It’s fun to watch futuristic movies where all transactions are performed via a chip embedded deep beneath your skin — until you realize that that type of science fiction fantasy is slowly becoming our reality. Many people have stopped using cash entirely — credit is heavily relied on, and your bank statement is nothing more than a bunch of numbers on a printout. Sure, you can still withdraw money if you need to… for now. Here are 5 ways cash is becoming more and more obsolete.

Sweden Moving Toward Cashless Economy

Just like in America, many small businesses in Sweden are credit cards only. But so are their public buses, event tickets, and even many banks. Even churches are installing credit card readers for donors who don’t carry cash on their person.

“There are towns where it isn’t at all possible anymore to enter a bank and use cash,” said Curt Persson, the chairman of Sweden’s National Pensioners’ Organization.

Right now, cash and coins make up a mere 3% of the Swedish economy — and many are speaking out in an attempt to lower that number even further. Since the presence of cash in the country has decreased, so has their robberies.

Internet startups in Sweden are now rushing to complete applications which allow the user to complete any and all types of bank transactions using their smart phones. Despite the wave of credit enthusiasm, many are unhappy with what they see as nothing more than a way for big banks to keep making money.

People Prefer Credit

Not only do banks seem to prefer credit, but people do, too. In the UK, 31% of consumers said they preferred cash and coins. 41% preferred credit.

The survey, held by the Payments Council, is said to predict a further decline of cash use to be expected in the near future. While small items are still typically purchased with cash, the integration of contactless cards and phone-enabling items like the Square (a small credit card reader which can be attached to your phone) will it back even more.

Additionally, most people hate carrying change around and wind up donating it to charity or dumping it in a small bank at home, where it gathers dust for a long period of time before the person gets around to cashing it at the bank.

Internet Purchases

With the creation of eBay came a mountain of money orders and the occasional check. Now, with PayPal and BillMeLater, credit has taken over entirely. eBay has gone as far as to ban the use of checks and money orders on its site (except for large purchases such as automobiles and real estate).

Payment upon pickup is now the only way to use cash on your eBay purchases. Etsy, the world’s biggest handmade crafts marketplace, still allows sellers to accept money orders and checks if they wish to do so, but their 15 million users are trumped by eBay’s almost 100 million.

eBay attempted to implement a similar credit-only plan in Australia by creating a ‘PayPal Only Plan’, which was quickly dropped due to overwhelming anger from the sellers.

Other than eBay, the majority of online purchases utilize a credit or debit card. WalMart has implemented a PayNearMe plan for those wishing to purchase online items for cash, but this is not a viable option for most online sellers.

Convenience of Credit

Carrying around a wad of cash is bulky, can be easily lost, and can often be dangerous. CNN Money reports that 43% of American adults go a week at a time without making a cash payment at all.

Digital wallets have turned old fashioned ones into obsolete hunks of useless paper. Coupons, credit cards, bank statements, and all types of payments can be controlled from your smart phone with the help of Google Wallet. Visa also has their own version of the digital wallet.

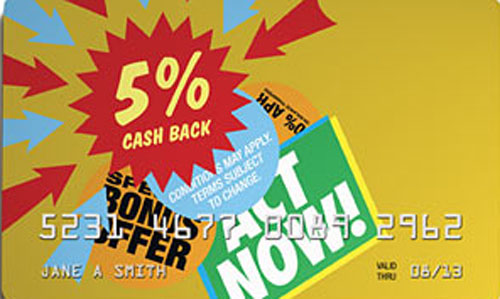

Incentives and Rewards

While using plastic may encourage us to spend more, there are also more rewards and kickbacks for doing so. Not only are there pages of credit cards which offer ‘bonus points’ every time you use to card to make certain purchases, but even PayPal’s debit card offers cash back rewards.

Travel vouchers, meal tickets, airplane miles, gift cards, and cold hard cash are all incentives for people to use their cards as much as possible. A hidden reward of using credit cards is not having to truly think about the cost — with cash, handling physical money makes the buyer aware of how much they’re spending and inspires the desire to keep track of his or her finances more closely. Swiping a credit card through a plastic box and signing on the dotted line doesn’t have the same effect.