Starting a small business in New York is exhilarating, rewarding, and—to be completely frank—overwhelming. A business idea is just the beginning. How do you start an LLC in New York?

Careful attention to detail and a touch of perseverance during your LLC’s formation will lay a solid foundation that will set you up for the challenges of running a small business for years to come.

Even though large corporations get a lot of attention, small businesses are the unsung pillar of New York state. In fact, the Empire State Development Division of Small Business reports that small businesses make up 98% of businesses statewide, and employ more than half of the state’s private sector workforce.

The majority of these small businesses are LLCs, as they provide both personal liability protection and allow for what’s known as “pass-through taxation” (more on that later). To put things simply, LLCs give business owners the security of a corporation without the heavy taxation. They’re often the perfect fit, especially for those looking to start a small business in New York.

While doing your own research is of the utmost importance, if you ever feel like you’re drowning in a sea of paperwork and legal terminology, remember that you’re not alone. ZenBusiness is an invaluable resource. Its experts will take care of every step of the process for you. It will not only get your business up and running but also to help it reach its greatest potential.

1. Verify You Want to Start an LLC in New York

There are four standard structures to consider before registering your new business:

- Sole proprietorship

- Partnership

- Corporation

- Limited liability company

Each of these options comes with its own set of pros and cons, especially when weighing tax obligations and personal risk.

Sole proprietorships and partnerships are widely considered to be the simplest option but often come with a fair amount of personal risk. An owner’s personal property or savings account, for example, could be used to pay for accrued debts or lawsuits.

Corporations provide the highest protection from personal liability and have the most potential for raising capital but are typically the costliest option due to their complexity and tax requirements.

For many—and especially for those looking to start a small business—a limited liability company (LLC) proves to be the perfect middle ground. LLCs offer protection from personal liability while maintaining a lower tax requirement than that of a corporation. And when the time comes to draw things down, they are relatively simple to dissolve, too.

In most cases, an LLC owner’s personal assets wouldn’t be in jeopardy in the event of a lawsuit or bankruptcy. Further, LLCs allow the same “pass-through taxation” that sole proprietors and partnerships are entitled to. Rather than paying income tax directly to the IRS, then again on personal tax returns (as is often required for corporations), the company’s profits and earnings are “passed through” the business to the personal tax returns of its owners.

2. Create a Business Plan for Your LLC

If an LLC is indeed the structure that best fits your business, the next step is to create a business plan that will help you set and achieve your goals as well as entice potential investors and garner funding.

Put simply, a business plan is a formal “to-do” list for your business. It outlines:

- A summary of your business, including a statement of purpose and how your business fits within the broader industry and market.

- Targets and strategies, including how you’ll organize and grow your business, and provides a basic timeline for doing so.

There are two standard formats for writing your business plan: traditional or lean start-up. Traditional business plans are more comprehensive, while lean start-up plans are a simple summary of the key aspects of your business.

Traditional business plans are more common, as they’re often required to secure funding. Though you should tailor your plan to fit your specific business, a traditional plan typically includes:

- Executive summary: These are the what and why of your company. Include a short summary of basic information as well as your mission statement.

- Company description: Provide a more in-depth look at your business. Describe who your company serves and why it’s the best company to do so.

- Market analysis: Analyze your competition and describe how you’ll use this information to your advantage.

- Organization and management: Outline how you’ll run your company, your leadership team, and which business structure you plan to use.

- Service or product dine: Describe what your company offers as well as any patents or copyrights you’ll need to secure this offering.

- Marketing and sales: Outline your marketing and sales strategy.

- Funding request: Be specific with the amount of money you’ll need, how you’ll spend this money, and timelines for repaying debts.

- Financial projections: Show how your business will be stable and successful over the next five years.

- Appendix: Include any relevant documents, such as licenses, resumes, or letters of recommendation.

While the prospect of mapping out this detailed information on your own may be intimidating, there are abundant resources designed to help you. LivePlan, for example, features hundreds of sample plans for comparison and takes you step-by-step toward crafting a strong plan of your own that will not only help you secure funding but also organize your business for years to come.

3. Choose a Name for Your LLC

Naming your new company is an exciting next step in starting your New York LLC. Though you may already have a name in mind, it’s hard to stress how important it is that the name you chose is compatible with New York state laws. Renaming your company can damage your brand and may undo the hard work you put in during its early stages.

New York has a number of specific regulations to keep in mind when choosing a name for your LLC:

- You must include “limited liability company,” “LLC,” or “L.L.C.”

- A handful of words are restricted or prohibited.

- Restricted words like “academy” come with additional requirements, ranging from paperwork to requiring licenced professionals like doctors or lawyers as a part of your organization.

- Prohibited words, such as “state police,” must be avoided entirely.

- A full list of prohibited and restricted words can be found online here.

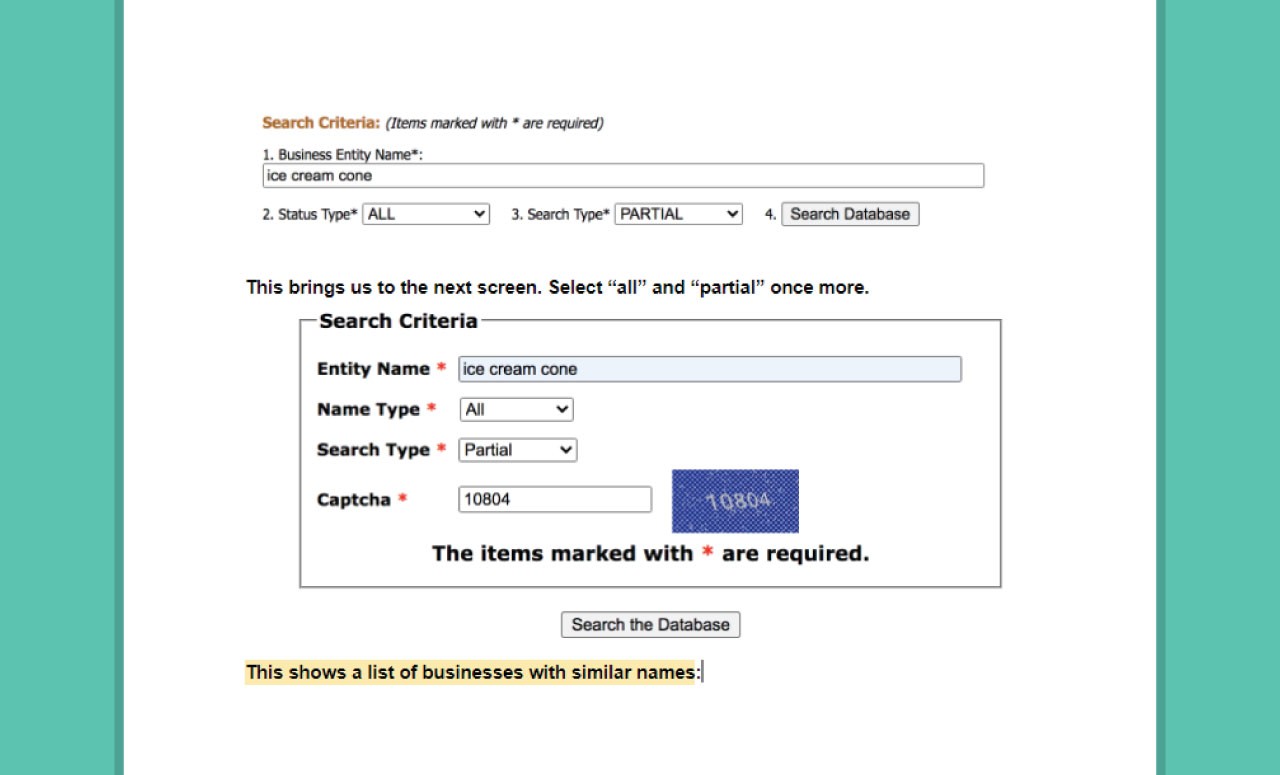

Next, ensure that your business name isn’t already in use. Search the name of your business without the LLC identifier using an online database. Be sure to scan for a variety of versions of your name to confirm a similar name isn’t already in existence. For example, if my LLC’s name is “Ice Cream Cone King, LLC,” searching verbatim yields no results. However, if I try a few combinations of the same name, I have some competition to consider.

To demonstrate:

This brings us to the next screen. Select “all” and “partial” once more.

This shows a list of businesses with similar names:

From there, try searching another variation of our name. A search for, “Ice Cream King,” yielded the following:

Alternatively, simply searching “ice cream” would show all the registered businesses in New York with “Ice Cream” in their names. What’s more, each result links to more information about the business, so you can reconsider opening, “Ice Cream Cone King LLC” if “King Ice Cream Kones LLC” is around the corner.

Another option to consider is using a name that differs from your business’ legal name. This is known as a DBA/ABN (“doing business as” or “assumed business name”) or a fictitious business name. A DBA has the benefit of allowing you to promote your business without using the required legal jargon, such as always having “LLC” written on promotional materials. It also requires separate paperwork known as an Assumed Name Certificate.

From there, consider your company’s web presence and searchability. A domain name that’s the same as—or at the very least similar to—the name of your business will go a long way in making your company as easy to find as possible. Use a domain name search like godaddy.com to see if your domain name is available. (In case you’re wondering, “icecreamconeking.com” is unused, so I’m off to a good start!) Once you find your domain name, be sure to register it so it’s still available when the time comes to build your website.

The final two steps for full due diligence in selecting your business name are:

- Confirm your name is available across social media channels. Namecheckr is a good source to check the popular sites you may use to promote your business.

- Ensure your name isn’t already trademarked by using New York’s trademark database.

Finally, once you’ve found a name that meets all of the criteria to be both legal and marketable, it’s time to file for a trademark. To register your trademark, you must file an application with the secretary of state.

As with many steps in preparing to start your small business, consulting an attorney can be an invaluable tool to preventing any legal issues that may arise. LegalZoom is a great option for receiving low-commitment, affordable legal advice from a trusted attorney.

4. File Articles of Organization with the New York Division of Corporations

Once you’ve chosen your company’s structure and name, it’s time to officially register your LLC! This is done by filing Articles of Organization.

To do so, you’ll first need to select your registered agent, or the person who is officially responsible for any tax and legal documents related to your business. A registered agent can range from a member of your team to a trusted friend to even yourself if you so choose. New York simply requires the agent to be at least 18 years old, a state resident, and to be reachable during business hours.

Many opt to hire a professional registered agent rather than taking on the responsibility themselves or relying on a friend or employee. Though this comes with an added cost, it’s well worth the additional expense if it fits into your budget.

Because the agent’s address is a matter of public record, hiring a commercial agent ensures greater privacy for your business. Further, in the event of a lawsuit, your agent would notify you with the utmost discretion rather than risk being served publicly.

Finally, it’s hard to beat the convenience and security of a professional agent. You can take a vacation, for example, without the worry of being away during normal business hours. Commercial agents also keep you up to date on important legal paperwork and requirements, easing your stress and reducing your workload.

ZenBusiness and LegalZoom are both solid resources for finding a professional registered agent who’s both affordable and reliable. In fact, ZenBusiness has the added benefit of including a registered agent in its pricing, so the company truly covers every step to not only form your LLC but set up your business for success.

Once you’ve chosen your registered agent, consider your management structure. There are two basic structures:

- Member-managed: Typically these are LLCs with a small number of members who are actively involved in daily business operations. In this more common structure, each member has a vote in big-picture business decisions.

- Ex: A husband-and-wife-owned bar would likely be member-managed.

- Manager-managed: These are usually larger LLCs whose team isn’t as involved in daily operations. This can increase efficiency by giving power to a select few.

- Ex: A restaurant with 20 passive investors would likely be manager managed.

Once you’ve decided on your registered agent and management structure, you can opt to fill out the Articles of Organization online or by mail. The online option goes as follows:

- Proposed entity name: Enter your LLC’s carefully selected name (see above for advice).

- Opening statement: This is an optional box to check that essentially states that the information you are filing is true.

- Limited liability company name: The name you enter must match the name you entered in Step 1. If your name includes words in a language other than English, enter the English translation in the second box.

- Purposes: Check this box if your LLC doesn’t require consent or approval from “any state official, department, board, agency, or other body. …”

- County: Select the county where your LLC’s office will be located.

- Service of process: This is the full address (not a P.O. box) where the Department of State should send legal documents.

- Registered agent: Check the “include following statement” box and complete this section, unless your registered agent is one of the LLC’s owners. Select “enter Registered Agent information” for an individual or “select a Registered Agent Company” for a commercial agent.

- Management structure: select the structure that best fits your company.

- Effective date: Set the date for when you want your LLC to officially start. No selection will automatically start your LLC from the day of filing or you can select a date up to 60 days later.

- Dissolution date: Select “perpetual,” unless you have a date you wish to dissolve your LLC, in which case you can enter the specific date in the second box.

- Liability statement: This is optional, but checking this box means that your LLC agrees to protect its members in the event of a lawsuit, provided they didn’t participate in “fraud, gross negligence, willful misconduct or a wrongful taking.”

- Organizer: Fill this out with the information of the person organizing the Articles of Organization.

- Signature: The organizer signs with their title, certifying that the information is true and correct.

- Filer: Fill this in with the person filing the Articles of Organization (most likely the same person as the organizer).

New York state also requires a $200 filing fee, made payable to the Department of State.

Remember, if you’re using a DBA, which differs from your legal name (see above for more information on DBAs), you must register it separately. For a full list of links to the information regarding naming your LLC and filing the Articles of Organization, the Department of State’s resources can be found here.

5. File Two New York LLC Publications

Archaic as it may seem, Section 206 of the New York LLC act requires an advertisement for your business to be published in two print publications within 120 days of the formation of your New York LLC. This is known as the Newspaper Publication Requirement. These ads must:

- Be in print for six consecutive weeks.

- Run in papers that are in your LLC office’s county (filed in step 5 of the Articles of Organization).

- Be approved by the County Clerk of the same county.

The publisher will send an Affidavit of Publication of the Newspapers (essentially a receipt for proof), which you must mail to the New York Division of Corporations, along with a $50 filing fee and Certificate of Publication.

6. Create an Operating Agreement

The next step to prepare for the launch of your business is to create an operating agreement. An operating agreement is an internal legal document that’s almost like an owner’s manual for your business. It clearly lays out the rights, powers, and duties of both the owners and members as well as rules and regulations for daily operation.

New York’s laws regarding operating agreements for LLCs are tricky. An agreement is required by law to be formed within 90 days of filing the Articles of Organization. Because it’s an internal document, however, it’s not officially filed with the Department of State. Further, the law doesn’t outline consequences for failing to produce said agreement.

Still, even in states that don’t require an operating agreement, it’s an essential step in forming an LLC that will undoubtedly save you from future heartache. It’s an opportunity to set the rules for your company rather than defaulting to the state’s guidelines. It also protects members of your LLC from personal liability and clearly defines company policy, which will help you with any interpersonal issues that may arise. Finally, it’s required to secure a company credit card and checking account.

At a minimum, an operating agreement should include:

- The basics: company name, location, formation date, members, and owners.

- Leadership: how management is structured as well as who will vote on important issues and how voting will occur.

- Funding: describing the capital contributions as they stand at the time of formation and how the company will garner additional funding.

- Distribution: describing how your company will divide profits and losses.

- Staffing changes: an outline of how members can be added or removed from your company as well as how ownership interest can be transferred.

- Dissolution: outlining the potential exit strategies in the event of the company’s dissolution.

The operating agreement is a legal document that will dictate how you address the most important aspects of your business, so the importance of having professional help can’t be overstated. ZenBusiness’ formation package offers a helpful template to guide you through each step, or you may want to consider consulting with an attorney using LegalZoom.

7. Apply for a Federal EIN

In many ways, starting a small business feels like having a child. And, just like your small child needs a Social Security number to one day operate as a fully functioning member of society, your small business needs an EIN.

An EIN, or Employer Identification Number, is a nine-digit number assigned by the IRS that you use to file taxes, open a bank account, build credit, register for permits and licenses, and grow your team.

The good news is that (unlike with most steps in this process) obtaining an EIN is 100% free! Simply apply online or fill out an SS-4 form, and send it via mail or fax to the Internal Revenue Service. Alternatively, you can apply toll free by calling (267) 941-1099 or opt for ZenBusiness’ formation package, which includes securing an EIN as part of its service.

8. Open a Company Bank Account

Once you’ve secured an EIN, you can begin the process of opening a bank account for your New York LLC. It’s critical, for a number of reasons, to separate your personal and professional accounts as soon as you start incurring expenses.

First, paperwork and taxes will be a nightmare if you maintain only one account. Tracking your company expenses also becomes infinitely more difficult when they’re mixed with your personal expenses.

Aside from a logistical headache, using a personal account can get you into legal hot water. One of the main benefits of starting an LLC is the personal liability protection that a New York LLC offers.

In the event of a bankruptcy, using your personal bank account could muddle the case for protecting your assets. As a result, you may be held personally liable for any debts owed by your company.

On a lighter note, you’d miss out on all the perks that come with a business account. Many banks offer special deals and services to small businesses. When choosing a bank, the main considerations are:

- Costs and fees: Some banks advertise free accounts but charge extra in sneaky fees, like fees for dipping below your minimum balance. Read each bank’s stipulations carefully.

- Interest rates: Some banks will offer lower interest rates if you can keep your balance above a certain amount. Estimate your average balance when weighing your options.

- Transaction limits: Estimate the number of transactions (deposits, withdrawals, etc.) you’ll make in a week. If you expect to make a lot of transactions, choose a bank that offers a higher limit to avoid extra fees.

- Loan availability: If you need or expect to need funding, look into banks with a good reputation for helping small businesses secure loans.

- Extra services: Some banks offer integration for services like Payroll, Paypal, and Square. Consider opting for a bank that integrates the software to increase efficiency.

- Local versus national: Local banks often boast more personalized customer service and have more freedom to tailor their policies to meet your LLC’s needs. National banks tend to have greater resources, including more advanced technology that will make your banking experience more convenient.

Your priorities will depend on your business’ needs, but a few banks to consider are:

- Chase: If your business requires frequent cash deposits (like a bar or coffee shop), you’ll want a bank with a physical location (or two) nearby. Look up the Chase nearest to your location to confirm, but, as the largest U.S. bank, chances are there’s a branch in a convenient location. Chase also offers low fees and a wide variety of account styles to choose from, so you can find a checking account that meets your business’ needs.

- Wells Fargo: Consider Wells Fargo if you need funding or think you’ll need funding in the future. They’re known to help small businesses secure SBA 7(a) loans (otherwise known as small-business loans). They also offer incentives for their small-business account, such as a free period and no charge for the first 50 transactions.

- BlueVine: If your business is conducted entirely cash free, BlueVine offers excellent service at a low cost. Their fees are low, and they specialize in loans for small businesses.

- Popular Bank: Located only in Florida, New York, and New Jersey, Popular offers a lot of the perks of a smaller bank, such as 200 transactions per month with no fees and no minimum balance.

Most banks will require the following to open your business account:

- Copy of your Articles of Organization

- Signed copy of your Operating Agreement

- EIN number

- Two forms of ID

From there, consider opening a business credit card. A separate credit card will further distinguish your personal finances from your LLC and you can begin to build your LLC’s credit. Good credit will help you secure future loans, so it’s essential to start building credit from the start.

The biggest immediate benefit to opening a credit card are the added perks, like cash back and miles for purchases. Some cards offer bigger incentives, so you’ll want to do your research and find the best credit card for small businesses, then reap the rewards.

Finally, make sure to begin tracking your expenses. Writing off business expenses can save you a ton of money when you file your year-end taxes. This bookkeeping can be done on your own with Quickbooks. Alternatively, you can hire a cloud solution like Bench to take care of accounting for you, minimizing the chance of potentially penalty-generating errors.

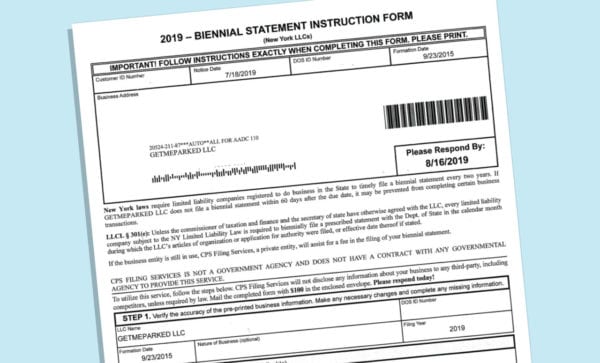

9. Cost of Doing Business: Biennial Statement and Taxes

LLCs in New York are required to file what’s called a biennial statement, which keeps the state up to date on the basic information about your business, such as the address of the executive officer and how many members currently serve on the board. The statement must be completed every two years (mark your calendar!) along with a $9 filing fee, both of which can be submitted online.

The taxes you’re required to pay depend on the type of business you’re running. Generally speaking, the majority of LLCs will report their income using one of two forms:

- 1065 Partnership Return: for LLCs with more than one member.

- 1040 Schedule C: for LLCs with one member.

From there, your additional taxes will depend on your industry and style of business. If you sell goods, for example, you’ll need to register as a sales tax vendor and pay taxes to the state on your sales.

The alcoholic beverage tax is another additional tax in New York, but a full list of additional requirements can be found here.

The DOS estimates the costs as follows:

As most of us have been told since well before we filed our first W-2, taxes are one of a couple things we just can’t avoid. Acceptance is the first step, followed by adherence to the laws with maniacal precision to avoid consequences.

Remember, CPAs—or certified public accountants—are a valuable tool for helping you with any of your tax questions. Don’t be afraid to ask for help!

10. Hiring Employees

Not every business hires employees, but if you do plan to add members to your team, it’s important that you follow New York state laws and register for New York Unemployment Insurance from the New York State Department of Labor’s Unemployment Insurance Division, then set up payroll and benefits. This will protect you from potential lawsuits and trouble with the IRS down the line.

First, understand the difference between independent contractors and employees. To put things simply, a full-time employee gives you more control and can even save you money in the long run depending on the type of work and the amount of hours you require. Our in-depth guide, including pros and cons of each hiring model, can be found here.

If you do plan to hire full-time employees, you must:

- Verify they’re eligible to work in the United States by completing a I-9 form and providing the required documentation.

- Report your new employee to the state.

- Secure workers’ compensation insurance, or “workman’s comp.” This is purchased through conventional insurance providers.

- Report wages, withhold Social Security and Medicare taxes, and pay unemployment taxes and unemployment insurance. More information and an online application can be found here.

Finally, select a reliable payroll provider that will help you pay your employees, manage their health benefits, and follow New York state laws and regulations.

There are a number of options on the market for payroll and benefits solutions, but we especially love Gusto because it’s so easy to use. And, with tools for setting up health and retirement benefits, paying independent contractors, HR consultations, and so much more, it’s truly a one-stop shop for all your employee-related needs.

11. Apply for New York Licenses and Permits

Some LLCs in New York require special licenses and permits to operate. This depends on the size and type of your business (do you have employees, do you sell food or liquor, etc.). These certifications are even determined by the county, village, or town in which you operate.

To find out which permits you need to operate, try using New York’s permits, licenses, and registrations portal. The U.S. Small Business Administration is also a handy resource for making sure you’re covered at the federal level.

Alternatively, LegalZoom’s business license tool can help you find the certifications you need by answering a few simple questions. From there, they can complete and submit each application on your behalf.

12. Protect the Owners and the Company

Beyond simply filing for your LLC, there are a number of steps to prepare for the launch of your business that can protect both your company and its owners from any issues that may arise. To review, your running checklist should look something like this:

- Prepare and file all the necessary paperwork to register your LLC.

- Research, select, and trademark a name

- Register a domain

- File Articles of Organization

- File publications

- Draft and sign an operating agreement.

- Secure an EIN

- Open a company bank account and credit card

- Obtain any additional licenses and permits that your LLC requires.

When signing legal documents, it’s crucial that you sign as the LLC rather than as yourself. This not only displays professionalism but, more importantly, protects you from personal liability.

Standardizing a signature block will make properly signing contracts and legal documents easier, protecting yourself from undertaking personal responsibility on behalf of your LLC. Here is a sample template you can follow:

Agreed to: [Company name]

By: [Your signature]

Its: [Your title]

Finally, one of the best precautionary measures you can take to protect yourself and your company’s finances is to secure insurance. The type of insurance you need and its resulting cost depend on the type of business you conduct. A company that employs manual laborers who use dangerous equipment, for example, will need greater coverage than a company whose employees work in an office.

There are a number of insurance companies to choose from, but many don’t specialize in small businesses, which is why we especially love Hiscox. They insure small businesses exclusively, so they understand specific needs and challenges that can come along with running a small company in New York.

13. Protect Your Intellectual Property

Intellectual property (IP) in many ways functions similarly to more tangible types of property. Just as a person can’t legally steal your car or house, so also are you entitled to the security of your expressed ideas, inventions, art, and designs.

Common ways to secure your intellectual property are through:

- Copyright: This empowers only you to copy or distribute your work (ex: my autobiography on life as New York’s youngest ice cream shop owner).

- Once you’ve produced an original work, you technically own the copyright. That said, officially registering your copyright with the federal government adds a huge amount of protection and credibility in the case of theft.

- Trademark: This empowers only you to use a word, phrase, or symbol to market your product (ex: “King of Cones” for my Ice Cream Cone King’s T-shirt).

- Consider officially registering your LLC’s name, logo, and slogan, which protects you across the entire U.S.

- Patent: This empowers only you to make, use, or sell your invention (ex: my 100% raw sugar ice cream cone).

- Consider filing for a patent even if you haven’t perfected your invention—you can reserve a patent under “patent pending” for up to one year.

If you’re at all confused about the differences between these three protections, LegalZoom breaks it down in this very digestible animated video.

The following forms of intellectual property are also used, though less common:

- Trade secret: This protects your economically valuable secret from being shared with competitors (ex: my ice cream recipe). By not obtaining a patent, the secret can remain hidden.

- Trade dress: This protects the aesthetic appearance of your company from being replicated. (ex: I couldn’t market my ice cream soda in a Coca-Cola bottle)

After you’ve legally secured your intellectual property, you may still need to share information with your employees or allow others to pay to use it. This is done securely through carefully negotiated IP agreements. These agreements lay out how the buyer can use your IP and for what amount of time.

Types of agreements include:

- NDA/confidentiality Agreements: These are legal contracts that forbid contractors or employees from sharing disclosed information.

- Independent contractor/1099 agreements: This form is used when hiring a contractor for a set job. It’s important to include a clause protecting your IP in this agreement if applicable.

- Work-made-for-hire agreements: Work that an employee of the company completes can be copyrighted by the company (rather than the creator).

- Noncompete agreements: This barrs an employee from working for a competitor during or after employment. This can protect your IP from being directly shared with the competition.

- Non-solicitation agreements: These prohibit former employees from bringing your company contacts to their new company.

As intellectual property is often the bread and butter that sets your business apart from its competitors, and its protection is of the utmost importance. While cars and even houses can be replaced, the thought of replacing an idea is often more devastating—or even impossible. For more help protecting your IP, use the IP portal on LegalZoom.

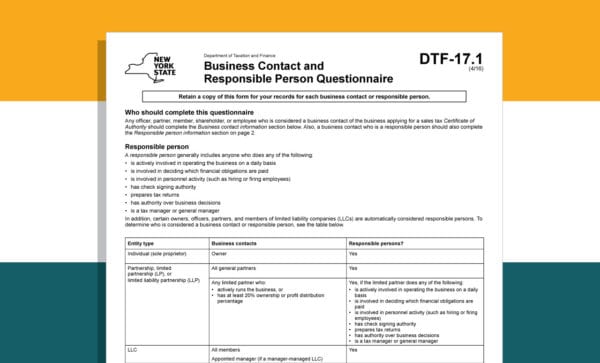

14. Comply with Local Tax Requirements

To avoid issues with the IRS, you must comply with not only federal and state taxes but local city and county taxes as well. Your local tax responsibility depends on your location and type of business.

For example, if you sell goods to customers in New York City, you’ll need to pay the local sales tax specific to New York City. This requires registering (form DTF-17 or online), and paying semiannual taxes to the Department of Taxation and Finance.

Again, it will depend entirely on your business and the laws of each county. For more information regarding local taxes and how they relate to your business, check out the department’s website.

You’re Now Ready to Start Your New York LLC!

In the end, starting an LLC in New York requires more than just a stellar business idea, but also compliance with the state’s many legal requirements. To be perfectly candid, this isn’t exactly the sexy part of starting a small business, but it is the necessary nitty-gritty of ensuring your road to success is well paved.

With so many forms to file, requirements to follow, and legal options to consider, it’s important to take the process one step at a time. Use every tool at your disposal: Consult with experts and lawyers if they’re available to you. Do your research to guarantee you’re making the best possible choices for your business.

Finally, consider opting for ZenBusiness to take care of all the boring details for you. They can’t give you your next great business idea (that’s on you), but they can provide experts who guide you through each step and file all of the necessary paperwork so you can spend your valuable time growing your team, marketing your business, and earning new clients. You know, the fun part.

In the words of Nike’s founder Phil Knight, who famously quoted his track coach in an interview with Forbes, “Play by the rules but be ferocious.”

Good luck!

LLC Resources

How to Start an LLC in California

How to Start an LLC in Florida

How to Start an LLC in Texas