Introduction

If you’ve got dreams of being a business owner in Georgia, starting an LLC may be the ideal way to make that goal a reality. Launching your own business is a uniquely exciting experience. It’s a new beginning that is sure to challenge you and help you achieve personal and professional growth along the way.

Small business is big in Georgia, where the 1.1 million small businesses make up 99.6 percent of businesses in the state, according to the U.S. Small Business Administration. All told, 1.7 million Georgians—43.1 percent of the state’s workforce—work for small businesses.

LLCs are particularly popular business entities in Georgia because they offer business owners more protection than other simple business structures and are (comparably) easy to set up. It isn’t as difficult as you might think to start an LLC, but if you would rather hire a professional to handle the logistics while you work to get your business off the ground, that’s an option.

A professional service like ZenBusiness can handle the whole process of LLC formation for you at a reasonable price, so you can keep focusing on running your business. Otherwise, you can handle the LLC formation process yourself by following these simple steps.

1. Verify That a Georgia LLC Is the Right Entity to Use

LLC stands for “limited liability company,” a type of business structure. An LLC is one of five business structures recognized by the state of Georgia. This business entity is particularly popular among small business owners.

Some business structures, like sole proprietorships and general partnerships, are relatively simple to set up. The problem is that these business entities don’t offer protection to the owner, who could end up personally liable for business losses. Other business structures, like corporations, protect the owner’s personal assets but are more complicated—not to mention expensive—to set up and run.

For many business owners, the LLC structure offers the best of both worlds. Making your company an LLC is the simple way to establish it as its own entity that is legally separate from you, so you will not be personally liable if your business takes on debt or gets sued.

LLCs also offer flexibility. Owners of LLCs in Georgia can choose to be taxed as a pass-through entity or a corporation. Pass-through taxation means that the company pays no taxes and the business owners, instead, pay personal income tax on their earnings from the company. LLCs taxed as corporations pay corporate income tax.

There are pros and cons of the LLC business structure, just as there are with any business structure. The U.S. Small Business Administration offers a helpful comparison of different business structures. Once you’ve decided on an LLC, you can move on to step #2.

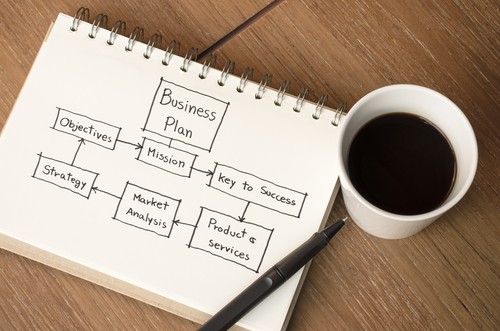

2. Create a Business Plan for Your LLC

Going into business without a plan could be a big mistake. That saying that failing to plan is akin to planning to fail holds a grain of truth.

At best, running your business without a plan might allow it to survive and make short-term gains, but the lack of strategy and forethought will make it difficult for your company to thrive. At worst, plunging into the business world without a plan could mean making major missteps that will leave your company without any real chance of succeeding.

Your completed business plan should include sections like the following:

- Executive summary: A high-level overview of your fully fleshed-out business plan.

- Company description: A section devoted to your company’s identity, including what sets it apart from competitors, what problems or needs it addresses, and who its customers are.

- Market analysis: A look at the data pertaining to market trends and competitors and your interpretation of that market data.

- Company organization: A description of your company’s internal organization, including not only its business structure but management organization and hierarchy of positions.

- Products or services: An exploration of the core products or services your company will offer and the logistics of how you will provide these products or services.

- Marketing plan: A roadmap for how you will bring in sales and customer engagement so that your company can thrive.

- Funding needs: A summary of what funding you want to get from investors and how you would use that funding to grow the business successfully and provide a return on their investment.

- Financial forecasts: The “money stuff” that encompasses expenses budgets, sales forecasts, profit and loss statements, and balance sheets, all created using as accurate data and mathematical formulae as possible.

When you look at the list of all that goes into a business plan, it’s easy to get overwhelmed. Taking it section by section, and remembering that a business plan doesn’t have to be perfect in the first draft, can make the process more manageable. A tool like LivePlan can simplify the writing of a business plan through the use of customizable templates and plain-language instructions and examples.

3. Choose a Name for Your LLC

Your LLC name may not be the deciding factor in whether your business succeeds, but it is one of the first things you have to decide. Not only does your company name help inform your business identity, but it also is required to begin the process of official LLC formation with the state.

Choosing a Unique Business Name

For many new small business owners, the biggest obstacle in choosing a name is availability. Georgia state law prohibits the filing of business names that are “not distinguishable” from established businesses filed in the state. While this standard is generally considered “more liberal” than the “deceptively similar” and “likelihood of confusion” standards that are used in certain other states, it may mean that your ideal business name is already taken.

Under Georgia’s name availability standards, differences in abbreviation, punctuation, phonetic spellings, plurals, ampersands, and articles (a, an, and the) don’t constitute distinguishable business names. Neither do entity types, such as the inclusion of “LLC” rather than “Inc.” in the company’s name.

Under Georgia name standards, you may need special approvals to use certain words in your LLC name. These restricted words include terms related to the insurance industry, the bank industry, and higher education.

Conducting a Business Name Search in Georgia

To make sure that the name you want to use for your LLC is available, you need to search the Georgia Corporations Divisions’ online business search database.

If your desired LLC name is available, you can move forward with forming a limited liability company under that name. Otherwise, you may need to keep searching for the right company name.

Reserving a Business Name for Your LLC

Perhaps you’re not ready to proceed with the LLC formation process just yet, but you want to keep your name available until you are. You can do this by reserving a business name with the Georgia Secretary of State.

Filing a name reservation request form reserves your name for just 30 days, but you can reapply if you want to reserve the name for longer. The cost to file a 30-day name reservation in Georgia is $25 if filing online or $30 if filing in paper format.

Registering DBA Names in Georgia

If your company will do business under any other name besides the legal name of your LLC, you need to register this name with the government. These additional names that companies go by are often called “doing business as” names, or DBA names. In Georgia, the official term for a DBA name is a trade name.

Trade name registration in Georgia isn’t statewide but rather countywide, filed with the appropriate county’s clerk. Failing to file your trade name registration with the county clerk is a big deal, because conducting business under an unauthorized name is against the law and could bring about fines and other penalties.

Choosing a Domain Name

Modern companies should have some kind of an online presence, which usually includes a website. Your domain name is the address at which visitors will find your website on the Internet. LLC owners can use GoDaddy’s domain registration and hosting services to search for names related to their company’s name or their industry.

Trademarking an LLC Name

Trademarking your company’s name isn’t a requirement for launching an LLC. However, doing so can protect your business’s identity and its intellectual property. At the federal level, you can start the process of trademarking your LLC name by running a trademark database search on the United States Patent and Trademark Office (USPTO)’s online system.

You can also trademark your name in Georgia by submitting an application to the Secretary of State. The process of filing a trademark application at the state level begins with running a Trademark Search on the Georgia Corporations Division website.

Applying for trademarks can be a complex undertaking, especially at the federal level. Busy small business owners often find it worth their while to hire an attorney to assist them with this process. Certain types of lawyers have particular experience handling matters of trademarks, patents, and intellectual property. If you would like to retain an attorney to handle the trademark application process but you aren’t sure where to start, we recommend consulting the online legal services company LegalZoom.

4. File Articles of Organization with the Georgia Secretary of State

The actual formation of your LLC happens when you file documents called Articles of Organization with the Georgia Secretary of State.

How to File LLC Formation Documents in Georgia

The easiest way to register your LLC with the Secretary of State is by using the Georgia Corporations Division’s online portal. Use the Create or Register a Business function to complete LLC formation paperwork online. Make sure you choose a domestic limited liability company as your business structure.

You can also register your LLC by mail or in person with the Secretary of State’s office in Atlanta. To do this, you will need to submit two forms:

- Articles of Organization—you can write your own or fill out the Articles of Organization for LLC (CD 030) form

- Transmittal Form — Limited Liability Companies (231)

What You’ll Need to Fill Out Your Georgia LLC Formation Paperwork

The most difficult part of filling out your LLC formation documents is gathering the information you need to provide to the state, including:

- LLC name: You need the name you chose in step #2 to file your LLC formation documents. If you reserved a business name, make sure you have your name reservation number handy.

- Filer’s name and contact information: The individual filing for the LLC must provide their name and address, as well as a valid email address.

- Company address: You need to provide the mailing address for your LLC’s principal office.

- Registered agent: The filer must designate a registered agent and provide that agent’s address.

- Organizers: Include the name and address of each of the LLC’s organizers.

Most of these requirements are what an aspiring small business owner may expect, but the registered agent requirement may surprise you.

What Is a Registered Agent?

LLCs in Georgia, as in many other states, must designate a registered agent. The registered agent may be an individual, a company with a business structure like LLC or partnership, or a corporation. The purpose of a registered agent is to be the designated party to accept official documents and communications, such as the service of process papers delivered when a company is sued.

The registered agent’s location, also referred to as the registered office, must be located in Georgia. No owner, officer, or shareholder of an LLC can serve as the company’s registered agent, so companies often hire an attorney or a professional service to perform this duty. ZenBusiness is one of the more popular professional business formation services that includes registered agent services in its packages.

State Fees for Registering a Georgia LLC

The cost to register an LLC with the Georgia Secretary of State is $110 if you register in person or by mail. The fee drops to $100 for business owners who choose to register online.

Online registration fees must be paid by credit card. Registering in person or by mail may allow you to use other means of payment, such as a check or money order.

Don’t Forget to Register Your Trade Name

Are you planning to conduct business under a nickname? Once you’ve registered your LLC, you still need to register any applicable trade names or DBA names you intend to use at this time. Generally, you should register trade names in Georgia with the clerk of the county in which your business is based.

Getting Help for LLC Formation in Georgia

The paperwork needed to form an LLC isn’t as extensive as you might expect, but the process can still be intimidating. If you would rather leave the logistics to a professional and focus on other aspects of building your business, consider hiring a professional service to handle this task for you. We recommend ZenBusiness or LegalZoom.

Both services do an excellent job helping small business owners make their entrepreneurial dreams a reality, but our favorite is ZenBusiness due to its ease of use, reasonable rates, and reputation for great customer service.

5. Create an Operating Agreement

Now that you have registered your LLC with the Georgia Secretary of State, your next step is to draft an operating agreement.

What Is an Operating Agreement?

Operating agreement is the term for the formal contract that governs your company. This document outlines the company’s organization and the rights and responsibilities of its members.

Why Operating Agreements Are Important

Having an operating agreement in place isn’t legally required for running your business. You don’t have to submit a copy of your operating agreement to the state of Georgia, but this still isn’t a step you can skip. A well-written operating agreement paves the way for company growth and protects you, your fellow members, and your LLC from disputes.

Whenever your company encounters a new challenge or an opportunity for growth, your operating agreement guides how your LLC will navigate changes. You might consult this contract if you decide to bring on new owners, merge with or acquire another company, change your LLC’s name, or alter its management or organization structure.

What Your LLC’s Operating Agreement Should Include

An operating agreement should address all aspects of the running of your company, including:

- The organization and founding—when and where it was created—of your company

- A list of the LLC members and an explanation of the company’s ownership structure

- Management structure, which may refer to owner-managed and member-managed structures

- The voting rights each member has to contribute to company decisions

- The capital contribution, or the amount of money each owner has invested into the LLC

- How the company’s owners will distribute its profits (and its losses)

- How the LLC will address membership changes, including adding new members, removing members, and transferring ownership of the company

- The exit strategies and wrapping up of final details upon closing or dissolving your company

How to Write Your Operating Agreement

Vague language in an operating agreement can undermine its potential to guide your company. Business owners may choose to work with a professional to avoid this problem.

Most business owners who use professional services for help with writing an operating agreement turn to one of two kinds of professionals:

- Business formation services typically help with operating agreements by supplying templates an LLC owner can follow. Writing an operating agreement based on a template is often a cheaper option than hiring an attorney to draft the contract for you. For operating agreement templates, we recommend purchasing a ZenBusiness LLC formation package.

- Lawyers will use their legal training to craft a thorough, comprehensive operating agreement or to review a written contract for you. Hiring a contract attorney may cost you more than using a template, and having a lawyer write your operating agreement will cost more than hiring a lawyer to merely review the contract. If you think you want an attorney’s help, LegalZoom is a great place to start.

6. Apply for a Federal EIN

Whether you choose to have your LLC taxed as a corporation or serve as a pass-through entity, you need to be prepared to pay your federal income taxes the right way. Generally, you should start by obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

EIN and Federal Taxes

Your EIN is your LLC’s federal tax identification number. Aside from its obvious use in tax reporting, having an EIN is often necessary for setting up your business bank account.

The IRS generally treats limited liability companies as disregarded entities when they are owned by just one member, while those owned by two or more members are classed as partnerships. Under these tax statuses, the LLC would be treated as a pass-through entity. If you wish to have your LLC classified as a corporation, you need to file IRS Form 8832, Entity Classification Election.

Applying for an EIN for Your Business

Business owners can apply for an EIN for free by visiting the EIN Assistant page on the IRS website. You can fill out an application online or by downloading and submitting IRS Form SS-4, Application for Employer Identification Number.

Getting an EIN for your Georgia LLC isn’t difficult or particularly time-consuming. Still, time is money when you’re putting every spare minute into launching your business. Services like ZenBusiness often include filing an application for an EIN as part of their LLC formation packages.

7. Open a Company Bank Account

Almost as soon as you create your LLC, you need to be mindful of managing the company’s finances and, specifically, of separating your personal assets from your business assets. The best way to do this is to open a small business bank account for your LLC.

What happens if you fail to keep your personal finances separate from your LLC’s assets?

Combining your finances, even if your company is a single member LLC and you’re entitled to all of its profits, undermines that liability protection provided by this business structure. Your LLC may be a separate entity legally, but if its money and your money are mixed in the same account, it’s easier for creditors or plaintiffs to attempt to go after your money to cover business debts or liabilities.

When your LLC’s assets share an account with your personal finances, it also obscures your company’s profitability. Suppose you want to apply for a loan or seek out investors so that you can grow your company. Without a clear picture of how the LLC is performing financially, you will have a hard time acquiring this funding. Storing your LLC’s assets in a dedicated business account means investors are seeing only the deposits, debits, and transactions related to doing business, rather than every personal bill you pay.

What Do You Need to Open a Business Bank Account in Georgia?

Before you go about opening a business account, you need to gather the documents the bank will need from you. Typically, these requirements include:

- Your Articles of Organization: A copy of your filled LLC formation documents is typically required to prove your company’s existence and its authority to do business in the state of Georgia.

- Your operating agreement: Don’t be surprised if the bank asks for a signed copy of your company’s operating agreement. This signed contract further demonstrates the company’s legitimacy and can be used to verify that you, as an individual, have the authority to open accounts on behalf of the LLC.

- Your EIN: The reason opening a business bank account is just below applying for an EIN in the process of forming an LLC is because most banks will require you to provide your company’s EIN to open a new business bank account.

- Personal identification: To open a business account, as with a personal account, you need identification to prove that you are who you say you are. Generally, you should come prepared with at least two forms of personal identification when you visit a bank to open a business account.

Choosing a Bank for Your Georgia Small Business

How do you select a bank to use for your small business needs? You could go through the same bank that handles your personal funds. You might also ask other small business owners you know for recommendations. It’s important that small business owners think through their needs and the account features and terms available to them. You don’t want to pay for features you don’t need or miss out on bonuses that would really benefit your company.

Georgia LLCs are fortunate in that they have hundreds of banks to choose from, including both national and regional options.

National banks have plenty of branches, so you’re never too far from a bank location for any in-person services your company requires. These large banks often have the best rates, as well.

Examples of national banks that Georgia LLC owners should consider include:

- Wells Fargo, which has more than 200 bank locations in the state and which has historically processed more small business loans in Georgia than any other bank, according to the U.S. Small Business Administration

- Chase, which has more than 100 branch locations across the state

You should also consider the option of a regional bank, which may focus more closely on the financial markets in Georgia. These smaller banks may have a more personal touch, such as considering your character in loan applications rather than basing small business loan decisions on a more rigid set of criteria.

Regional banks to consider in Georgia include:

- SunTrust, with hundreds of branches across more than 80 cities throughout Georgia (since December 2019, SunTrust is part of Truist as a result of a merger with BB&T)

- Ameris Bank, with locations in more than 70 Georgia cities

Getting a Business Credit Card

A business checking account is a great asset for a small business owner, but there are some transactions—like online purchases—for which you won’t want to break out an outdated checkbook. Having a small business credit card is handy for making purchases where a traditional check either isn’t accepted or would just slow you down.

The best business credit cards also tend to offer fraud more protection (compared to debit cards, especially) and incentives that are basically free money.

When you don’t have a credit card for your LLC, you will often end up purchasing business expenses on your own personal credit card. Although you could save receipts and reimburse yourself from your business checking account later, this process is imperfect and more complicated, and it means you’re combining your business and personal finances all over again. Your business credit card helps you maintain this distinction between your personal and business assets.

Like choosing a bank, choosing a small business credit card can seem overwhelming. Figure out what’s most important to your LLC—low interest rates, travel rewards, cashback, low fees—and search for cards that best fit those needs.

Remember to use your company’s credit wisely and not overspend. Maintaining a balance can mean you wind up paying more money for your purchases due to credit card interest charges, so aim to pay off all balances within the grace period whenever you can (and if you can’t, pay these debts as soon as possible).

Setting Up Your Business Bookkeeping

Balancing the books isn’t any small business owner’s favorite part of entrepreneurship, but this task is crucial to success. Good bookkeeping helps you accurately keep track of expenses and income, so you will know if your company’s spending is out of control or if you need to adjust your budget to weather economic downturns or invest in future company growth.

The easier your bookkeeping is, the better you will be able to stay on top of it. We suggest that new small business owners choose one of two options for managing their bookkeeping:

- Outsource this task completely by hiring a cloud solution like Bench

- Invest in QuickBooks, an easy-to-use accounting software package that reduces the challenge of small business bookkeeping to a manageable do-it-yourself task, even if you have no background knowledge of accounting

8. Pay Your Annual Georgia Taxes

The federal government isn’t the only entity that may require your LLC to pay taxes. Your company may also have tax obligations, in one form or another, to the state of Georgia.

Only corporations pay Georgia’s net worth tax and corporate income tax, so you won’t have to worry about making these payments unless you select corporation as your tax status with the IRS. The state of Georgia uses the same tax classification that companies select for federal tax purposes with the IRS.

If your LLC is considered a corporation for tax purposes, you should file Form 600, Corporation Tax Return, with the Georgia Department of Revenue to make your payment.

If your LLC is taxed as a partnership, you should file the informational Form 700, Partnership Tax Return, with the Georgia Department of Revenue.

Although they may not pay the net worth tax or the corporate income tax, LLCs must file an annual LLC registration with the Georgia Secretary of State. Failure to file your annual registration by April 1st could result in administrative dissolution of your business. The fee for filing an annual report is $50 if filed online or $60 if filed by mail.

Part of starting a business in Georgia is registering your company with the Georgia Department of Revenue. You can set up your account and file your taxes—monthly or quarterly, depending on the requirements specific to your business—by visiting the Georgia Tax Center online.

Making sense of the different tax obligations can be tricky, so some small business owners find it best to consult a certified public accountant (CPA) for assistance. Use the Find a CPA tool from the Georgia Society of Certified Public Accountants to locate a qualified CPA in your area.

9. Register with the Georgia Department of Labor

For many small businesses, the next step is registering the company as an employer with the Georgia Department of Labor. If your LLC is a solo operation, you can skip this step, but you will need to register as an employer if you ever decide to bring on help later as your company grows.

Employees vs. Independent Contractors

The kind of help you hire affects this obligation. If you want to hire in-house workers to be part of your team, they will be your employees and you will be their employer. You need to register with the Department of Labor.

If you are looking for professionals with special skills who can assist with certain projects or provide services to your company but who aren’t part of the in-house team under your control, you might hire independent contractors instead. You don’t have to register as an employer if you only work with independent contractors, but be prepared to prove that you aren’t misclassifying true employees as contractors in an attempt to avoid this obligation.

How to Register as an Employer in Georgia

To register with the Georgia Department of Labor, you will need to log on to the Employer Registration application on the Department’s website. You will need your federal EIN to begin this process, as well as:

- Your company’s mailing address

- The names, addresses, and social security numbers of all LLC members and officers

- Dates of the company’s first employee hire and first payroll in the state of Georgia

Your obligations as an employer, according to the Georgia Small Business Development Center, include:

- Securing a state withholding number for state tax withholding purposes, which you can do by visiting the Georgia Department of Revenue Income Tax Division online or calling 404-417-2311.

- Obtaining a Georgia Department of Labor number that you can use to pay State Unemployment Insurance for your employees. You can get this number by filing an application online with the Department of Labor.

Planning for Payroll

Part of being an employer is managing payroll, or the payment of your workers. Paying employees can get complicated, especially when factors like overtime, paid time off, and tax withholding come into play. It’s not as simple as multiplying an employee’s hours worked by their hourly wage and writing a check. The more employees you have, the more it amplifies the challenges of payroll management.

Handling payroll manually can eat up a lot of your time. Even small businesses often choose to use a payroll provider that automates tax withholding and payroll tax filing and facilitates direct deposit payments.

We recommend checking out Gusto for your payroll management needs. Not only is Gusto easy to use and assists Georgia LLC owners in complying with the law, but the user-friendly platform also allows you to manage other benefits, like health insurance plans and retirement savings. You can use Gusto to pay independent contractors who provide per-service or per-project work for your company. The payroll provider even integrates with bookkeeping solutions like Bench.

10. Apply for Georgia Licenses and Permits

Most companies founded in Georgia will need a general business license awarded by the municipality. For example, all businesses that operate within the city limits in Atlanta must apply for a business license from that municipality. Once you register your LLC as a business in the municipality within Georgia where it is located, you can do business throughout the state.

Business owners in Atlanta can apply for their business license online through the ATLCORE Business Licensing and Permitting Portal. Atlanta also requires regulatory permits for different business types, although these permits are awarded by agencies and departments within the municipality in some cases and by the state in other cases.

Companies in different industries may also need special licenses and permits to operate. Businesses in Georgia may have to seek licensure from different agencies and departments at the state, federal, or local level, depending on what products or services they provide. The Georgia Secretary of State is in charge of professional licensing at the state level. You can begin the process of getting the licenses your LLC needs by logging into the Professional Licensing section of the Georgia Online Application Services portal.

Figuring out the complex combination of federal, state, and local permits and licenses your company needs can be complicated. The Business Licenses tool offered by LegalZoom can help you make sense of the requirements and get in compliance fast.

11. Protect the Owners and the Company

There’s always a risk to going into business, but taking the right steps can protect and insulate your personal assets from the risks of a business endeavor. Setting up your company as an LLC, an entity that’s legally separate from you, is a good first step to protecting you and any fellow owners of the LLC.

Other steps you have taken throughout this process also serve to protect you. An operating agreement that covers all contingencies will reduce the likelihood of minor disagreements between members turning into major disputes that lead to litigation. This contract spells out how decisions about the company are to be made and who holds what rights in the process.

Keeping your LLC’s assets separate from your personal assets, through the use of a company bank account and a business credit card, also reinforce that legal distinction that protects you from personal liability. Maintaining all of the licenses and permits required speaks to your credibility and will help your company avoid any allegations of doing unauthorized work in regulated industries.

Another way of protecting yourself—one that may seem small but may matter for legal purposes—is correctly signing legal documents. When your company enters into contracts or signs other legal documents, you, as the business owner, will likely be the party responsible for signing those forms. You shouldn’t sign as an individual but rather as a representative of the company, and how you sign should make this distinction clear.

Here’s how we structure signature sections on contracts in order to reflect the separate legal existence of the company. Feel free to steal this:

Agreed to:

_[Your Company Name]_

By: _Your Signature_

Its: _Founder and Owner [or whatever other title you use]_

It’s also important that you set in place the right types and amounts of insurance coverage to protect your business. Different kinds of companies may have different insurance needs. A general business insurance policy may be enough to cover a company with basic insurance needs, like a retail store where a customer could slip and fall on the property. Other types of companies have more specialized needs, such as malpractice insurance, professional liability insurance, or construction insurance.

The task of figuring out what insurance you need and finding coverage can seem daunting for a small business owner. We recommend that you check out Hiscox, an insurer that specializes in small business coverage needs of all kinds.

12. Protect Your Intellectual Property

Your company’s assets include more than its tangible property and its funding capital. You also need to protect your intellectual property.

What Is Intellectual Property and Why Does It Matter?

Intellectual property covers any of what the World Intellectual Property Organization refers to as “creations of the mind.” Business names and branded terms, logos, proprietary processes and designs, secret recipes, and other creations that combine to set your company apart are all types of intellectual property that you may want to protect.

Intellectual property matters because, without it, your company may be indistinguishable from competitors. Do customers flock to your restaurant for that special sauce, secret combination of seasonings, or an otherwise unique recipe that creates a taste they can’t get anywhere else? If so, losing that secret recipe could cause a noticeable drop in business.

Maybe you developed and branded a special process for your service-based business that your clients know and love because it makes their life easier. If your competitors started advertising that they, too, offer this proprietary process, they could lure away your customers.

Even your LLC name and logo are part of what makes your company memorable and keeps your customers coming back. Protecting your intellectual property means protecting everything that makes your business unique.

Types of Intellectual Property

There are several forms of intellectual property. Not every company will need to worry about protecting every kind of intellectual property, but for most businesses, it is worth at least considering some of the following ways to protect your intellectual property:

- Trademark: The form of intellectual property protection that applies to company and brand names, logos, symbols, and slogans

- Copyright: Legal protection that applies to creative works like music, movies, books, and software programs

- Patent: Protection of technical inventions that may include designs, chemical compounds, mechanical processes, and more

- Trade dress: Intellectual property protection of the look of a product and its packaging

- Trade secret: Legal protection of other proprietary assets, from recipes to algorithms and from client lists to devices, to which secrecy is an essential part of what makes it valuable

How to Protect Intellectual Property

An important way to safeguard your intellectual property is by filing applications for legal protection. You might apply for a copyright from the U.S. Copyright Office or a patent or trademark from the United States Patent and Trademark Office.

The government isn’t the only place to turn. You can also make it standard practice in your company to use contracts and agreements that will protect your intellectual property. Non-disclosure agreements (NDAs) and confidentiality agreements can keep your company’s secrets a secret. You might also put into place non-compete agreements, non-solicitation agreements, Work Made for Hire agreements, and independent contractor agreements.

If you want help with the trademarking process or with drafting the agreements that your company will use to protect itself, visit the intellectual property portal on LegalZoom.

13. Comply with Local Tax Requirements

Government agencies at every level want their share of taxes. In addition to the federal income tax requirements and any state tax obligations you may have, you might face local taxes, too. For example, you may have to pay property taxes if your LLC owns its commercial property. In Georgia, businesses may be required to collect sales and use tax on the sales of non-exempt tangible goods to final consumers.

The business license fees you pay for a county or municipal business license in Georgia may also serve as a tax of sorts. In Atlanta, for example, the business license fee is essentially a gross receipts tax because it is calculated based on the company’s total reported gross receipts and the number of workers it employs.

Conclusion to Starting an LLC in Georgia

Taking the leap from dreamer to real-life entrepreneur is one of life’s biggest adventures. Starting your own business is as rewarding as it is challenging, and it’s sure to test your skills.

Still, no aspiring business owner is really looking forward to the LLC formation process. Filing paperwork and slogging through tedious online forms isn’t especially exciting, even if these steps are necessary for getting your LLC officially off the ground.

Don’t even think of skipping important steps like filing your formation documents. Compliance with Georgia regulations may not be why you went into business, but being in compliance is the only way to avoid serious penalties that could include hefty fines and much more.

Does the process of LLC formation, now that you know what it entails, still look daunting? Keep in mind that you don’t have to do this work yourself. Part of being a business owner is understanding when to delegate tasks and how to best use your own time and skills. Consider hiring a company like ZenBusiness to take care of the entire LLC formation process for you, so you can use your talents to really start building your business for success.

Related: