to feel intimidated by the procedures and paperwork needed to form an LLC in Texas? Handing these responsibilities over to a professional could save you time—and remember, time is money when you’re running a company.

Two services you can turn to for help with filing a certificate of formation are ZenBusiness and LegalZoom. Both companies are good, but if we had to choose, we’d recommend ZenBusiness. Here’s why:

- Ease of use

- Affordable services

- A full line of products to grow your business

ZenBusiness is a formation service that files the certificate of formation paperwork for you. A subscription comes complete with business filing experts on-staff and available to guide new small business owners through the LLC filing process. We’ve found that the cost—with services starting at $49 per year—is well worth the peace of mind of ZenBusiness’s 100% Accuracy Guarantee, not to mention the time you save.

If you’re in a hurry to file your Texas LLC certificate of formation, a higher-tier ZenBusiness plan with expedited processing can shorten the three to five weeks it usually takes to process an LLC formation form to just two to four business days.

What Is a Registered Agent?

One prerequisite to filing the certificate of formation that may have surprised you is the registered agent requirement. For limited liability companies and corporations in the Lonestar State, a Texas registered agent must receive any legal notices or tax documents on behalf of the company, such as a service of process in the event that the LLC is being sued.

The registered agent essentially acts as the intermediary between the State and the LLC.

Under the Texas Business Organizations Code, every business entity filed in Texas must have a registered agent. What makes this criterion hard to meet is that, under the Texas Secretary of State’s guidelines, “an entity may not serve as its own registered agent.”

So who should you choose as a registered agent, if your LLC can’t be its own registered agent?

You personally can serve as your LLC’s registered agent if you want to keep control over your company’s notices and tax documents. But your address will then be entered into the public record.

Your best option is to use a professional, paid registered agent service. ZenBusiness includes registered agent services in all of its business formation packages to keep things simple. Since serving as your registered agent is literally the service’s job, you can count on the company to handle your documents and correspondence with care.

5. Create an Operating Agreement

Writing an operating agreement isn’t legally mandated by the Lone Star State, but running an LLC without one just isn’t smart. Crafting a clear and thorough LLC operating agreement can protect the foundation of your company as it grows and markets change.

What Is an Operating Agreement?

An LLC operating agreement is a written contract—signed by every owner of your LLC—that outlines the company’s organization and operations practices.

What to Put in Your Operating Agreement

- When and where the LLC was founded

- A list of the LLC’s initial owners or members

- Ownership structure, or the percentage of the company each member owns

- The amount of capital each owner has contributed to the company

- How to distribute or allocate the LLC’s profits and losses among its members

- Any voting power members have

- Management structure, specifically whether member-managed or manager-managed

- How the process of adding members or transferring ownership will work

- Exit strategies and what happens upon dissolution of the LLC

Why Operating Agreements Are Important

An operating agreement is an essential part of starting an LLC in Texas because it:

- Outlines owners’ rights, responsibilities, and capital investments

- Records the percent of the company each LLC member owns

- Sets the stage for how the company will handle membership changes and ownership transfer

Without an effective operating agreement in place, business disputes between LLC members could lead to costly lawsuits and fractured relationships that can rip your company apart. Even single-member LLCs should write an operating agreement that distinguishes your obligations as an LLC owner from you as an individual, according to the Digital Media Law Project.

How to Write Your Operating Agreement

Writing your Texas LLC operating agreement requires some thoughtful discussions and negotiations with your fellow LLC owners (if any).

A tried-and-true template is a perfect place to start. ZenBusiness customers get access to an operating agreement template included with their business formation package. Because an operating agreement is a legal contract, it’s often a good idea to have the document reviewed by an attorney. Find a lawyer now with LegalZoom.

6. Apply for a Federal EIN

LLCs in Texas need a federal EIN. A federal EIN is a number used to identify your LLC for tax purposes. The Employer Identification Number (EIN) is also called a Federal Tax Identification Number, according to the Texas Comptroller of Public Accounts.

Why You Need an EIN

You will need your EIN for your LLC’s regular operations, including:

- Federal tax reporting

- Hiring and paying your employees

- Opening a business bank account

- Applying for any business licenses or permits required in your industry

How to Get an EIN

You can obtain an EIN online by submitting a free application through the IRS Portal or by filling out IRS Form SS-4.

Make sure you set aside uninterrupted time to apply for your EIN. Once you start the application process, you must complete it in one sitting. You will lose your progress after 15 minutes of inactivity, so any distraction could mean that you will have to start over.

Or you could let ZenBusiness get your EIN for you by choosing the service’s Pro or Premium subscription plans.

7. Open a Company Bank Account

When you’re running an LLC, you’ve got to keep your personal finances and your company assets separate. Keeping all of your LLC’s money in separate business banking accounts clearly delineates what belongs to the company—and could be pursued to pay debts or lawsuits—and what belongs to you individually.

What You Need to Open a Business Bank Account for a Texas LLC

You can open your company bank account in person or online. Either way, you’ll need to provide documentation like:

- A copy of your LLC filing—your filed certificate of formation or articles of organization

- Your federal tax information—the LLC’s Employer Identification Number (EIN)

- The LLC Operating Agreement, signed by all owners of the company

- Two forms of personal identification, such as a driver’s license

What Banks to Consider for a Texas LLC

Don’t choose a bank on a whim. Although factors like proximity and convenience matter, you need to look at the big picture—what services and benefits your bank offers for a Texas LLC.

A national bank will typically offer better rates and a more extensive line of products and services. If you anticipate needing a business loan, a national bank may be able to offer you more money.

On the other hand, regional banks better understand the local market in Texas state. They’re more likely to factor in criteria like local market conditions in your industry and your own character when deciding whether to award a loan and under what terms, according to The Wall Street Journal.

Our Picks for Business Banking Accounts

If you want a national bank, consider:

- Chase, which operates more than 600 branches and ATM locations in more than 130 cities in Texas (including 124 locations in Houston, 55 in Dallas, and 40 each in San Antonio and Austin)

- Wells Fargo, which operates 582 Banks and 1,206 ATMs across more than 200 cities in Texas

If you prefer a regional bank, look into:

- Texas Capital Bank, with locations in Austin, Dallas, Fort Worth, Houston, and San Antonio

- First National Bank Texas, with more than 300 locations across the Lone Star State

Getting a Company Credit Card

Whether your Texas LLC sells products or services, you’re going to have some expenses. A business credit card is one of the best ways to pay for these expenses.

Getting a business credit card means you’ll never have to put business expenses on your personal credit cards, dangerously blurring the line between your personal finances and business assets. As long as you watch out for interest charges and other fees—and, ideally, pay the balance off before the grace period ends each month—you can use your business credit card to maximize your business capital.

Wading through the sea of business credit cards out there takes more time than a busy small business owner has to spare. BusinessPundit’s ranking of the best credit cards can help you quickly compare your options.

Generally, the best business credit cards have perks that outweigh any annual fee, rewards and sign-up bonuses, and benefits like free additional cards for your trusted employees. These business credit cards help you get more out of your money.

Set Up Business Bookkeeping

Haphazard bookkeeping can be deadly to a Texas LLC. Without knowing where your money is going, you could wind up in debt that forces your company to close its doors. At the very least, you will miss out on opportunities for growth and improvement unless you have a good handle on bookkeeping.

If you prefer to balance the books yourself, our pick for the best bookkeeping software is QuickBooks. If the thought of wasting your time poring over debit and credit sheets is exhausting, you would be better off outsourcing your bookkeeping needs to a cloud solution like Bench.

8. Pay Your Annual Texas Taxes

Paying state taxes for your LLC may come as a surprise to Texas small business owners, since the Lone Star State doesn’t collect personal income tax. However, there are state filing fee requirements, annual franchise tax obligations, and other costs that accompany forming an LLC and maintaining compliance throughout your company’s operations.

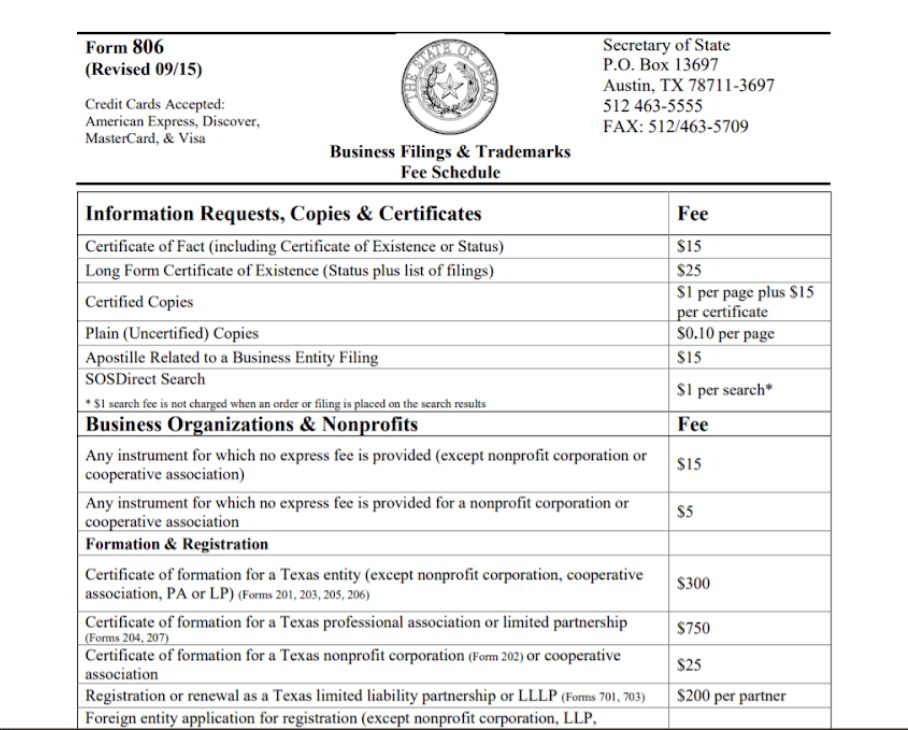

To figure out which annual taxes Texas LLCs must pay, start by reviewing the Business Filings & Trademarks Fee Schedule, available on the Texas Secretary of State’s website. There are fees to:

- Form an LLC

- Register a name

- Correct or abandon filings

- Amend paperwork

- Move forward with a merger

- Change a business structure

- Change your registered agent

- Terminate an LLC

- File name registrations and assumed name certificates

One type of tax to pay particular attention to is the Texas franchise tax. A franchise tax applies to every taxable entity in Texas. The annual franchise tax is due on May 15, according to the Texas Comptroller of Public Accounts. Under the Texas franchise tax, your LLC must pay a tax rate based on its margin. You don’t, however, have to file an annual report with the Secretary of State.

For 2020 and 2021, LLCs and other types of taxable companies must pay franchise taxes if they bring in more than the $1,180,000 threshold. The Texas franchise tax rates for 2020 and 2021 are 0.375% for retail and wholesale businesses. Other taxable entities must pay a 0.75% franchise tax. If a Texas LLC qualifies for EZ Computation, it can pay a lower franchise tax rate of 0.331%.

If you need help figuring out which franchise tax rate applies to your LLC and what fees and tax you owe to form an LLC in Texas, your best option is to get in touch with a certified public accountant, or CPA. The Texas Society of Certified Public Accountants can help you find a CPA who can calculate your franchise tax burden and other tax obligations.

9. Register with the Texas Workforce Commission

If you’re going to hire employees, you need to register your Texas LLC with the state employment department.

Note: if you’re the only one working for your Texas LLC, you can skip this step. Similarly, if you’ll be partnering with independent contractors rather than in-house employees, you don’t have to worry about this step. Independent contractors are individuals who engage with your company as a separate business entity performing project-based work over which you have very limited control.

Under the Texas Unemployment Compensation Act (TUCA), any “liable employer” must pay unemployment taxes, the Texas Workforce Commission reported. Texas employers also must file quarterly electronic Unemployment Insurance (UI) wage reports.

How to Register a Texas LLC With the State Employment Department

You can register your LLC in Texas with the state employment office online. However, you must have hired and paid wages to an employee before you can actually register your LLC, according to the Texas Workforce Commission.

To register your LLC with the Texas Workforce Commission, you need to create an account and be ready to provide the following information:

- Your email address

- The mailing address of the LLC

- For each individual business location, the trade name and address

- The names, addresses, and social security members of all owners of the LLC

- The main products, services, or activities provided by the Texas LLC

- If ownership was transferred, the name and address of the LLC’s previous owner

- The date when your Texas LLC first hired an employee

- The date your LLC first paid wages to an employee

- The total amount of quarterly wage payments the LLC has made (including all locations)

Choosing a Payroll Provider

To pay workers and keep on top of wage reporting and unemployment insurance payments, you’re going to need to choose a payroll provider. Our favorite payroll service is Gusto, a user-friendly payroll platform that integrates with Bench bookkeeping solutions to create a seamless experience.

With the combined services of Gusto and Bench, Texas LLC owners can keep track of payments, set up employee benefits like health insurance and retirement, and much more.

10. Apply for Texas Licenses and Permits

The state of Texas regulates many industries. If you’re forming an LLC in one of these regulated industries, you’re going to need a special license or permit to conduct your business.

How do you figure out what licenses and permits might apply to your Texas LLC? The Business Permit Office, part of the Office of the Governor’s Economic Development and Tourism Division, has compiled a handy (but lengthy) Texas Business Permits and Licenses Guide that lists the required licenses and permits by business type.

If you’re still not sure which licensure requirements apply to your LLC, LegalZoom’s Business Licenses tool can figure it out for you—and even help you get the licensure process started.

11. Protect the Owners and the Company

All of the steps you’ve taken so far to systematically set up your Texas LLC will also help you protect the company—not to mention, you and any other owners with a stake in the limited liability company.

- LLC formation. Deciding to form an LLC protects the company and its owners by separating personal assets from the company’s assets.

- An LLC operating agreement. This signed document outlines owners’ responsibilities, shares of the company, rights, and the processes to add or remove owners or for initial LLC members to exit the company.

- A company bank account. Keeping your LLC’s financial matters separate from your own finances is easier if you’ve set up a separate bank account for your company.

- A company credit card. Using your personal card for company expenses undermines that distinction between your company’s finances and your personal finances, even if you reimburse yourself out of the LLC’s coffers.

- Licenses and permits. If your industry is required under Texas law to be licensed and you don’t comply, you could face serious legal trouble.

Correctly Signing Legal Documents

When you sign a legal document on behalf of your Texas LLC, you shouldn’t sign as yourself, the individual. Instead, you ought to sign as the company. This may seem like splitting hairs, but legally, there’s a world of difference between you signing as a private citizen and signing as your Texas LLC.

Here’s how we structure signature sections on contracts in order to reflect the separate legal existence of the company.

Feel free to steal this:

Agreed to:

_[Your Company Name]_

By: _Your Signature_

Its: _Founder and Owner [or whatever other title you use]_

Get Insurance for Your LLC in Texas

A Texas LLC should have insurance—but precisely what kinds of insurance you need depends on the type of company you run. To explore your business insurance needs and options, we suggest working with Hiscox, an insurer that works exclusively with small businesses.

12. Protect Your Intellectual Property

If you’ve never thought about intellectual property, it’s time to start. Don’t put off matters of trademarks, copyrights, and other legal forms of protecting your intellectual property just because it’s complicated. Your Texas LLC depends on you securing what’s yours.

What Is IP and Why Does It Matter?

When you’re starting up an LLC in Texas, it’s easy to get bogged down in the physical property required to operate your business: workspace, tools and equipment, office supplies, software solutions, and so much more.

But your building, your equipment, and your computer infrastructure are only the things your company needs, not what it is. What sets your Texas LLC apart from other companies is its intellectual property. This includes the ideas, product and logo designs, innovative terms and product names, visual or artistic works, written content, and more that you use in the course of your business.

Protecting the intellectual property of your Texas LLC is critical because it represents the fundamental aspects of your company. Your LLC could move to a new building, replace all of your equipment, buy new office supplies, and hire new workers, but it would still remain the same company. However, if you lost the ideas, designs, content, and other creations that set your Texas LLC apart, the company wouldn’t be able to go on.

Types of IP

- Trademarks: Generally, the words, terms, and visual symbols that constitute intellectual property

- Copyrights: Works of “authorship,” which—according to the USPTO—can include everything from visual artwork and literary works to architectural designs and computer software.

- Patents: Inventions that encompass everything from the design of machines to synthetic chemical compounds and pharmaceutical drugs

- Trade dress: The visual appearance, often presented through product configuration or packaging, that links a product with a particular company or entity

- Trade secrets: A secret recipe for your signature dish, a secret formula that sets apart your beauty product, or any other proprietary process, device, or composition that is unique to your company.

How to Protect IP

The first step you can take to protect your LLC’s intellectual property is to register for any copyrights, trademarks, and patents that are relevant to your company. Register a copyright online with the United States Copyright Office. Apply for a business patent or business trademark through the USPTO website.

Next, integrate IP agreements into your business operations to further safeguard your intellectual property. These agreements can include:

- Confidentiality Agreements and Non-Disclosure Agreements (NDA)

- Non-Compete Agreements

- Work Made For Hire Agreements

- Non-Solicitation Agreements

- Independent Contractor Agreements

You have to be careful writing up these agreements, because mistakes and subpar language can render these contracts unenforceable. If possible, have an attorney review these agreements to ensure that they are clear and legally binding.

Get Help Protecting Your IP

Intellectual property is a complex area of law, and evolving technologies are only adding to the intricacy of this field. If your Texas LLC relies heavily on its intellectual property, then it’s wise to turn to an IP attorney for reliable, professional assistance. LegalZoom has a dedicated intellectual property portal full of resources for small businesses, along with consultation services with authorities in IP law.

13. Comply with Local Tax Requirements

Matters like federal income and employment taxes and Texas state franchise tax reports can make your head spin. However, the federal government and the state aren’t the only levels of government that want a cut of your Texas LLC’s profits. You may face local and county tax obligations, as well.

Reach out to your county and municipal governments to find out what other taxes you might owe. If you have other local contacts in your industry, they may be able to warn you of any other tax burden or fees that you haven’t become aware of yet. Don’t wait until it’s too late—and you’re facing not just unexpected expenses but also late tax penalties—to find out where your LLC stands with taxes.

Conclusion

Launching a Texas LLC isn’t for the faint of heart. It is, however, an incomparable adventure—one that’s well worth the challenges it takes to form an LLC.

If you started reading this article hoping that setting up your Texas LLC would be a quick, hassle-free experience, you might feel a little disheartened. None of this—filing paperwork, ensuring compliance, etc.—is what entrepreneurial dreams are made of.

However, missing a step or putting off submitting a state filing form could get your company, and you personally, in a lot of trouble. As tedious as it may seem, the tiniest details matter when it comes to jumping through the legal hoops of Texas LLC formation.

The good news is that, if you’re planning to form an LLC, Texas small business owners can get help setting up their companies. Pass these pesky obligations on to a professional and free up your time for the business decisions that really require your expertise.

Help is available at a surprisingly affordable cost from formation services like ZenBusiness, which can offer you critical support in the early days of your LLC formation and take care of the whole process for you. Even after you’ve completed your certificate of formation and fully set up your Texas LLC, ZenBusiness will still be with you as your registered agent.

Whether you take charge of the process yourself or hand it over to a professional, setting up a Texas LLC will, hopefully, be the first of many milestones and successes your company accomplishes.

LLC Resources

How to Start an LLC in California

How to Start an LLC in Florida

How to Start an LLC in New York