Initial unemployment claims continue to come in each week at state unemployment offices across the country. Although some states are in the process of reopening businesses, coronavirus quarantine has already damaged the economy, some say, beyond repair.

Governors across the country are making difficult decisions with a lot on the line. The repercussions of reopening too soon could be as catastrophic as remaining in quarantine.

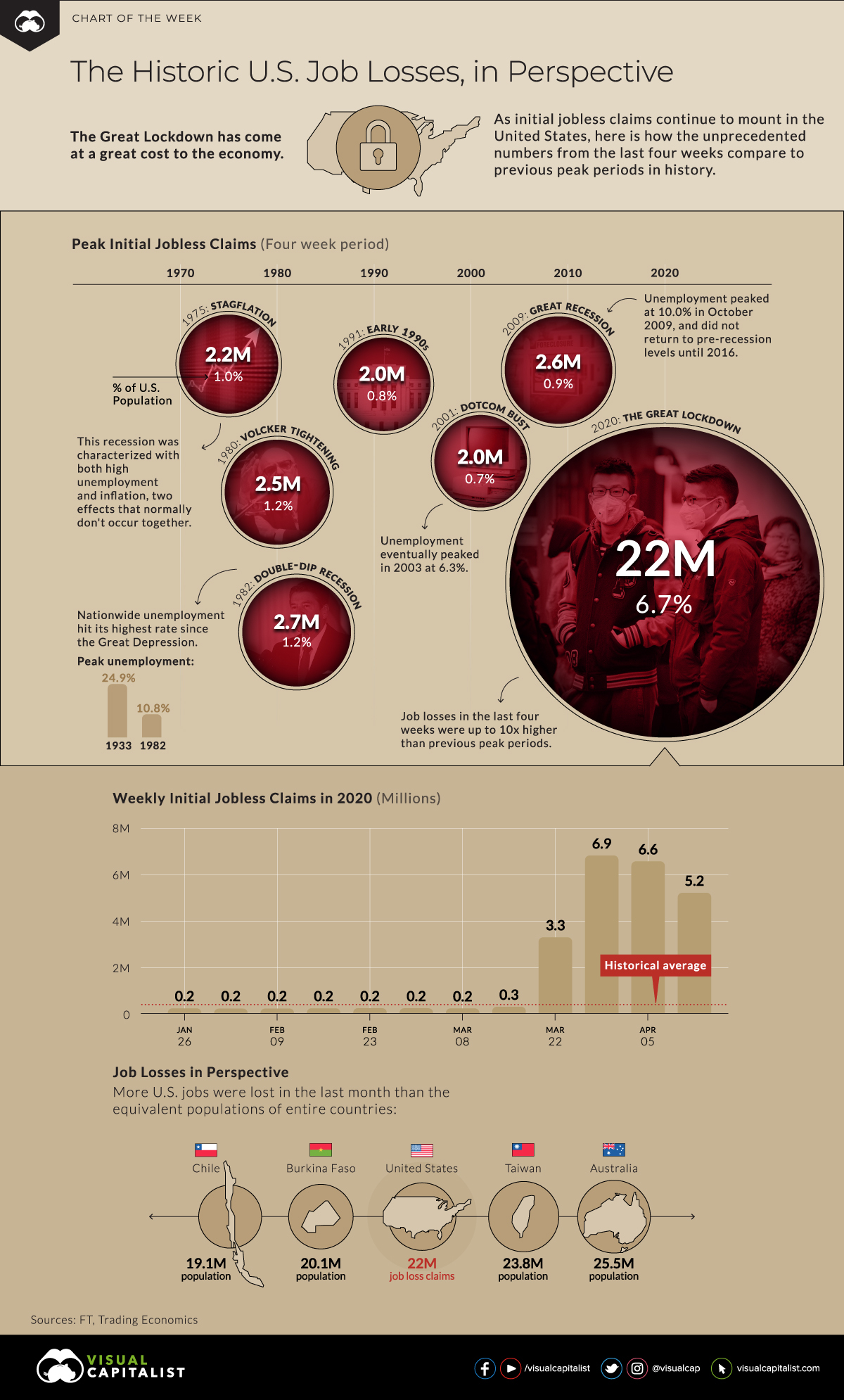

This graphic by Visual Capitalist illustrates the sheer magnitude of the number of new initial unemployment claims as compared to previous periods in history with alarmingly high unemployment.

These previous peak periods of unemployment pale in comparison to the 22 million new unemployment claims over the last four weeks. The US has not seen this level of unemployment since the Great Depression of 1933.

In 1982 the US experienced a double-dip recession that peaked at 10.8% unemployment.

During the more recent Great Recession, unemployment peaked at 10% in October 2009.

Unemployment did not return to pre-recession levels until 2016.

Everything about the US economy was looking pretty great until the pandemic started. Until March 22, 2020, weekly initial jobless claims were below the historical average. It may be a while before we see that trend again even when the threat of coronavirus is gone. Some small businesses will be gone for good.

Putting Unemployment Into Perspective

More jobs were lost in the United States over the last four weeks that the populations of entire nations.

Chile has a population of 19.1 million

Burkina Faso has a population of 20.1 million

Taiwan has a population of 23.8 million

Australia has a population of 25.5 million

The US lost 22 million jobs in a month.

It will certainly take a long time for the US (and the world) to recover from the economic effects of COVID-19, but as restrictions are lifted more people will return to work. Life will return to normal, eventually. Whether that “normal” is the prosperity we previously enjoyed is yet to be seen.